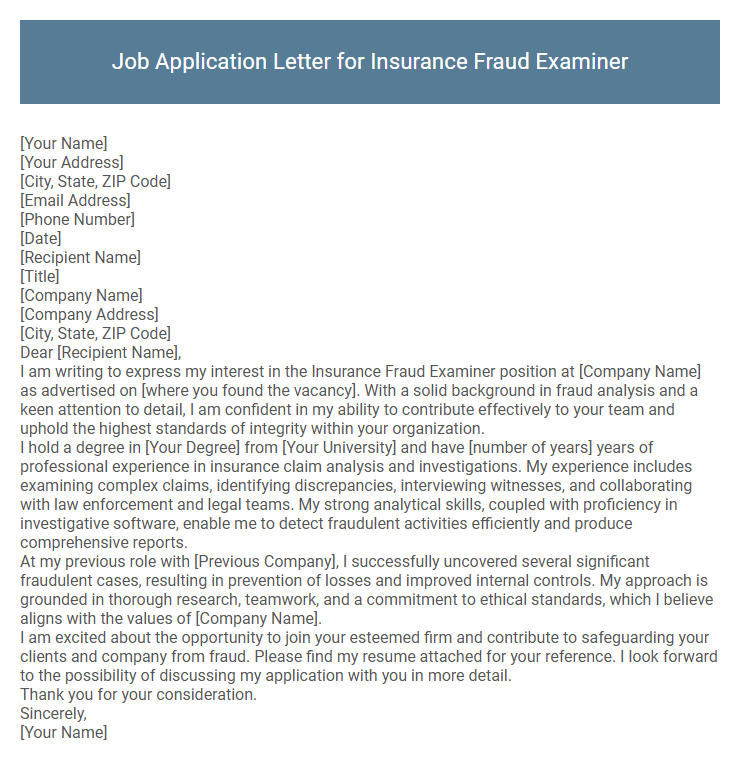

Job Application Letter for Insurance Fraud Examiner Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Fraud Examiner position at [Company Name] as advertised on [where you found the vacancy]. With a solid background in fraud analysis and a keen attention to detail, I am confident in my ability to contribute effectively to your team and uphold the highest standards of integrity within your organization.

I hold a degree in [Your Degree] from [Your University] and have [number of years] years of professional experience in insurance claim analysis and investigations. My experience includes examining complex claims, identifying discrepancies, interviewing witnesses, and collaborating with law enforcement and legal teams. My strong analytical skills, coupled with proficiency in investigative software, enable me to detect fraudulent activities efficiently and produce comprehensive reports.

At my previous role with [Previous Company], I successfully uncovered several significant fraudulent cases, resulting in prevention of losses and improved internal controls. My approach is grounded in thorough research, teamwork, and a commitment to ethical standards, which I believe aligns with the values of [Company Name].

I am excited about the opportunity to join your esteemed firm and contribute to safeguarding your clients and company from fraud. Please find my resume attached for your reference. I look forward to the possibility of discussing my application with you in more detail.

Thank you for your consideration.

Sincerely,

[Your Name]

A well-crafted job application letter for an Insurance Fraud Examiner highlights relevant investigative skills and expertise in identifying fraudulent activities. Emphasizing experience with claims analysis, regulatory compliance, and risk assessment enhances the candidate's credibility. Clear communication of attention to detail and ethical standards reflects a strong fit for this role.

What key qualifications should an Insurance Fraud Examiner highlight in a job application letter?

An Insurance Fraud Examiner should highlight expertise in investigative techniques and knowledge of insurance policies to identify fraudulent claims effectively. Emphasizing strong analytical skills and attention to detail is crucial for scrutinizing complex documents and detecting inconsistencies. Proficiency in legal regulations and excellent communication abilities for collaborating with law enforcement and legal teams are essential qualifications to showcase.

How should I address my letter if I don't know the hiring manager's name?

When applying for the Insurance Fraud Examiner position without knowing the hiring manager's name, use a professional and respectful salutation that addresses the department or role. Avoid generic greetings and focus on clarity to convey professionalism.

- Use "Dear Hiring Manager" - This is a widely accepted and respectful way to address an unknown recipient.

- Address the Department - For example, "Dear Claims Department" directly targets the relevant team.

- Avoid Generic Greetings - Phrases like "To Whom It May Concern" appear outdated and less personalized.

What relevant experiences should be mentioned in the application letter?

Highlight experience in investigating insurance claims, identifying fraudulent activities, and analyzing complex data. Emphasize proficiency in using forensic tools and conducting in-depth interviews with claimants and witnesses.

Mention knowledge of insurance policies, legal regulations, and procedures related to fraud detection. Include examples of successful case resolutions and collaboration with law enforcement or legal teams.

How can I showcase my analytical skills in the cover letter?

| Analytical Skills Showcase | Example Description |

|---|---|

| Detail-Oriented Investigation | Highlight experience in meticulously reviewing claims and documents to identify inconsistencies and suspicious patterns. |

| Data Analysis Proficiency | Mention proficiency with analytical tools and software used to detect fraudulent activities and trends. |

| Problem-Solving Ability | Emphasize instances where you successfully resolved complex fraud cases through logical reasoning and critical thinking. |

| Report Preparation | Describe ability to compile clear, concise reports summarizing findings and recommending actions based on data analysis. |

| Cross-Functional Collaboration | Show experience working with legal, claims, and law enforcement teams to interpret data and support investigations. |

Should I include certifications related to fraud examination in my letter?

Including certifications related to fraud examination in your job application letter for an Insurance Fraud Examiner position strengthens your credibility and demonstrates specialized expertise. Certifications such as CFE (Certified Fraud Examiner) highlight your commitment to professional standards in fraud detection and prevention. Mentioning these credentials can differentiate you from other candidates and align your skills with the employer's requirements.

What is the ideal length for a job application letter for this position?

What is the ideal length for a job application letter for an Insurance Fraud Examiner position? The letter should be concise, ideally between 300 to 400 words. This length allows for a clear presentation of relevant skills and experiences without overwhelming the reader.

How can I demonstrate knowledge of insurance laws in my application letter?

Demonstrate your expertise in insurance laws by referencing your familiarity with relevant regulations and compliance standards. Highlight specific experiences where you applied this knowledge to detect or prevent fraud.

- Reference specific laws - Mention key statutes like the Insurance Fraud Prevention Act or state-specific insurance regulations to show your legal understanding.

- Detail practical application - Describe instances where you used legal knowledge to investigate suspicious claims or ensure regulatory compliance.

- Highlight certifications - Include certifications such as Certified Fraud Examiner (CFE) to validate your proficiency in insurance law and fraud detection.

Use clear, concise examples that align your skills with the legal requirements of the Insurance Fraud Examiner role.

Is it necessary to mention familiarity with fraud detection software?

Mentioning familiarity with fraud detection software in a job application letter for an Insurance Fraud Examiner is highly beneficial. It demonstrates technical proficiency and readiness to handle key job responsibilities effectively.

Insurance companies rely heavily on advanced fraud detection systems to identify suspicious claims. Highlighting experience with these tools shows the applicant's ability to leverage technology in investigations. Employers prefer candidates who can quickly adapt to their software environments to improve fraud detection accuracy.

How do I convey confidentiality and ethics in my letter?

In my job application letter for the Insurance Fraud Examiner position, I emphasize my unwavering commitment to confidentiality by highlighting my experience handling sensitive information with the utmost discretion. I demonstrate a strong ethical foundation by outlining my adherence to industry standards and my dedication to maintaining integrity during investigations. These points reassure employers of my reliability in preserving trust and upholding the law throughout the fraud examination process.