Job Application Letter for Mortgage Broker Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

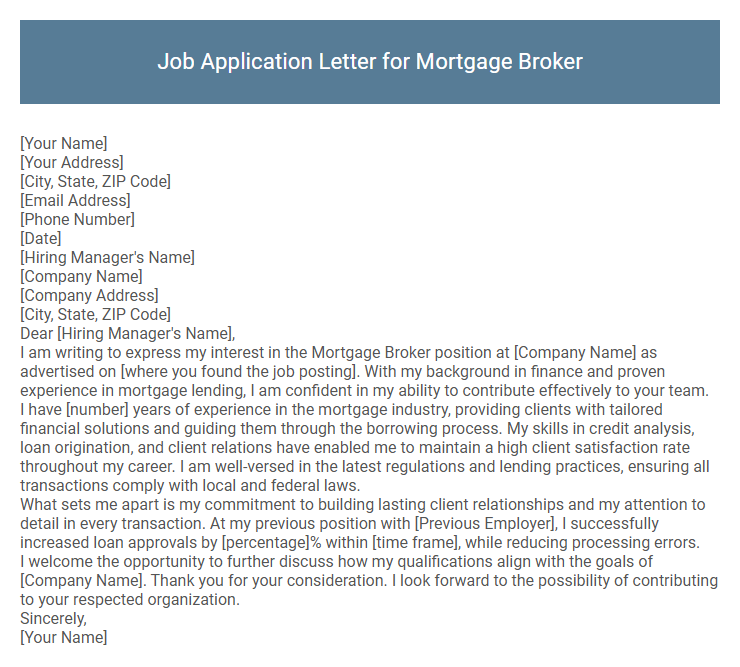

I am writing to express my interest in the Mortgage Broker position at [Company Name] as advertised on [where you found the job posting]. With my background in finance and proven experience in mortgage lending, I am confident in my ability to contribute effectively to your team.

I have [number] years of experience in the mortgage industry, providing clients with tailored financial solutions and guiding them through the borrowing process. My skills in credit analysis, loan origination, and client relations have enabled me to maintain a high client satisfaction rate throughout my career. I am well-versed in the latest regulations and lending practices, ensuring all transactions comply with local and federal laws.

What sets me apart is my commitment to building lasting client relationships and my attention to detail in every transaction. At my previous position with [Previous Employer], I successfully increased loan approvals by [percentage]% within [time frame], while reducing processing errors.

I welcome the opportunity to further discuss how my qualifications align with the goals of [Company Name]. Thank you for your consideration. I look forward to the possibility of contributing to your respected organization.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a mortgage broker position requires highlighting relevant financial expertise, strong client relationship skills, and a thorough understanding of mortgage products. Emphasize your track record in guiding clients through complex loan processes and securing favorable mortgage terms. Demonstrating professionalism and attention to detail can set you apart in the competitive mortgage industry.

What is a job application letter for a mortgage broker?

A job application letter for a mortgage broker is a formal document sent to potential employers to express interest in a mortgage broker position. It highlights relevant skills, such as knowledge of loan processing, client communication, and financial assessment. This letter aims to demonstrate qualifications and secure an interview opportunity.

What key qualifications should I include in my application letter?

When writing a job application letter for a Mortgage Broker position, emphasize your strong knowledge of mortgage products, excellent communication skills, and proven ability to assess clients' financial situations accurately. Highlight your experience in loan processing, client relationship management, and compliance with lending regulations.

Include qualifications such as a certification in mortgage brokering or finance, proficiency in financial software, and a track record of successful mortgage approvals. Showcase your skills in negotiation and problem-solving to secure the best terms for clients. Demonstrate your commitment to staying updated with industry trends and regulatory changes to ensure effective and ethical service.

How do I address my letter to a hiring manager?

How do I address my job application letter to a hiring manager for a Mortgage Broker position? Use a professional salutation such as "Dear Hiring Manager" if the specific name is unknown. Research the company's website or LinkedIn to find the hiring manager's name for a more personalized greeting.

What specific skills are employers seeking in mortgage brokers?

Employers seek mortgage brokers with strong financial analysis skills and a thorough understanding of loan products. Effective communication and customer service abilities are essential to guide clients through complex mortgage processes. Attention to detail and regulatory compliance knowledge ensure smooth and lawful transactions.

Should I mention licensing or certifications in my letter?

| Aspect | Details |

|---|---|

| Importance of Licensing | Essential to mention licensing to validate your legal qualifications and credibility as a mortgage broker. |

| Certifications to Include | List relevant certifications such as NMLS (Nationwide Multistate Licensing System) and any state-specific licenses. |

| Placement in Letter | Include licensing details in the opening or middle paragraphs to highlight professional qualifications early. |

| Benefits | Enhances trust with employers, shows compliance with industry regulations, and highlights your expertise. |

| Additional Tips | Briefly mention ongoing education or renewed certifications to demonstrate commitment to current standards. |

How long should my job application letter be?

Your job application letter for a mortgage broker position should ideally be one page long, typically between 250 to 400 words. This length ensures you provide enough detail about your qualifications and experience without overwhelming the reader.

Focus on concise, relevant information that highlights your expertise in mortgage lending, client relations, and financial analysis. Hiring managers prefer clear, well-structured letters that quickly convey your suitability for the role.

Do I need to provide examples of past mortgage broker experience?

Providing examples of past mortgage broker experience in a job application letter significantly strengthens your candidacy. It demonstrates your practical knowledge and ability to handle real-world mortgage scenarios effectively.

- Relevance - Highlighting specific mortgage deals or client interactions shows your direct expertise in the field.

- Credibility - Concrete examples build trust and prove your capability to prospective employers.

- Competitive Edge - Detailing past successes differentiates you from other applicants with similar qualifications.

Including detailed past mortgage broker experiences in your application letter is highly recommended for a stronger impact.

How can I show my familiarity with lending regulations?

Demonstrating knowledge of lending regulations is crucial in a job application letter for a mortgage broker. Highlighting specific compliance experience shows your readiness to navigate complex legal frameworks effectively.

- Mention Relevant Certifications - Including licenses such as NMLS registration proves your understanding of industry standards and regulatory requirements.

- Reference Training and Courses - Describing completed courses on RESPA, TILA, or other lending laws illustrates your commitment to compliance education.

- Provide Examples of Compliance Experience - Detailing past roles where you ensured adherence to lending regulations reinforces your practical knowledge and reliability.

Is it necessary to tailor my letter for each mortgage company?

Tailoring your job application letter for each mortgage company significantly increases your chances of standing out. Customized letters demonstrate genuine interest and alignment with the company's values and services.

- Enhanced Relevance - Customizing your letter highlights specific skills and experiences that match the mortgage company's unique needs.

- Shows Dedication - A personalized letter reflects your commitment and seriousness about working with that particular firm.

- Improves Engagement - Mortgage companies are more likely to engage with applicants who address their specific goals and culture.