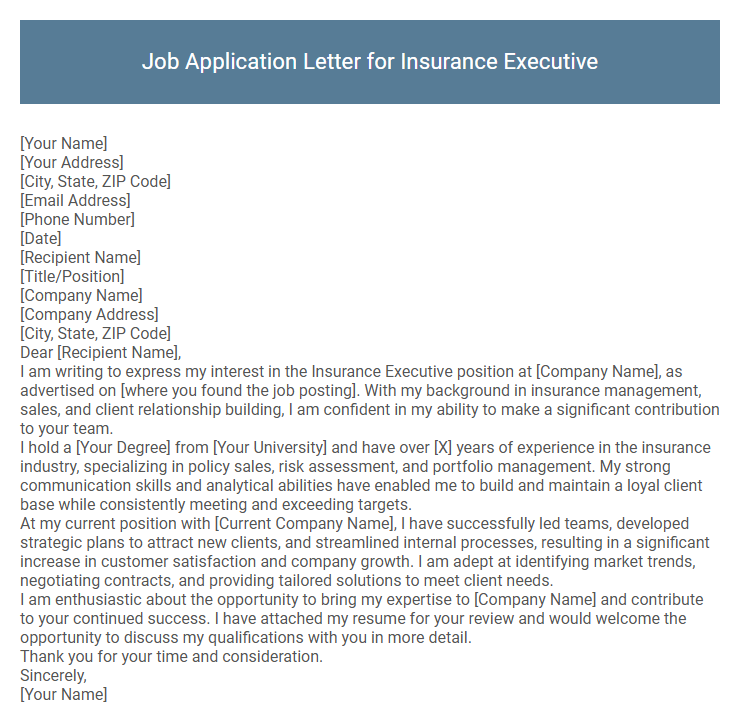

Job Application Letter for Insurance Executive Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Executive position at [Company Name], as advertised on [where you found the job posting]. With my background in insurance management, sales, and client relationship building, I am confident in my ability to make a significant contribution to your team.

I hold a [Your Degree] from [Your University] and have over [X] years of experience in the insurance industry, specializing in policy sales, risk assessment, and portfolio management. My strong communication skills and analytical abilities have enabled me to build and maintain a loyal client base while consistently meeting and exceeding targets.

At my current position with [Current Company Name], I have successfully led teams, developed strategic plans to attract new clients, and streamlined internal processes, resulting in a significant increase in customer satisfaction and company growth. I am adept at identifying market trends, negotiating contracts, and providing tailored solutions to meet client needs.

I am enthusiastic about the opportunity to bring my expertise to [Company Name] and contribute to your continued success. I have attached my resume for your review and would welcome the opportunity to discuss my qualifications with you in more detail.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an insurance executive position requires highlighting expertise in risk management, customer relations, and policy development. Emphasizing leadership skills and a track record of driving sales growth will capture the attention of hiring managers. Tailoring the letter to showcase industry knowledge and a commitment to client satisfaction strengthens the candidate's appeal.

What key qualifications should I highlight in my insurance executive job application letter?

Highlight your expertise in risk assessment, client relationship management, and insurance policy knowledge. Emphasize strong communication skills and experience in sales or underwriting to demonstrate your ability to drive business growth. Showcase your proficiency in regulatory compliance and claims management to ensure trust and reliability.

How should I address the hiring manager in my application letter?

How should I address the hiring manager in my job application letter for an Insurance Executive position? Use a formal salutation such as "Dear Hiring Manager" if the name is unknown. When possible, personalize it by addressing the manager by their full name or title to show attention to detail.

What is the ideal length for a job application letter for an insurance executive position?

The ideal length for a job application letter for an insurance executive position is concise yet informative, typically fitting onto one page. This length ensures the letter captures key qualifications and experiences without overwhelming the reader.

- Conciseness - Keeping the letter to one page highlights relevant skills and achievements efficiently.

- Clarity - A focused letter helps hiring managers quickly understand the candidate's suitability for the insurance executive role.

- Professionalism - A well-structured, succinct letter reflects strong communication skills essential in insurance executive positions.

Which achievements should I emphasize in my insurance executive cover letter?

Highlight achievements that demonstrate your ability to increase sales and client retention, such as exceeding sales targets by a specific percentage or securing high-value insurance contracts. Emphasize successful implementation of risk assessment strategies that minimized client losses and improved policy profitability.

Showcase leadership in developing innovative marketing campaigns or training programs that enhanced team performance and customer satisfaction. Include quantifiable results like growth in client portfolios or positive impact on company revenue to strengthen your application.

Should I mention specific insurance products or services in my letter?

Mentioning specific insurance products or services in your job application letter demonstrates your industry knowledge and aligns your skills with the company's offerings. Highlighting relevant products like life insurance, health insurance, or property insurance shows your understanding of key market areas. Tailor these mentions to the employer's portfolio to increase your letter's impact and relevance.

How do I showcase leadership experience in my application letter?

| Aspect | How to Showcase Leadership Experience |

|---|---|

| Highlight Relevant Roles | Mention positions where you led teams, managed projects, or drove initiatives within insurance or related sectors. |

| Quantify Achievements | Include specific metrics such as percentage growth in sales, team size managed, or targets exceeded under your leadership. |

| Demonstrate Decision-Making | Describe instances where you made strategic decisions that positively impacted business outcomes or client satisfaction. |

| Emphasize Communication Skills | Show how you effectively motivated teams, resolved conflicts, or presented ideas to stakeholders. |

| Connect Leadership to Insurance Expertise | Link leadership experience directly with insurance industry knowledge, such as developing client solutions or navigating regulatory environments. |

What tone is appropriate for an insurance executive job application letter?

The tone of a job application letter for an insurance executive should be professional and confident, reflecting expertise in risk management and client relations. It should convey reliability and attention to detail, essential qualities in the insurance industry. Maintaining a courteous and clear tone helps demonstrate strong communication skills critical for the role.

Should I attach references with my job application letter?

Attaching references with your job application letter for an Insurance Executive position is generally recommended as it strengthens your credibility and demonstrates your professionalism. References provide potential employers with verified insights into your skills, work ethic, and industry experience. However, if the job listing explicitly requests references at a later stage, you may choose to omit them and prepare to provide them upon request.

How do I tailor my letter for different insurance companies?

Tailor your job application letter for an Insurance Executive position by researching each company's values, services, and target market. Highlight relevant skills and experiences that align specifically with the company's insurance products and client needs.

Start by addressing the letter to the hiring manager with the company's name. Emphasize your knowledge of their insurance portfolio and how your expertise can contribute to their goals. Use keywords from the job description and company website to enhance relevance and demonstrate genuine interest.