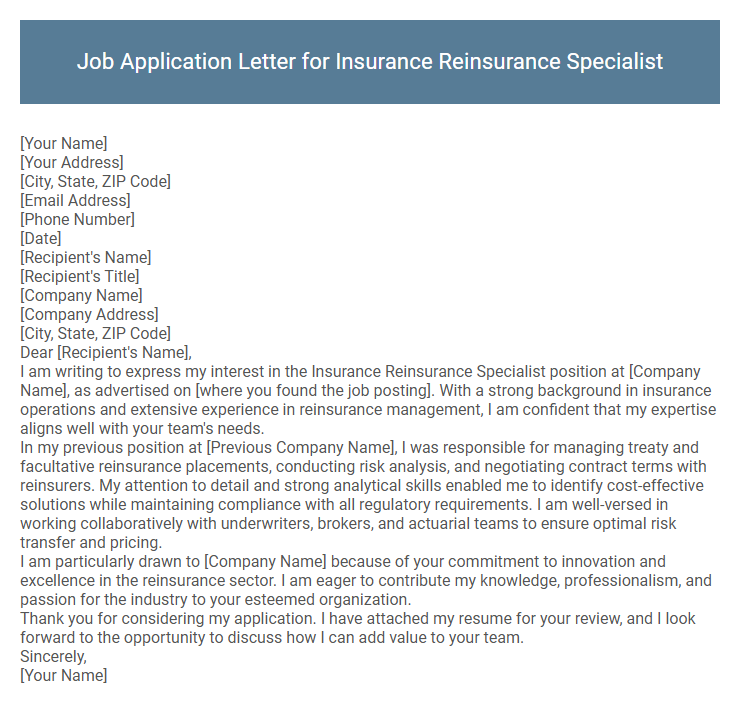

Job Application Letter for Insurance Reinsurance Specialist Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Reinsurance Specialist position at [Company Name], as advertised on [where you found the job posting]. With a strong background in insurance operations and extensive experience in reinsurance management, I am confident that my expertise aligns well with your team's needs.

In my previous position at [Previous Company Name], I was responsible for managing treaty and facultative reinsurance placements, conducting risk analysis, and negotiating contract terms with reinsurers. My attention to detail and strong analytical skills enabled me to identify cost-effective solutions while maintaining compliance with all regulatory requirements. I am well-versed in working collaboratively with underwriters, brokers, and actuarial teams to ensure optimal risk transfer and pricing.

I am particularly drawn to [Company Name] because of your commitment to innovation and excellence in the reinsurance sector. I am eager to contribute my knowledge, professionalism, and passion for the industry to your esteemed organization.

Thank you for considering my application. I have attached my resume for your review, and I look forward to the opportunity to discuss how I can add value to your team.

Sincerely,

[Your Name]

A job application letter for an Insurance Reinsurance Specialist highlights expertise in managing risk transfer between insurers and reinsurers. It emphasizes proficiency in evaluating insurance policies, analyzing reinsurance contracts, and ensuring regulatory compliance. Showcasing strong analytical skills and industry knowledge positions candidates as valuable assets for companies seeking to optimize risk management strategies.

What key qualifications should I highlight in my job application letter for an Insurance Reinsurance Specialist role?

Highlight your expertise in underwriting, risk assessment, and claims management specifically within insurance and reinsurance sectors. Emphasize strong knowledge of regulatory compliance and proficiency in data analysis tools used for risk modeling. Showcase your ability to negotiate reinsurance treaties and collaborate with cross-functional teams to optimize coverage and financial performance.

Should I mention specific reinsurance agreements or treaties I've worked with?

When writing a job application letter for an Insurance Reinsurance Specialist position, mentioning specific reinsurance agreements or treaties you've worked with can demonstrate your expertise and practical experience. Highlighting well-known treaties like proportional or non-proportional agreements showcases your understanding of industry practices. Focus on how your involvement contributed to risk assessment, pricing, or contract management to make your application more compelling.

How do I structure a job application letter for an Insurance Reinsurance Specialist position?

Begin your job application letter with a clear introduction stating the position you are applying for and a brief summary of your relevant experience in insurance and reinsurance. Follow with a middle paragraph highlighting specific skills such as risk assessment, policy analysis, and client communication that demonstrate your expertise. Conclude by expressing enthusiasm for the role and your readiness to contribute to the company's success.

What technical skills are most relevant to include for this job?

Technical skills relevant for an Insurance Reinsurance Specialist include proficiency in risk assessment, underwriting, and claims analysis. Expertise in reinsurance contract management, data analytics tools like Excel and SQL, and industry software such as AIR or RMS is essential. Strong knowledge of regulatory compliance and financial modeling also enhances job performance in this role.

How can I showcase my negotiation experience in my application letter?

Highlight specific examples where you successfully negotiated terms that benefited your company in insurance or reinsurance deals. Emphasize your ability to analyze risk, communicate clearly, and reach agreements that align with business goals.

- Quantify Achievements - Include data showing improved contract terms or cost savings obtained through your negotiations.

- Detail Strategy - Describe negotiation techniques you used, such as risk assessment or stakeholder engagement.

- Showcase Outcomes - Explain how your negotiations contributed to successful partnerships or increased profitability.

Is industry certification important to mention in my job application letter?

Including industry certifications in your job application letter for an Insurance Reinsurance Specialist role significantly enhances your professional credibility. Certifications highlight your specialized knowledge and commitment to the field.

- Demonstrates Expertise - Certifications prove your mastery of key insurance and reinsurance principles required for the role.

- Boosts Employer Confidence - Employers trust certified candidates to meet industry standards and handle complex risk assessments.

- Competitive Advantage - Highlighting certifications sets you apart from other applicants without recognized credentials.

Clearly mentioning relevant certifications increases your chances of securing interviews in the competitive insurance reinsurance sector.

Can I use the same cover letter template for different insurance companies?

Using the same cover letter template for different insurance companies is possible but requires customization. Tailoring key details to each company's values and job description enhances relevance.

Highlight specific skills and experiences that align with the insurer or reinsurer's unique needs. Address the company by name and reference their market position or products. This personalized approach increases the chances of standing out to hiring managers.

What achievements should I quantify in my application letter for this role?

| Achievement | Quantifiable Metrics |

|---|---|

| Risk Assessment Accuracy | Percentage improvement in risk evaluation precision, e.g., "Enhanced risk assessment accuracy by 20%" |

| Claims Processing Efficiency | Reduction in processing time or increase in claims handled, e.g., "Reduced claims processing time by 30%" |

| Loss Ratio Improvement | Decrease in loss ratio percentage through effective reinsurance strategies, e.g., "Lowered loss ratio from 65% to 50%" |

| Portfolio Growth | Growth in reinsurance portfolio size or premium volume, e.g., "Expanded reinsurance portfolio by $5M annually" |

| Cost Savings | Amount saved via optimized reinsurance contracts or negotiations, e.g., "Achieved $2M in cost savings through contract renegotiations" |

How important is it to tailor my letter to each job posting?

Tailoring your job application letter to each insurance reinsurance specialist posting ensures that your skills and experiences directly align with the employer's specific requirements. Highlighting relevant expertise in risk assessment, treaty negotiations, and claims management increases your chances of standing out to recruiters.

Customizing your letter demonstrates genuine interest and knowledge about the company, which is crucial in competitive insurance and reinsurance markets. It enables you to address key competencies such as underwriting strategies and regulatory compliance that are prioritized by each employer.