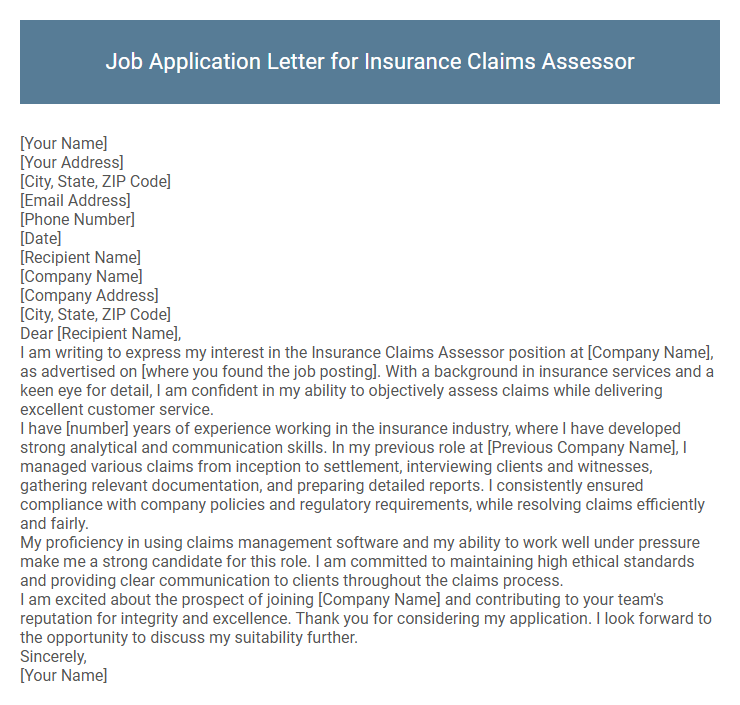

Job Application Letter for Insurance Claims Assessor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Claims Assessor position at [Company Name], as advertised on [where you found the job posting]. With a background in insurance services and a keen eye for detail, I am confident in my ability to objectively assess claims while delivering excellent customer service.

I have [number] years of experience working in the insurance industry, where I have developed strong analytical and communication skills. In my previous role at [Previous Company Name], I managed various claims from inception to settlement, interviewing clients and witnesses, gathering relevant documentation, and preparing detailed reports. I consistently ensured compliance with company policies and regulatory requirements, while resolving claims efficiently and fairly.

My proficiency in using claims management software and my ability to work well under pressure make me a strong candidate for this role. I am committed to maintaining high ethical standards and providing clear communication to clients throughout the claims process.

I am excited about the prospect of joining [Company Name] and contributing to your team's reputation for integrity and excellence. Thank you for considering my application. I look forward to the opportunity to discuss my suitability further.

Sincerely,

[Your Name]

Applying for the position of Insurance Claims Assessor requires a clear demonstration of expertise in evaluating insurance claims accurately and efficiently. Highlighting strong analytical skills, attention to detail, and a thorough understanding of insurance policies ensures a compelling job application letter. Emphasizing experience in investigating claims and maintaining regulatory compliance can significantly increase the chances of securing the role.

What should I include in a job application letter for an Insurance Claims Assessor position?

Include a clear introduction stating the position you are applying for and a brief overview of your relevant experience in insurance claims assessment. Highlight key skills such as attention to detail, knowledge of insurance policies, and strong analytical abilities. Conclude with a confident statement expressing your enthusiasm for the role and how you can contribute to the company's success.

How do I highlight my experience relevant to claims assessment?

| Element | How to Highlight Experience |

|---|---|

| Professional Summary | Start with a concise summary emphasizing years of experience in insurance claims assessment and expertise in evaluating policy coverage and damage reports. |

| Key Skills | List skills such as risk analysis, claim investigation, negotiation, fraud detection, and report preparation directly related to claims assessment. |

| Work Experience | Detail previous roles with focus on assessing claims, handling complex cases, collaborating with claimants and legal teams, and improving claims processing efficiency. |

| Achievements | Mention specific results like reducing claim processing time, improving accuracy in claim evaluations, or successful dispute resolution rates. |

| Certifications & Training | Include certifications such as Chartered Insurance Institute (CII) qualifications or specific claims handling courses that validate professional expertise. |

What key skills are employers looking for in Insurance Claims Assessors?

Employers seek Insurance Claims Assessors with strong analytical skills to accurately evaluate and process claims. Excellent communication abilities are essential for effectively liaising with clients, adjusters, and legal representatives. Attention to detail and knowledge of insurance policies ensure precise assessment and fraud detection.

How do I address my knowledge of insurance policies in the letter?

Highlight your comprehensive understanding of various insurance policies and how this knowledge equips you to accurately assess claims. Emphasize your ability to interpret policy terms, conditions, and exclusions to ensure fair and compliant claim evaluations.

- Policy Expertise - Demonstrate familiarity with diverse insurance products including property, health, and liability policies.

- Claims Accuracy - Showcase skills in applying detailed policy knowledge to validate claims and prevent fraud.

- Regulatory Compliance - Highlight adherence to legal and regulatory standards while assessing claims based on policy frameworks.

Should I mention certifications or training in my application letter?

Mentioning certifications or training in a Job Application Letter for an Insurance Claims Assessor is highly recommended. Certifications such as CPCU, AIC, or relevant risk management courses demonstrate your expertise and commitment to the field. Highlighting these credentials can set you apart from other candidates and assure employers of your qualifications.

How can I demonstrate my analytical skills in the letter?

To demonstrate analytical skills in a Job Application Letter for an Insurance Claims Assessor, highlight specific instances where data evaluation led to accurate claim resolutions. Emphasize your ability to identify discrepancies and make informed decisions based on thorough analysis.

- Data Interpretation - Describe analyzing complex claim documents to identify inconsistencies and validate information accurately.

- Problem Solving - Show how evaluating claim patterns helped detect potential fraud or errors, improving claim processing efficiency.

- Decision Making - Explain making evidence-based recommendations for claim approvals or denials by assessing risk factors and policy terms.

These examples provide concrete proof of your analytical expertise relevant to insurance claim assessments.

Is it necessary to mention previous employer names in the application letter?

Mentioning previous employer names in a job application letter for an Insurance Claims Assessor is not strictly necessary. Emphasis should be on relevant skills and experience that align with the job requirements.

Highlighting previous employers can provide credibility and context to your expertise in claims assessment. Focus on roles that demonstrate your ability to evaluate insurance claims accurately and efficiently. Tailor the information to show how your background meets the insurer's expectations.

How long should my job application letter be for this role?

The job application letter for an Insurance Claims Assessor should be concise, ideally one page. This length ensures clear communication of relevant skills without overwhelming the hiring manager.

- Conciseness is key - Keep the letter between 250 to 400 words to maintain the employer's attention.

- Focus on relevance - Highlight key qualifications and experience specific to claims assessment.

- Professional tone - Use clear and direct language to communicate your suitability for the role efficiently.

What is the best way to conclude an Insurance Claims Assessor application letter?

Conclude your Insurance Claims Assessor application letter by expressing enthusiasm for the opportunity to contribute your analytical and decision-making skills to the company. Reinforce your commitment to accurate and fair claim assessments that align with company policies and client satisfaction.

Thank the employer for considering your application and express your eagerness to discuss how your expertise can benefit their claims department. Invite them to contact you for an interview or further discussion at their convenience.