Job Application Letter for Insurance Fraud Investigator Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

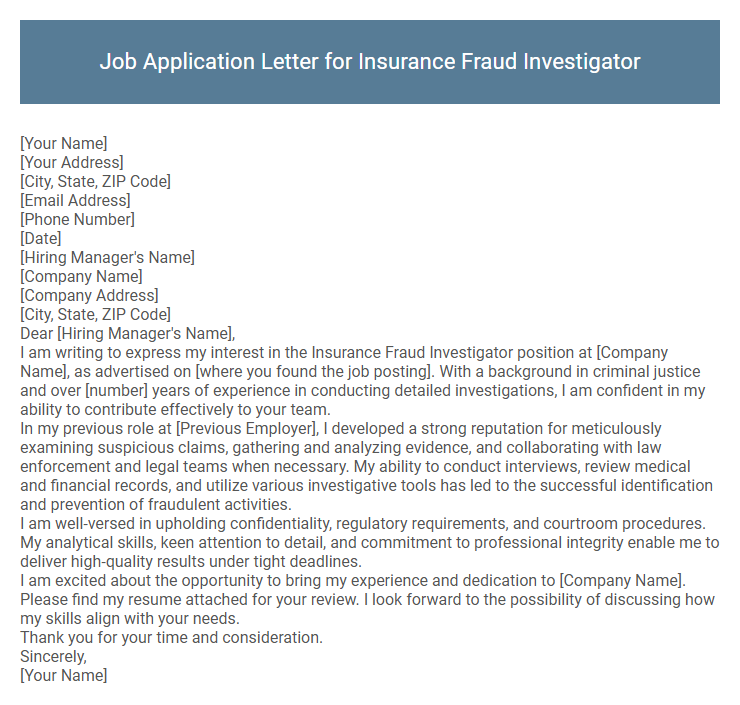

I am writing to express my interest in the Insurance Fraud Investigator position at [Company Name], as advertised on [where you found the job posting]. With a background in criminal justice and over [number] years of experience in conducting detailed investigations, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Employer], I developed a strong reputation for meticulously examining suspicious claims, gathering and analyzing evidence, and collaborating with law enforcement and legal teams when necessary. My ability to conduct interviews, review medical and financial records, and utilize various investigative tools has led to the successful identification and prevention of fraudulent activities.

I am well-versed in upholding confidentiality, regulatory requirements, and courtroom procedures. My analytical skills, keen attention to detail, and commitment to professional integrity enable me to deliver high-quality results under tight deadlines.

I am excited about the opportunity to bring my experience and dedication to [Company Name]. Please find my resume attached for your review. I look forward to the possibility of discussing how my skills align with your needs.

Thank you for your time and consideration.

Sincerely,

[Your Name]

A job application letter for an Insurance Fraud Investigator highlights the candidate's expertise in detecting and preventing fraudulent activities within the insurance industry. This document emphasizes analytical skills, attention to detail, and knowledge of investigative techniques critical to safeguarding company assets. Demonstrating experience with legal regulations and strong communication abilities can significantly enhance the application's impact.

What key skills should be highlighted in a job application letter for an Insurance Fraud Investigator?

Key skills to highlight in a job application letter for an Insurance Fraud Investigator include strong analytical abilities to detect fraud patterns and discrepancies. Emphasize expertise in investigative techniques, attention to detail, and proficiency with relevant software and databases. Communication skills for interviewing witnesses and writing clear reports are essential for effective case resolution.

How do I format a job application letter for an Insurance Fraud Investigator position?

Begin your job application letter for an Insurance Fraud Investigator position with a formal header including your contact information, the date, and the employer's details. Start the introduction by stating the position you are applying for and briefly mentioning your relevant experience.

In the body, highlight your skills in fraud detection, analytical abilities, and knowledge of insurance policies. Emphasize any experience with investigative techniques and legal compliance. Conclude by expressing enthusiasm for the role and your readiness to contribute to the company's fraud prevention efforts.

Should I mention specific fraud investigation techniques in my letter?

Including specific fraud investigation techniques in your job application letter can demonstrate your expertise and practical knowledge, making your candidacy stand out. However, balance detailed skills with a concise overview to maintain the letter's readability and relevance to the job description.

- Highlight Relevant Techniques - Mention key methods like data analysis, surveillance, or interviewing to showcase your hands-on experience.

- Align with Job Requirements - Tailor the techniques referenced to those emphasized in the job posting to show your suitability.

- Keep It Concise - Provide brief, impactful descriptions to maintain the letter's clarity and focus on your strengths.

What certifications are important to include in an application letter for this role?

Including relevant certifications in a job application letter for an Insurance Fraud Investigator enhances credibility and demonstrates specialized expertise. Highlighting these credentials helps employers quickly verify qualifications essential for the role.

- Certified Fraud Examiner (CFE) - Validates expertise in fraud prevention, detection, and investigation specific to insurance and related industries.

- Insurance Fraud Investigator Certification - Shows specialized knowledge in insurance claims analysis and fraud detection methodologies.

- Certified Insurance Investigator (CII) - Demonstrates a thorough understanding of insurance laws, regulations, and investigative techniques.

Including these certifications in the application letter significantly improves the candidate's profile and chances of securing the position.

How do I address a lack of direct experience in insurance fraud investigation?

When addressing a lack of direct experience in insurance fraud investigation in a job application letter, emphasize transferable skills and relevant experiences. Highlight your enthusiasm for learning and commitment to developing expertise in the field.

Focus on showcasing analytical skills, attention to detail, and any background in investigation or risk assessment that aligns with the role.

- Highlight Transferable Skills - Emphasize experience in areas like data analysis, critical thinking, or compliance that are relevant to fraud investigation.

- Showcase Related Experience - Demonstrate involvement in roles requiring investigation, risk management, or security that support your capability to learn insurance fraud investigation.

- Express Commitment to Learning - Convey eagerness to pursue additional training, certifications, or mentorship to build specific knowledge in insurance fraud.

What achievements impress employers in this field?

Employers in the insurance fraud investigation field value achievements such as successfully uncovering complex fraud schemes that result in significant cost savings. Demonstrating proficiency in advanced data analysis tools and forensic accounting techniques also impresses hiring managers. Consistently maintaining a high case closure rate with documented recoveries of fraudulent claims highlights an applicant's expertise.

Is it necessary to customize each application letter for different companies?

Customizing each job application letter for an Insurance Fraud Investigator position is essential for demonstrating genuine interest and understanding of the specific company's values and needs. Tailored letters highlight relevant skills and experiences that align with the company's investigative approach and fraud prevention strategies. This personalized approach increases the likelihood of standing out among applicants and securing an interview.

How can I demonstrate analytical abilities in my application letter?

How can I effectively demonstrate my analytical abilities in a job application letter for an Insurance Fraud Investigator position? Highlight specific examples of past experiences where you identified patterns, analyzed complex data, and solved fraud cases. Emphasize skills such as attention to detail, critical thinking, and proficiency with data analysis tools relevant to fraud investigation.

What is the ideal length for a job application letter for this position?

The ideal length for a job application letter for an Insurance Fraud Investigator position is one page, approximately 250 to 300 words. This length allows concise presentation of relevant experience, analytical skills, and attention to detail crucial for the role. Keeping the letter focused ensures clarity and professionalism, appealing to hiring managers in the insurance industry.