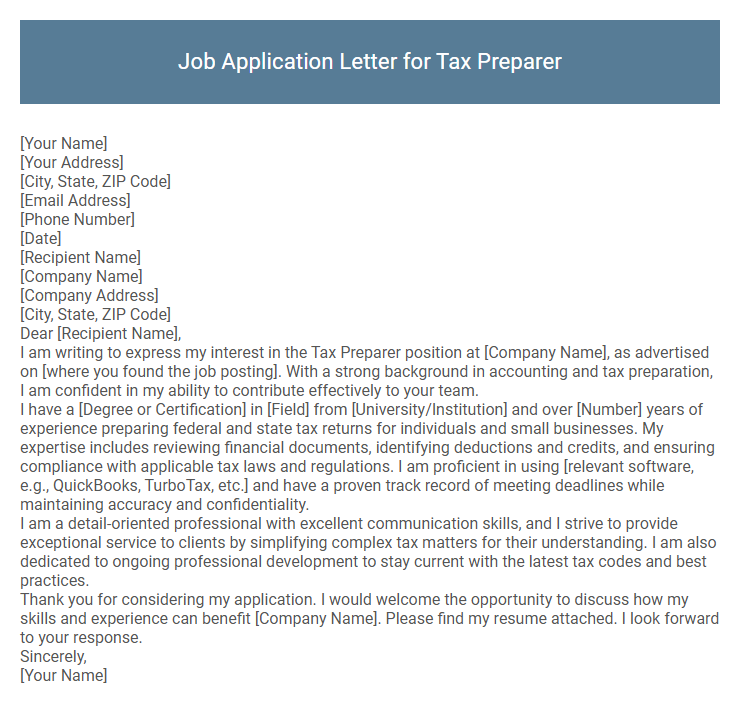

Job Application Letter for Tax Preparer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Tax Preparer position at [Company Name], as advertised on [where you found the job posting]. With a strong background in accounting and tax preparation, I am confident in my ability to contribute effectively to your team.

I have a [Degree or Certification] in [Field] from [University/Institution] and over [Number] years of experience preparing federal and state tax returns for individuals and small businesses. My expertise includes reviewing financial documents, identifying deductions and credits, and ensuring compliance with applicable tax laws and regulations. I am proficient in using [relevant software, e.g., QuickBooks, TurboTax, etc.] and have a proven track record of meeting deadlines while maintaining accuracy and confidentiality.

I am a detail-oriented professional with excellent communication skills, and I strive to provide exceptional service to clients by simplifying complex tax matters for their understanding. I am also dedicated to ongoing professional development to stay current with the latest tax codes and best practices.

Thank you for considering my application. I would welcome the opportunity to discuss how my skills and experience can benefit [Company Name]. Please find my resume attached. I look forward to your response.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a tax preparer role requires highlighting expertise in tax regulations, attention to detail, and strong analytical skills. Emphasizing experience with various tax software and a proven track record of maximizing client refunds can set candidates apart. Clear communication and the ability to stay updated with changing tax laws demonstrate professionalism and reliability in this field.

What should I include in a job application letter for a Tax Preparer position?

Include your relevant experience with tax laws, preparation software, and client consultation in the job application letter for a Tax Preparer position. Highlight certifications such as CPA or Enrolled Agent, and demonstrate your attention to detail and accuracy in financial documentation. Emphasize your ability to meet deadlines, maintain confidentiality, and provide excellent customer service to clients.

How do I highlight my tax preparation skills in my application letter?

Showcase your expertise by emphasizing specific tax codes and software proficiency relevant to the role. Demonstrate your attention to detail and accuracy in managing client financial information.

- Highlight technical skills - Mention experience with popular tax software like TurboTax, QuickBooks, or TaxAct and knowledge of IRS regulations.

- Showcase problem-solving ability - Describe how you resolved complex tax issues or maximized client refunds through thorough preparation.

- Emphasize client communication - Explain your approach to explaining tax processes clearly and building trust with clients.

Tailor your job application letter to reflect concrete examples of successful tax preparation achievements.

Should I mention certifications like CPA or EA in my cover letter?

Mentioning certifications like CPA (Certified Public Accountant) or EA (Enrolled Agent) in your job application letter for a Tax Preparer position is highly recommended. These credentials highlight your expertise and can differentiate you from other candidates.

Including certifications also assures the employer of your knowledge in tax laws and regulations, which is critical for the role. Make sure to briefly state your certifications early in the cover letter to capture attention.

What is the ideal length for a Tax Preparer application letter?

The ideal length for a Tax Preparer application letter is one page, typically between 250 to 400 words. This ensures the letter is concise while covering relevant skills, experience, and qualifications.

Employers prefer a focused letter that highlights expertise in tax laws, accuracy, and client communication without unnecessary details. Maintaining brevity improves readability and increases the chance of securing an interview.

How do I address my letter if I don't know the hiring manager's name?

If you don't know the hiring manager's name, use a professional and generic greeting like "Dear Hiring Manager" or "Dear Recruitment Team." This approach maintains a respectful tone while addressing the appropriate audience.

Avoid phrases like "To whom it may concern" as they can seem outdated. Research the company's website or LinkedIn page to find the hiring manager's name whenever possible. If no name is available, a clear and polite generic greeting ensures your letter remains professional and targeted.

Can I include relevant software experience (e.g., QuickBooks, TurboTax) in the letter?

| Aspect | Details |

|---|---|

| Relevance of Software Experience | Including experience with QuickBooks, TurboTax, or similar tax preparation software highlights practical skills essential for a Tax Preparer position. |

| Placement in Letter | Mention software proficiency in the skills or experience section to demonstrate technical capability and efficiency in handling tax documents. |

| Impact on Application | Showcasing software knowledge can differentiate you from other candidates and reassure employers of your readiness to use required tools. |

| How to Present | Use specific examples such as "Managed client accounts using QuickBooks" or "Prepared tax returns with TurboTax, ensuring accurate filings." |

| Additional Tips | Include certifications or formal training related to the software to strengthen credibility. |

How do I show attention to detail in my application letter?

Highlight your experience accurately preparing tax documents and your commitment to compliance with current tax laws. Emphasize your organizational skills by mentioning your ability to manage multiple client files without errors. Include examples of double-checking figures and reviewing forms thoroughly to ensure precise tax filing.

Is it necessary to mention previous client satisfaction or accuracy rates?

Is it necessary to mention previous client satisfaction or accuracy rates in a Job Application Letter for a Tax Preparer? Highlighting client satisfaction and accuracy rates demonstrates reliability and expertise, essential qualities for tax preparation roles. Employers often prioritize candidates who can prove their track record of precise and trustworthy service.

Should I discuss my familiarity with federal and state tax codes?

Discussing your familiarity with federal and state tax codes in a job application letter for a Tax Preparer is essential. It showcases your expertise and relevance to the position.

- Demonstrates Expertise - Highlighting knowledge of tax codes assures employers of your capability to handle complex tax situations accurately.

- Enhances Credibility - Familiarity with relevant tax regulations builds trust with potential employers about your professional readiness.

- Matches Job Requirements - Emphasizing this familiarity aligns your skills directly with the core responsibilities of a Tax Preparer role.