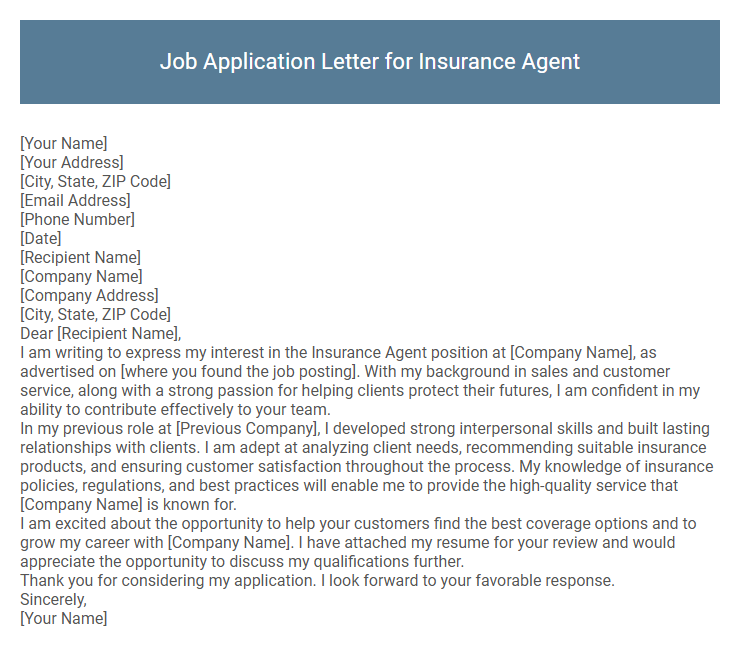

Job Application Letter for Insurance Agent Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Agent position at [Company Name], as advertised on [where you found the job posting]. With my background in sales and customer service, along with a strong passion for helping clients protect their futures, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I developed strong interpersonal skills and built lasting relationships with clients. I am adept at analyzing client needs, recommending suitable insurance products, and ensuring customer satisfaction throughout the process. My knowledge of insurance policies, regulations, and best practices will enable me to provide the high-quality service that [Company Name] is known for.

I am excited about the opportunity to help your customers find the best coverage options and to grow my career with [Company Name]. I have attached my resume for your review and would appreciate the opportunity to discuss my qualifications further.

Thank you for considering my application. I look forward to your favorable response.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an insurance agent position highlights your expertise in risk assessment, client relationship management, and policy sales. Emphasizing strong communication skills and a thorough understanding of insurance products can differentiate you from other candidates. Tailoring your letter to reflect relevant experience and a commitment to customer service ensures a professional and persuasive application.

What should I include in a job application letter for an insurance agent position?

Include a clear introduction stating the position you are applying for and how you learned about the vacancy. Highlight relevant skills such as customer service, knowledge of insurance policies, and sales experience. Conclude with a call to action, expressing your enthusiasm for an interview and providing your contact information.

How do I address my letter if I don't know the hiring manager's name?

| Situation | Addressing the Letter |

|---|---|

| Unknown Hiring Manager's Name | Use general but professional greetings such as "Dear Hiring Manager," or "Dear Recruitment Team," to ensure respect and formality. |

| Unknown Department | Address the letter with "Dear Insurance Recruitment Team," or "Dear Human Resources Department," for targeted relevance. |

| Research Attempt Failed | Include a brief statement in the introduction expressing enthusiasm for the role without mentioning a specific name. |

| Option to Call Company | Consider calling the company's HR department to request the hiring manager's name for a personalized greeting. |

| Generic Opening Example | Start with "To Whom It May Concern:" only if no other options are viable, as it can seem less personalized. |

What key skills should I highlight in my insurance agent application letter?

Highlight strong communication and interpersonal skills in your insurance agent application letter to demonstrate your ability to connect with clients effectively. Emphasize your knowledge of insurance products and regulatory compliance to show your expertise and professionalism.

Showcase your sales and negotiation skills, which are essential for closing policies and building client trust. Include your problem-solving abilities and attention to detail, ensuring accurate policy recommendations tailored to client needs. Mention any experience with customer service and claims processing to illustrate your comprehensive understanding of the insurance industry.

How long should my job application letter be?

Your job application letter for an insurance agent position should be concise, ideally one page long. Focus on relevant skills, experience, and your motivation for applying.

A length of 3 to 4 paragraphs is optimal to maintain the recruiter's interest. Avoid unnecessary details to ensure clarity and professionalism.

Should I mention my sales achievements in the letter?

Mentioning your sales achievements in a job application letter for an insurance agent position highlights your proven success and ability to meet targets. Including specific accomplishments makes your application more compelling and relevant to hiring managers.

- Demonstrates Competence - Highlighting sales achievements shows you possess the necessary skills to drive revenue in insurance sales.

- Builds Credibility - Quantifiable accomplishments validate your expertise and distinguish you from other candidates.

- Aligns with Employer Goals - Showcasing results aligns your experience with the company's focus on growth and client acquisition.

How do I demonstrate my knowledge of insurance products?

I demonstrate my knowledge of insurance products by clearly explaining policy features, benefits, and coverage options tailored to clients' needs. I stay updated on industry trends and regulatory changes to provide accurate and relevant information. I also share examples of past successful client consultations to highlight my expertise and problem-solving skills.

Can I use a template for my application letter?

Using a template for your insurance agent job application letter can streamline the writing process and ensure you include all essential components. Customizing the template to reflect your unique skills and experiences enhances its effectiveness.

- Consistency - Templates provide a professional structure that highlights your qualifications clearly.

- Time-saving - Templates reduce the time spent on formatting and organizing your letter.

- Customization - Personalizing a template ensures it aligns with the specific job and company culture.

A tailored application letter template serves as a strong foundation but must be adapted to showcase your individual strengths as an insurance agent.

Is it necessary to customize my letter for each insurance company?

Customizing your job application letter for each insurance company significantly improves your chances of standing out. Tailored letters demonstrate genuine interest and alignment with the company's values and needs.

- Relevance - Customized letters highlight your qualifications that match the specific insurance company's requirements.

- Professionalism - Personalizing your letter shows attention to detail and respect for the employer's unique culture.

- Competitive Edge - A tailored application helps differentiate you from generic submissions, increasing interview opportunities.

What tone should I use in the application letter?

Use a professional and confident tone in your job application letter for an insurance agent position. Demonstrate enthusiasm and genuine interest in helping clients with their insurance needs.

Maintain clarity and politeness throughout the letter to convey respect and professionalism. Emphasize your commitment to providing excellent customer service and attention to detail.