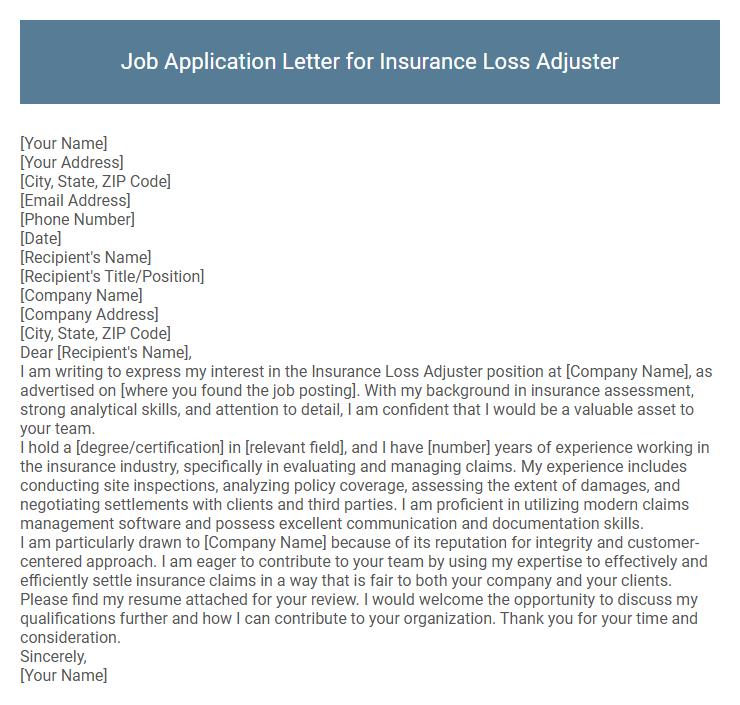

Job Application Letter for Insurance Loss Adjuster Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Loss Adjuster position at [Company Name], as advertised on [where you found the job posting]. With my background in insurance assessment, strong analytical skills, and attention to detail, I am confident that I would be a valuable asset to your team.

I hold a [degree/certification] in [relevant field], and I have [number] years of experience working in the insurance industry, specifically in evaluating and managing claims. My experience includes conducting site inspections, analyzing policy coverage, assessing the extent of damages, and negotiating settlements with clients and third parties. I am proficient in utilizing modern claims management software and possess excellent communication and documentation skills.

I am particularly drawn to [Company Name] because of its reputation for integrity and customer-centered approach. I am eager to contribute to your team by using my expertise to effectively and efficiently settle insurance claims in a way that is fair to both your company and your clients.

Please find my resume attached for your review. I would welcome the opportunity to discuss my qualifications further and how I can contribute to your organization. Thank you for your time and consideration.

Sincerely,

[Your Name]

A job application letter for an insurance loss adjuster highlights your expertise in evaluating insurance claims with precision and integrity. Emphasizing analytical skills and attention to detail, the letter demonstrates your ability to assess damages accurately and negotiate settlements fairly. Showcasing relevant experience and industry knowledge strengthens your candidacy for this critical role in risk management.

What should I include in a job application letter for an Insurance Loss Adjuster position?

Include your relevant experience in insurance claims assessment and loss evaluation, emphasizing attention to detail and analytical skills. Highlight certifications, such as CPCU or AIC, and familiarity with insurance policies and legal regulations. Demonstrate strong communication abilities and a commitment to accurate, timely claim resolution for client satisfaction.

How do I highlight relevant skills in my Insurance Loss Adjuster application letter?

Highlight analytical skills and attention to detail by describing specific instances where you successfully assessed and managed claims. Emphasize your ability to evaluate damages accurately and communicate findings clearly to clients and insurers.

Showcase your knowledge of insurance policies and industry regulations to demonstrate expertise. Include examples of problem-solving and negotiation skills used to settle claims efficiently and fairly.

What is the ideal length for a job application letter for an Insurance Loss Adjuster?

