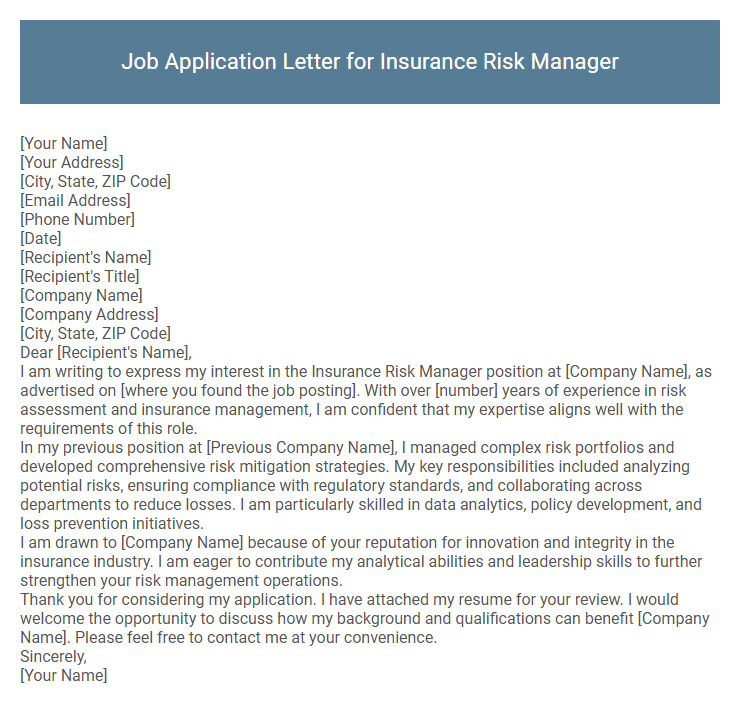

Job Application Letter for Insurance Risk Manager Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Risk Manager position at [Company Name], as advertised on [where you found the job posting]. With over [number] years of experience in risk assessment and insurance management, I am confident that my expertise aligns well with the requirements of this role.

In my previous position at [Previous Company Name], I managed complex risk portfolios and developed comprehensive risk mitigation strategies. My key responsibilities included analyzing potential risks, ensuring compliance with regulatory standards, and collaborating across departments to reduce losses. I am particularly skilled in data analytics, policy development, and loss prevention initiatives.

I am drawn to [Company Name] because of your reputation for innovation and integrity in the insurance industry. I am eager to contribute my analytical abilities and leadership skills to further strengthen your risk management operations.

Thank you for considering my application. I have attached my resume for your review. I would welcome the opportunity to discuss how my background and qualifications can benefit [Company Name]. Please feel free to contact me at your convenience.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an Insurance Risk Manager position requires highlighting expertise in risk assessment, mitigation strategies, and compliance with industry regulations. Demonstrating strong analytical skills and a proactive approach to identifying potential risks ensures alignment with organizational goals and protection against financial losses. Emphasizing leadership experience and effective communication abilities enhances the candidate's suitability for managing risk portfolios and collaborating with cross-functional teams.

What should I include in a job application letter for an Insurance Risk Manager position?

Include a strong opening that states the position you are applying for and your enthusiasm for the Insurance Risk Manager role. Highlight your relevant experience in risk assessment, mitigation strategies, and familiarity with industry regulations. Emphasize your analytical skills, problem-solving abilities, and track record of managing insurance risks effectively.

How do I highlight my risk management skills in the cover letter?

Emphasize your expertise in identifying, assessing, and mitigating risks to demonstrate your value as an Insurance Risk Manager. Showcase specific achievements that reflect your proactive approach and strategic problem-solving skills.

- Quantify Successes - Highlight measurable outcomes such as reduced claim losses or improved risk assessment accuracy to prove effectiveness.

- Use Industry Terminology - Incorporate relevant insurance and risk management terms to show deep sector knowledge and professionalism.

- Highlight Analytical Skills - Describe how you use data analytics and modeling to predict risks and develop mitigation strategies.

Tailor your cover letter to align your risk management skills with the specific needs and goals of the insurance company.

What format should I use for an Insurance Risk Manager application letter?

| Section | Details |

| Header | Include your contact information, date, and the employer's details at the top |

| Salutation | Use a formal greeting such as "Dear Hiring Manager" or address the recipient by name if known |

| Introduction | State the position you are applying for and a brief summary of your qualifications |

| Body | Explain your experience in risk management, relevant skills, accomplishments, and how you can add value to the insurance company |

| Closing | Express enthusiasm for the role, request an interview, and include a professional closing statement with your signature |

How long should my job application letter be?

Your job application letter for an Insurance Risk Manager position should be concise, ideally between 250 to 400 words. Focus on highlighting your key qualifications, relevant experience, and how you can add value to the company. Keep it clear and to the point to maintain the hiring manager's attention.

Should I mention specific insurance industry certifications in my letter?

Mentioning specific insurance industry certifications in your job application letter for an Insurance Risk Manager position demonstrates your expertise and commitment to the field. Certifications such as CPCU, ARM, or CRM can significantly strengthen your candidacy by highlighting your specialized knowledge.

Including these credentials helps recruiters quickly identify your qualifications and suitability for the role. Ensure you briefly explain how these certifications have enhanced your skills relevant to risk management tasks.

Is it necessary to tailor my letter to each insurance company?

Is it necessary to tailor my job application letter for an Insurance Risk Manager to each insurance company? Customizing your letter highlights your understanding of the company's specific risk management needs and demonstrates genuine interest. Personalized letters increase the chances of standing out among other applicants and show that you have researched the company's goals and challenges.

How do I demonstrate knowledge of insurance regulations in my letter?

Showing knowledge of insurance regulations in a job application letter requires precise examples and relevant terminology. It is essential to align your experience with current industry standards and legal requirements.

- Reference specific regulations - Mention familiarity with key insurance laws such as Solvency II, GDPR, or state-level compliance standards to demonstrate your regulatory knowledge.

- Highlight practical application - Describe situations where you ensured compliance, mitigated risks, or updated policies according to regulatory changes to showcase hands-on expertise.

- Include certifications or training - List relevant certifications like CPCU or attendance at compliance seminars to emphasize your ongoing commitment to understanding insurance regulations.

What key achievements should I mention relating to risk management?

Highlight successful implementation of risk assessment frameworks that reduced company exposure by 15%. Emphasize experience in developing strategic risk mitigation plans resulting in a 20% decrease in insurance claims. Mention leadership in cross-functional teams to enhance compliance with regulatory standards, improving audit outcomes significantly.

Can I include references in my application letter?

Including references in a job application letter for an Insurance Risk Manager position is generally not required unless specifically requested by the employer. It is more effective to mention that references are available upon request.

Employers typically prefer to receive references later in the hiring process after an initial review of qualifications. Providing references prematurely may clutter the application and distract from your key skills and experience. Clearly stating your willingness to provide references demonstrates professionalism and readiness to support your candidacy.