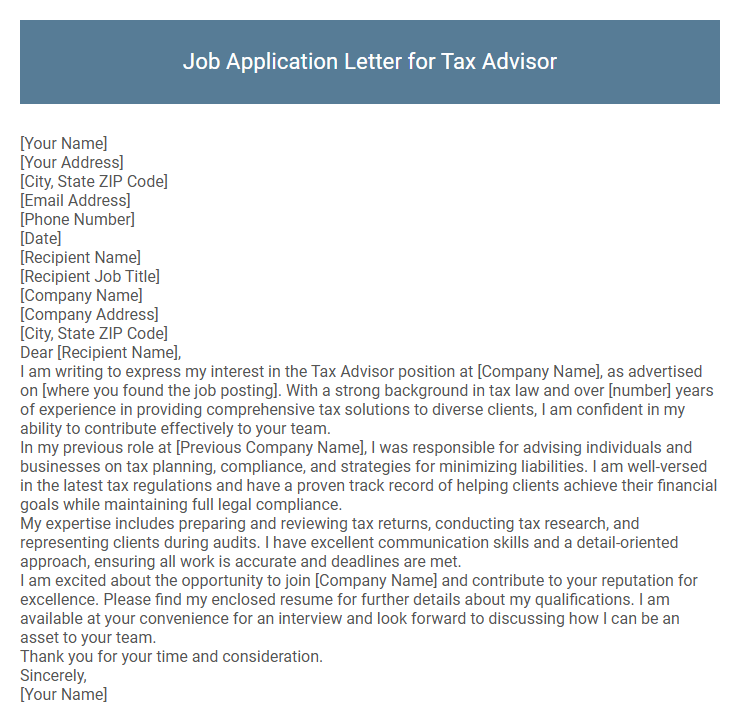

Job Application Letter for Tax Advisor Sample

[Your Address]

[City, State ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Recipient Job Title]

[Company Name]

[Company Address]

[City, State ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Tax Advisor position at [Company Name], as advertised on [where you found the job posting]. With a strong background in tax law and over [number] years of experience in providing comprehensive tax solutions to diverse clients, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I was responsible for advising individuals and businesses on tax planning, compliance, and strategies for minimizing liabilities. I am well-versed in the latest tax regulations and have a proven track record of helping clients achieve their financial goals while maintaining full legal compliance.

My expertise includes preparing and reviewing tax returns, conducting tax research, and representing clients during audits. I have excellent communication skills and a detail-oriented approach, ensuring all work is accurate and deadlines are met.

I am excited about the opportunity to join [Company Name] and contribute to your reputation for excellence. Please find my enclosed resume for further details about my qualifications. I am available at your convenience for an interview and look forward to discussing how I can be an asset to your team.

Thank you for your time and consideration.

Sincerely,

[Your Name]

A job application letter for a Tax Advisor highlights expertise in tax laws, compliance, and financial analysis to support clients' fiscal responsibilities. It emphasizes problem-solving skills, attention to detail, and the ability to provide accurate tax planning and advice. Demonstrating knowledge of current tax regulations and effective communication strengthens the candidate's appeal to potential employers.

What should I include in a job application letter for a Tax Advisor position?

Include a clear introduction stating your interest in the Tax Advisor position and how your qualifications align with the role. Highlight your expertise in tax regulations, tax planning, compliance, and experience with tax software or financial analysis. Conclude with a strong closing statement expressing enthusiasm for the opportunity and a call to action for an interview.

How do I highlight my tax expertise in the application letter?

Emphasize your professional certifications such as CPA or Enrolled Agent to establish credibility in tax expertise. Highlight specific experience in tax planning, compliance, and audit support to demonstrate practical skills and knowledge. Include measurable achievements like successful tax savings or resolving complex client tax issues to showcase your impact and proficiency.

Should I mention specific tax certifications in the letter?

Including specific tax certifications in your job application letter for a Tax Advisor position is highly recommended to demonstrate your qualifications. Mentioning these credentials helps recruiters quickly gauge your expertise and suitability for the role.

- Highlight Relevant Certifications - Specify certifications such as CPA, Enrolled Agent, or Chartered Tax Advisor to showcase your professional expertise.

- Build Credibility - Certifications validate your knowledge and commitment to tax regulations and compliance, reinforcing trust with potential employers.

- Tailor to Job Description - Align the mentioned certifications with those required or preferred in the job posting to increase relevance and impact.

Explicitly stating tax certifications can differentiate you from other candidates and enhance your application's effectiveness.

How do I tailor my letter to the company's tax needs?

Tailor your job application letter for a Tax Advisor role by researching the company's specific tax challenges and priorities. Align your expertise with their needs to demonstrate how you can provide targeted solutions and add value.

- Identify Company Tax Issues - Analyze recent financial reports and industry news to pinpoint the company's tax challenges and regulatory environment.

- Highlight Relevant Expertise - Showcase your experience with applicable tax laws, compliance strategies, and advisory services related to the company's sector.

- Offer Customized Solutions - Propose actionable insights and strategies in your letter that address the company's unique tax planning, risk management, or audit preparation needs.

What is the ideal length of a Tax Advisor application letter?

The ideal length of a Tax Advisor application letter is concise, typically between half a page to one full page. This allows candidates to clearly highlight their relevant skills and experience without overwhelming the reader.

Employers prefer focused content that addresses specific tax expertise, certifications, and achievements. Keeping the letter brief ensures it is easily read and leaves a strong professional impression.

Can I use a template for my Tax Advisor job application letter?

Using a template for your Tax Advisor job application letter can streamline the writing process and ensure all essential elements are included. Customize the template to highlight your expertise in tax laws, compliance, and advisory skills relevant to the specific role. Tailoring your application increases its effectiveness and demonstrates genuine interest to potential employers.

How do I address my experience with changing tax regulations?

How do I effectively highlight my experience with changing tax regulations in a job application letter for a Tax Advisor position? Emphasize your ability to stay updated with evolving tax laws through continuous education and professional development. Demonstrate examples where you successfully adapted strategies to comply with new regulations, ensuring optimal client outcomes.

Should I mention my familiarity with tax software in the letter?

Mentioning your familiarity with tax software in a job application letter for a Tax Advisor position highlights your technical skills and efficiency in handling complex tax tasks. Employers value candidates who can streamline processes using relevant software.

Including specific software names like TurboTax, QuickBooks, or TaxSlayer can strengthen your application by demonstrating practical experience. This detail showcases your readiness to contribute immediately and adapt quickly to the firm's tools.

Is it important to include communication skills in the application?

Including communication skills in a job application letter for a Tax Advisor is crucial because it highlights the ability to explain complex tax regulations clearly to clients. Employers value Tax Advisors who can effectively interact with diverse stakeholders to ensure accurate and compliant financial advice.

- Clarity in Tax Regulations - Effective communication helps Tax Advisors simplify and convey complex tax laws to clients and colleagues.

- Client Trust Building - Strong communication skills foster trust and confidence between the advisor and clients, essential for successful tax planning.

- Collaboration Efficiency - Clear communication enhances collaboration within teams and with external parties, improving overall advisory accuracy and compliance.