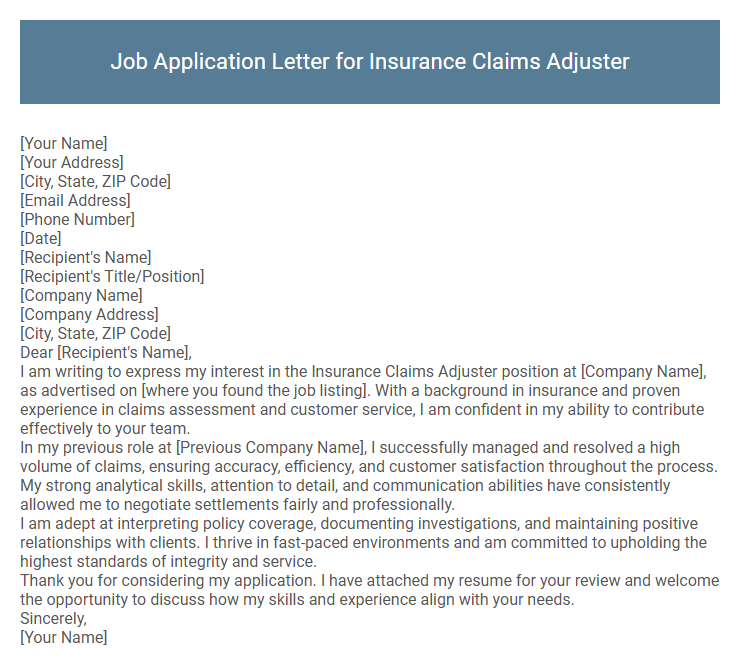

Job Application Letter for Insurance Claims Adjuster Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Claims Adjuster position at [Company Name], as advertised on [where you found the job listing]. With a background in insurance and proven experience in claims assessment and customer service, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I successfully managed and resolved a high volume of claims, ensuring accuracy, efficiency, and customer satisfaction throughout the process. My strong analytical skills, attention to detail, and communication abilities have consistently allowed me to negotiate settlements fairly and professionally.

I am adept at interpreting policy coverage, documenting investigations, and maintaining positive relationships with clients. I thrive in fast-paced environments and am committed to upholding the highest standards of integrity and service.

Thank you for considering my application. I have attached my resume for your review and welcome the opportunity to discuss how my skills and experience align with your needs.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an Insurance Claims Adjuster requires highlighting your analytical skills and attention to detail. Emphasize your experience in evaluating claims accurately and ensuring compliance with policy terms. Showcasing your ability to communicate effectively with clients and stakeholders strengthens your candidacy.

What should I include in a job application letter for an Insurance Claims Adjuster position?

Include a clear statement of your relevant experience in investigating and evaluating insurance claims, highlighting your attention to detail and analytical skills. Emphasize your knowledge of insurance policies, negotiation abilities, and proficiency in handling claims efficiently. Demonstrate strong communication skills and a commitment to providing excellent customer service throughout the claims process.

How do I address my relevant experience in the letter?

Addressing relevant experience in a job application letter for an Insurance Claims Adjuster requires highlighting specific skills and accomplishments related to claims investigation and resolution. Emphasize your ability to analyze policy details, negotiate settlements, and collaborate with clients and professionals.

- Highlight Specific Experience - Detail your previous roles involving claims evaluation, damage assessment, and claim settlements.

- Quantify Achievements - Include measurable outcomes such as claim resolution rates or cost savings you contributed to.

- Showcase Relevant Skills - Emphasize expertise in communication, negotiation, and understanding of insurance regulations.

What key skills are important for an Insurance Claims Adjuster application?

Key skills important for an Insurance Claims Adjuster application include strong analytical abilities to evaluate claims accurately and determine appropriate settlements. Excellent communication skills are essential for negotiating with clients and working collaboratively with insurance companies. Attention to detail and proficiency in relevant software tools ensure efficient claims processing and compliance with industry regulations.

Should I mention certifications in my application letter?

Mentioning certifications in a job application letter for an Insurance Claims Adjuster can enhance credibility and demonstrate expertise. Certifications provide evidence of specialized knowledge and commitment to the field.

- Highlight Relevant Certifications - Including certifications like CPCU or AIC shows professional qualification and dedication.

- Boosts Candidate's Credibility - Certifications validate skills and reassure employers about your competency.

- Tailor to Job Requirements - Mention certifications that specifically match the employer's criteria or job description.

How long should my cover letter be?

Your cover letter for an Insurance Claims Adjuster position should be concise and focused, ideally spanning one page. It must clearly highlight your relevant skills and experience without overwhelming the reader with excessive detail.

- Optimal Length - One page, typically 3-4 paragraphs, balances detail with readability.

- Focus on Relevance - Emphasize key achievements and skills linked to claims adjusting roles.

- Clear Structure - Introduction, body with qualifications, and a strong closing to encourage follow-up.

Keeping your cover letter succinct increases your chances of making a positive impression on hiring managers in the insurance sector.

Is it necessary to tailor my letter for each insurance company?

Tailoring your job application letter for each insurance company is essential. It demonstrates your genuine interest and aligns your skills with the company's specific needs.

Customized letters increase the chances of standing out by addressing the company's values and job requirements directly. A generic letter may overlook key qualifications the employer seeks.

How do I show my knowledge of insurance policies in the letter?

How do I effectively demonstrate my knowledge of insurance policies in a job application letter for an Insurance Claims Adjuster position? Highlight specific types of insurance policies you have experience with, such as auto, property, or liability insurance. Mention your familiarity with policy terms, coverage limits, exclusions, and claim processing procedures to showcase your expertise.

What is a strong closing statement for this role?

A strong closing statement for an Insurance Claims Adjuster job application letter should confidently express your enthusiasm for the role and your readiness to contribute effectively. Emphasize your commitment to accuracy and client satisfaction while inviting further discussion.

I am eager to bring my expertise in claims evaluation and risk assessment to your team, ensuring fair and timely resolutions. My attention to detail and strong communication skills will support your company's goals and enhance client trust. I welcome the opportunity to discuss how my qualifications align with your needs in greater detail.

Do I need to reference specific claims types, like auto or property?

When writing a job application letter for an Insurance Claims Adjuster position, referencing specific claim types like auto or property can demonstrate relevant expertise. Highlighting experience in particular claim areas shows your ability to handle specialized tasks effectively.

However, if the job posting specifies certain claim types, tailor your letter to emphasize those areas. Otherwise, mention a broad range of claims to showcase versatility and adaptability within the insurance field.