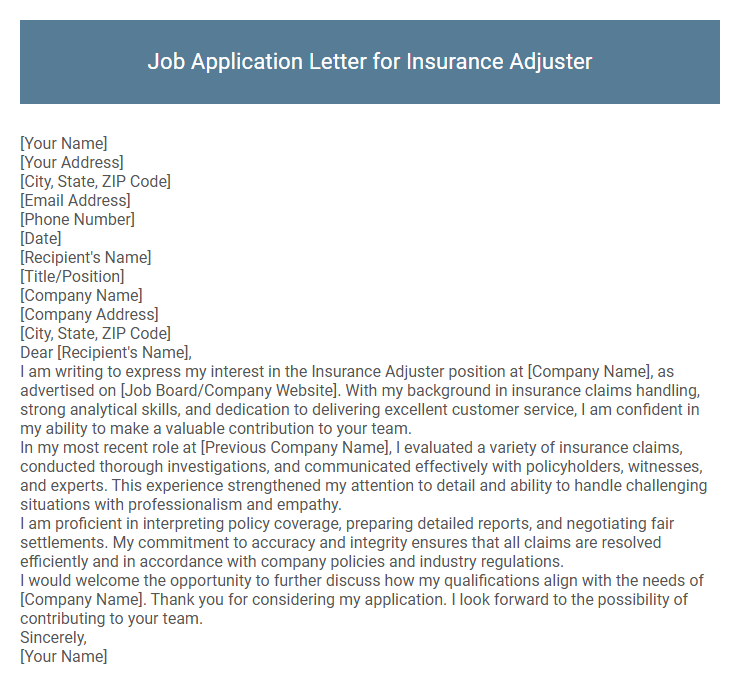

Job Application Letter for Insurance Adjuster Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Adjuster position at [Company Name], as advertised on [Job Board/Company Website]. With my background in insurance claims handling, strong analytical skills, and dedication to delivering excellent customer service, I am confident in my ability to make a valuable contribution to your team.

In my most recent role at [Previous Company Name], I evaluated a variety of insurance claims, conducted thorough investigations, and communicated effectively with policyholders, witnesses, and experts. This experience strengthened my attention to detail and ability to handle challenging situations with professionalism and empathy.

I am proficient in interpreting policy coverage, preparing detailed reports, and negotiating fair settlements. My commitment to accuracy and integrity ensures that all claims are resolved efficiently and in accordance with company policies and industry regulations.

I would welcome the opportunity to further discuss how my qualifications align with the needs of [Company Name]. Thank you for considering my application. I look forward to the possibility of contributing to your team.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an insurance adjuster position requires highlighting relevant experience in claims assessment, negotiation skills, and attention to detail. Emphasizing proficiency in evaluating damages and determining fair settlements ensures alignment with employer expectations. A well-structured letter conveys professionalism and a strong commitment to delivering accurate, timely resolutions.

What should I include in a job application letter for an insurance adjuster position?

Include a clear introduction stating the position you are applying for and your enthusiasm for the insurance adjuster role. Highlight relevant experience in claims assessment, negotiation skills, and knowledge of insurance policies. Conclude with a confident statement expressing your readiness to contribute to the company's success and a request for an interview opportunity.

How do I address my cover letter for an insurance adjuster job?

Address your cover letter to the hiring manager or specific recruiter listed in the job posting when applying for an insurance adjuster position. Use formal titles such as "Dear Hiring Manager" or "Dear [Name]" to create a professional impression.

Avoid generic greetings like "To Whom It May Concern" to demonstrate attention to detail and genuine interest in the role. Research the company's website or LinkedIn page to find the appropriate contact person whenever possible.

What key skills should I highlight for an insurance adjuster application?

| Key Skills | Explanation |

|---|---|

| Claims Investigation | Ability to thoroughly analyze insurance claims and gather evidence to determine claim validity. |

| Communication | Strong verbal and written communication skills to interact effectively with clients, lawyers, and insurance companies. |

| Negotiation | Proficiency in negotiating settlements that are fair to both the claimant and the insurance company. |

| Attention to Detail | Meticulous review of claim documentation and policies to avoid errors and fraud. |

| Analytical Skills | Capability to assess complex information and make logical decisions based on policy coverage and regulations. |

Should I mention certifications in my application letter?

Mentioning certifications in your job application letter for an Insurance Adjuster position enhances your credibility and showcases your relevant expertise. Certifications demonstrate your commitment to the profession and can set you apart from other candidates.

- Highlight Relevant Certifications - Include certifications like CPCU, AIC, or ARM to emphasize your specialized knowledge.

- Support Your Qualifications - Certifications validate your skills and understanding of insurance policies and claims processes.

- Build Trust with Employers - Demonstrating certifications reassures employers of your professional competence and dedication.

Incorporating your certifications strategically can strengthen your application letter and improve your chances of securing the Insurance Adjuster role.

How do I demonstrate experience in claims handling in my letter?

Demonstrate your experience in claims handling by clearly outlining specific cases you managed and the outcomes you achieved. Highlight your proficiency with claim assessment, negotiation, and resolution to convey practical expertise.

- Detail relevant experience - Describe the types of claims you have handled, emphasizing complexity and volume.

- Quantify achievements - Include metrics such as claim settlement values, reduction in processing time, or customer satisfaction improvements.

- Showcase your skills - Mention knowledge of insurance policies, investigative techniques, and regulatory compliance.

What is the ideal length for an insurance adjuster cover letter?

The ideal length for an insurance adjuster cover letter is one page, typically around 250 to 400 words. This length ensures a concise presentation of relevant skills, experience, and enthusiasm without overwhelming the reader. Keeping it brief allows hiring managers to quickly assess your suitability for the role.

How do I tailor my letter to the specific insurance company?

Research the insurance company's values, mission, and recent accomplishments to align your letter with their specific goals. Highlight relevant skills and experiences that match the company's job description and culture.

Use the company's name and reference specific projects or policies to demonstrate genuine interest. Customize your achievements to address the challenges or opportunities faced by that insurer.

Should I include references in my application letter?

Including references in your job application letter for an Insurance Adjuster position is generally not necessary unless specifically requested by the employer. Focus on highlighting relevant skills, experience, and achievements directly related to claims assessment and risk evaluation. Prepare a separate references list to provide upon request during the interview or hiring process.

What format is best for an insurance adjuster job application letter?

The best format for an insurance adjuster job application letter is a professional block style with clear headings, concise paragraphs, and a formal tone. Use an introduction that states the job position, followed by a summary of relevant skills such as claims evaluation, negotiation, and risk assessment. Conclude with a strong closing statement expressing enthusiasm and a call to action for an interview.