The ideal length for a job application letter for an Insurance Loss Adjuster is one page, typically around 300 to 400 words. This allows the applicant to clearly highlight relevant skills and experience without overwhelming the reader.

The letter should be concise, focusing on key qualifications such as expertise in claims assessment, negotiation, and customer service. Detailed examples of past achievements or certifications can strengthen the application. Keeping the letter well-organized and to the point increases the chances of capturing the employer's attention effectively.

Should I mention specific insurance claims experience in my letter?

Mentioning specific insurance claims experience in your job application letter for an Insurance Loss Adjuster role is highly beneficial. It demonstrates your relevant skills and practical knowledge, highlighting your ability to assess and manage claims effectively. Including examples of claim types you have handled can strengthen your application and set you apart from other candidates.

How do I address my application letter if I don't know the hiring manager's name?

When addressing a job application letter for an Insurance Loss Adjuster without the hiring manager's name, use a professional and respectful general greeting. Avoid generic phrases and aim for clarity to make a positive impression.

- Use "Dear Hiring Manager" - This is a widely accepted and professional way to address unknown recipients in the insurance industry.

- Include the job title if possible - For example, "Dear Hiring Manager, Insurance Loss Adjuster Position" to specify your application context.

- Research the company - Sometimes job postings or company websites may reveal the department head or HR contact to personalize the greeting.

What achievements are important to showcase in an Insurance Loss Adjuster cover letter?

Showcase achievements in accurately assessing and settling insurance claims to demonstrate expertise in minimizing company losses. Highlight successful negotiation outcomes with policyholders and contractors that protect company interests while maintaining customer satisfaction. Emphasize proficiency in using advanced claims management software and adherence to regulatory compliance to ensure efficient and legal claim processing.

How can I express my knowledge of insurance regulations in my application letter?

Demonstrate a thorough understanding of insurance policies and legal frameworks impacting claims management in your job application letter. Highlight specific experience interpreting insurance regulations to ensure accurate and compliant loss assessments.

- Reference Relevant Regulations - Mention familiarity with state and federal insurance laws such as the Insurance Code or the Fair Claims Settlement Practices Regulations.

- Showcase Practical Application - Describe instances where you applied regulatory knowledge to resolve complex claims or mitigate compliance risks effectively.

- Emphasize Continuing Education - Note any certifications or training related to insurance law and compliance to underscore your expertise and commitment.

Conveying detailed knowledge of insurance regulations enhances credibility and positions you as a knowledgeable candidate for the loss adjuster role.

Is it necessary to include my certifications in the application letter?

| Certification Inclusion | Including certifications in a job application letter for an Insurance Loss Adjuster is highly recommended. Certifications demonstrate professional competence, specialized knowledge, and credibility. They can significantly enhance your candidacy by showcasing relevant skills and qualifications directly related to insurance claims and loss assessment. |

| Relevant Certifications | Common certifications include CPCU (Chartered Property Casualty Underwriter), AIC (Associate in Claims), and ARM (Associate in Risk Management). Mentioning these credentials signals expertise and commitment to the insurance industry. |

| Placement in Letter | Certifications should be mentioned briefly in the introduction or body of the letter, highlighting how they support your suitability for the role. Detailed listing is better suited for the resume, but noting key certifications in the letter adds value. |

| Impact on Hiring Managers | Hiring managers seek candidates with proven knowledge and qualifications. Including certifications helps your application stand out and aligns with job requirements for technical proficiency and ethical standards. |

| Summary | Including certifications in the application letter strengthens your professional image, emphasizes relevant expertise, and increases the likelihood of progressing to the interview stage. |

How do I close a job application letter for an Insurance Loss Adjuster position?

Thank you for considering my application for the Insurance Loss Adjuster position. I am eager to bring my expertise in claims assessment and negotiation to your team. I look forward to the opportunity to discuss how my skills can contribute to your company's success.