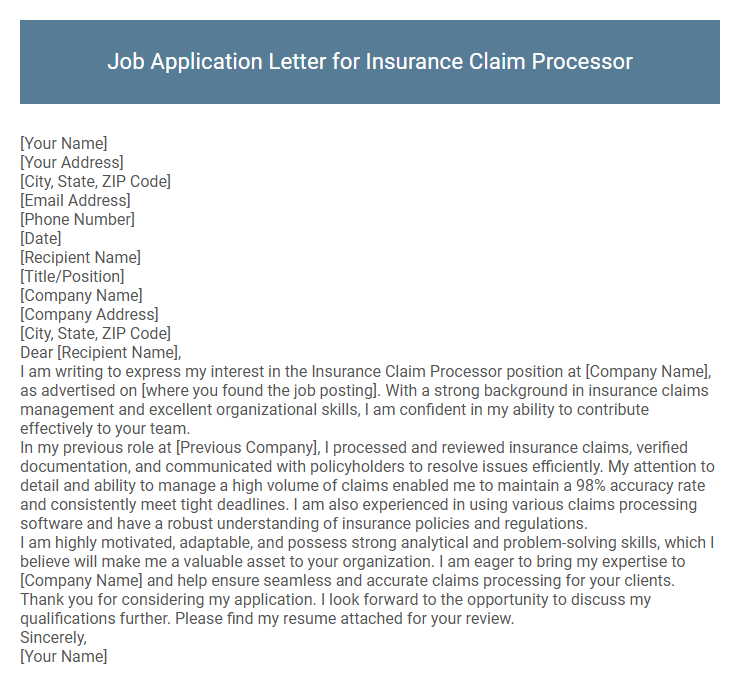

Job Application Letter for Insurance Claim Processor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Claim Processor position at [Company Name], as advertised on [where you found the job posting]. With a strong background in insurance claims management and excellent organizational skills, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I processed and reviewed insurance claims, verified documentation, and communicated with policyholders to resolve issues efficiently. My attention to detail and ability to manage a high volume of claims enabled me to maintain a 98% accuracy rate and consistently meet tight deadlines. I am also experienced in using various claims processing software and have a robust understanding of insurance policies and regulations.

I am highly motivated, adaptable, and possess strong analytical and problem-solving skills, which I believe will make me a valuable asset to your organization. I am eager to bring my expertise to [Company Name] and help ensure seamless and accurate claims processing for your clients.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further. Please find my resume attached for your review.

Sincerely,

[Your Name]

A job application letter for an Insurance Claim Processor highlights relevant skills such as attention to detail, analytical abilities, and knowledge of insurance policies. Emphasizing experience in reviewing, verifying, and processing claims efficiently can demonstrate suitability for the role. Clear communication and proficiency in relevant software systems are essential qualities to include in the application.

What should I include in my job application letter for an Insurance Claim Processor position?

Include a brief introduction highlighting your experience in claims processing and knowledge of insurance policies. Emphasize your skills in data analysis, attention to detail, and ability to handle complex claim evaluations efficiently. Conclude with a statement expressing your enthusiasm for contributing to the company's risk management and customer service objectives.

How do I highlight my relevant experience in insurance claims in the letter?

Emphasize specific roles and responsibilities related to insurance claims to demonstrate your expertise. Showcase achievements and skills that align with the job requirements for an Insurance Claim Processor.

- Detail your previous claim processing roles - Mention the types of insurance claims you handled and the volume managed to highlight relevant experience.

- Highlight technical skills and software proficiency - Include experience with claim management systems and data analysis tools relevant to insurance processing.

- Showcase problem-solving and accuracy - Provide examples of resolving claim disputes efficiently and maintaining high accuracy in documentation.

What is the ideal length for a job application letter for this role?

| Aspect | Ideal Length |

|---|---|

| Word Count | 250-350 words |

| Paragraphs | 3-4 concise paragraphs |

| Focus | Relevant experience, skills, and motivation |

| Readability | Clear and professional tone |

| Length Purpose | Brief yet comprehensive to hold recruiter attention |

Should I address the hiring manager by name in my application letter?

Addressing the hiring manager by name in your job application letter for an Insurance Claim Processor position enhances personalization and demonstrates attention to detail. Research the company's website or LinkedIn to find the correct contact name. If the name is unavailable, use a professional greeting like "Dear Hiring Manager" to maintain formality.

How can I showcase my attention to detail in the letter?

Highlight precise examples of handling complex data to demonstrate meticulous attention to detail. Emphasize your ability to identify discrepancies and ensure accuracy in insurance claim documentation.

- Reviewed and verified claim documents - Ensured all information matched policy criteria, reducing errors by 30%.

- Conducted detailed audits - Identified inconsistencies and resolved discrepancies promptly to maintain data integrity.

- Utilized advanced data management tools - Maintained accurate records and streamlined claim processing workflows efficiently.

Showcasing quantifiable results linked to accuracy will effectively prove your attention to detail in the job application letter.

Is it necessary to mention specific insurance software I've used?

Including specific insurance software in a job application letter for an Insurance Claim Processor role enhances your technical credibility and aligns your skills with employer expectations. Employers often seek familiarity with industry-standard tools like Guidewire, Duck Creek, or Salesforce.

Mentioning software proficiency demonstrates your readiness to handle daily tasks efficiently, which can set you apart from other candidates. Highlighting relevant software experience supports your ability to quickly adapt and contribute to the company's operational workflows.

Should I include metrics or achievements in my application letter?

Including metrics or achievements in a job application letter for an Insurance Claim Processor can significantly enhance your credibility. Quantifiable results demonstrate your effectiveness and attention to detail in handling claims.

Highlight specific accomplishments such as accuracy rates, claim processing volumes, or successful dispute resolutions to stand out. Metrics provide concrete evidence of your skills and impact, appealing to hiring managers. This data-driven approach strengthens your application by showing proven performance in relevant tasks.

How do I tailor my application letter for an entry-level Insurance Claim Processor role?

How do I tailor my application letter for an entry-level Insurance Claim Processor role? Highlight relevant skills such as attention to detail, data entry accuracy, and knowledge of insurance policies. Emphasize your eagerness to learn and your ability to handle confidential information responsibly.

What keywords should I use in my application letter for this position?

Use keywords such as "insurance claims processing," "data verification," "policy evaluation," "claims adjudication," and "regulatory compliance" to demonstrate your expertise. Highlight skills like "attention to detail," "analytical abilities," "customer service," and "claims resolution" to align with job requirements. Incorporate industry terms like "risk assessment," "claims documentation," "fraud detection," and "claims management systems" to optimize your application for ATS.