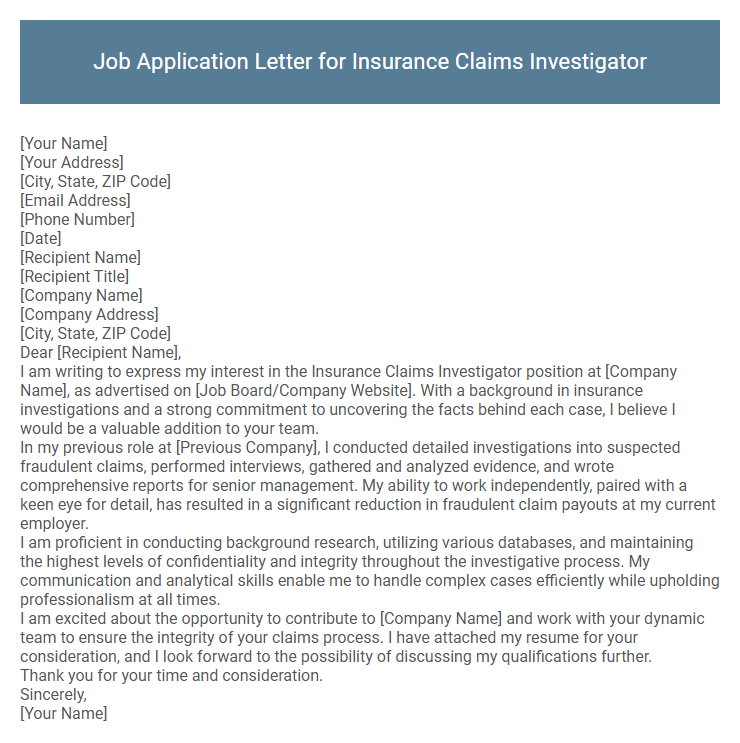

Job Application Letter for Insurance Claims Investigator Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Recipient Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Claims Investigator position at [Company Name], as advertised on [Job Board/Company Website]. With a background in insurance investigations and a strong commitment to uncovering the facts behind each case, I believe I would be a valuable addition to your team.

In my previous role at [Previous Company], I conducted detailed investigations into suspected fraudulent claims, performed interviews, gathered and analyzed evidence, and wrote comprehensive reports for senior management. My ability to work independently, paired with a keen eye for detail, has resulted in a significant reduction in fraudulent claim payouts at my current employer.

I am proficient in conducting background research, utilizing various databases, and maintaining the highest levels of confidentiality and integrity throughout the investigative process. My communication and analytical skills enable me to handle complex cases efficiently while upholding professionalism at all times.

I am excited about the opportunity to contribute to [Company Name] and work with your dynamic team to ensure the integrity of your claims process. I have attached my resume for your consideration, and I look forward to the possibility of discussing my qualifications further.

Thank you for your time and consideration.

Sincerely,

[Your Name]

A well-crafted job application letter for an Insurance Claims Investigator highlights expertise in assessing claims, analyzing data, and ensuring compliance with company policies. Emphasizing strong investigative skills and attention to detail demonstrates the candidate's ability to identify fraudulent activities and accurately evaluate claim validity. Clear communication and thorough documentation reinforce the applicant's commitment to supporting efficient claims resolution within the insurance industry.

What should I include in a job application letter for an Insurance Claims Investigator?

Include your relevant experience in insurance claims investigation, highlighting skills in risk assessment, fraud detection, and detailed report preparation. Emphasize your knowledge of insurance policies, legal regulations, and your ability to analyze complex information accurately. Demonstrate strong communication skills and a commitment to ethical standards in handling sensitive claim information.

How do I highlight relevant skills for an Insurance Claims Investigator position?

Highlighting relevant skills for an Insurance Claims Investigator position involves emphasizing analytical abilities, attention to detail, and knowledge of insurance policies. Demonstrating experience in investigating claims and assessing risk is crucial to make your application stand out.

- Analytical Skills - Showcase your ability to examine complex information and identify inconsistencies in claims.

- Attention to Detail - Emphasize your precision in documenting findings and ensuring thorough claim evaluations.

- Insurance Knowledge - Highlight familiarity with insurance laws, policies, and claim procedures relevant to investigations.

Should I mention specific certifications in my application letter?

| Certification | Importance in Application Letter |

|---|---|

| CIC (Certified Insurance Counselor) | Highly recommended to mention; showcases specialized insurance knowledge. |

| APL (Associate in Claims) | Essential to include; demonstrates expertise in claims handling and processing. |

| ARM (Associate in Risk Management) | Valuable to highlight; indicates risk assessment skills relevant to investigations. |

| CPCU (Chartered Property Casualty Underwriter) | Advantageous to mention; reflects comprehensive insurance industry understanding. |

| Relevant state licenses | Critical to state if required; confirms legal eligibility to perform claims investigations. |

How can I show experience with fraud detection in my letter?

Highlighting your expertise in fraud detection within a job application letter for an Insurance Claims Investigator position is crucial to stand out. Emphasizing concrete achievements and relevant skills demonstrates your value to potential employers.

- Quantify Impact - Describe specific instances where you identified fraudulent claims, resulting in cost savings or prevention of losses.

- Detail Analytical Skills - Explain your use of data analysis, pattern recognition, and investigative techniques to uncover inconsistencies.

- Showcase Collaboration - Mention teamwork with legal departments, law enforcement, or fraud units to successfully resolve fraud cases.

Demonstrating these aspects effectively conveys your capability to detect and manage insurance fraud.

What is the ideal length for a job application letter for this role?

The ideal length for a job application letter for an Insurance Claims Investigator role is one page, typically around 300 to 400 words. This length allows for a concise yet detailed presentation of relevant skills, experience, and achievements. Keeping the letter focused ensures it captures the attention of hiring managers efficiently without overwhelming them.

How formal should the language be in the application letter?

The language in a job application letter for an Insurance Claims Investigator should be professional and formal to reflect the seriousness of the role. Clear, concise, and respectful wording demonstrates the applicant's attention to detail and reliability.

Avoid slang, casual expressions, or overly complex jargon that may confuse the reader. Use industry-relevant terms appropriately to showcase knowledge without compromising clarity.

Is it important to tailor the letter to each insurance company?

Tailoring a job application letter for an Insurance Claims Investigator to each insurance company is crucial for demonstrating genuine interest and understanding of the company's values. Personalized letters increase the chances of standing out by aligning the applicant's skills with the specific needs of the insurer.

- Company-Specific Language - Using terminology and references unique to the insurance company shows research and attentiveness.

- Highlighting Relevant Experience - Emphasizing experience that matches the insurer's claim types or policies improves relevance and appeal.

- Demonstrating Cultural Fit - Addressing the insurer's mission or culture in the letter positions the applicant as a better organizational fit.

What achievements should I emphasize for an Insurance Claims Investigator role?

Highlight achievements in accurately assessing and processing complex insurance claims, resulting in reduced fraud and increased recovery rates. Emphasize successful collaboration with legal and medical professionals to resolve claims efficiently while maintaining compliance with industry regulations. Showcase proficiency in data analysis and investigation techniques that led to faster claim resolutions and improved customer satisfaction.

Should I reference my knowledge of insurance regulations in the letter?

Referencing your knowledge of insurance regulations in a job application letter for an Insurance Claims Investigator position is highly beneficial. It demonstrates your understanding of the legal framework essential for accurate claims assessment.

Highlighting this expertise shows employers you can navigate complex policies and ensure compliance. Including specific regulatory knowledge can set you apart as a well-qualified candidate.