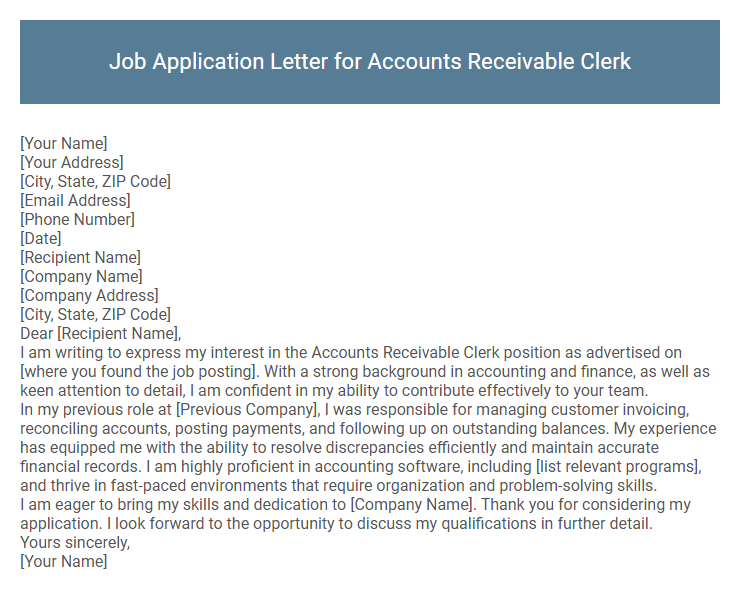

Job Application Letter for Accounts Receivable Clerk Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Accounts Receivable Clerk position as advertised on [where you found the job posting]. With a strong background in accounting and finance, as well as keen attention to detail, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I was responsible for managing customer invoicing, reconciling accounts, posting payments, and following up on outstanding balances. My experience has equipped me with the ability to resolve discrepancies efficiently and maintain accurate financial records. I am highly proficient in accounting software, including [list relevant programs], and thrive in fast-paced environments that require organization and problem-solving skills.

I am eager to bring my skills and dedication to [Company Name]. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications in further detail.

Yours sincerely,

[Your Name]

A carefully crafted job application letter for an Accounts Receivable Clerk highlights expertise in managing invoicing, processing payments, and maintaining accurate financial records. Demonstrating proficiency in accounting software and attention to detail ensures timely collection of outstanding balances and supports overall financial health. Clear communication skills and a commitment to accuracy contribute to effective collaboration with clients and internal teams.

What key skills should I highlight in my job application letter for Accounts Receivable Clerk?

Highlight proficiency in managing invoicing and payment processing to ensure accurate and timely accounts receivable records. Emphasize strong attention to detail and excellent organizational skills to track outstanding balances and reconcile discrepancies effectively. Showcase communication abilities for coordinating with clients and resolving billing issues professionally.

How do I properly format a job application letter for this position?

Begin your job application letter for an Accounts Receivable Clerk by including your contact information, the employer's details, and a clear subject line stating the position. Use a professional greeting, followed by a concise introduction highlighting your relevant experience and skills in managing invoices and payments. Conclude with a polite closing that expresses your enthusiasm for the role and a call to action for an interview opportunity.

What experience is most relevant to mention for an Accounts Receivable Clerk role?

Experience with managing invoice processing, payment reconciliation, and maintaining accurate financial records is most relevant for an Accounts Receivable Clerk role. Proficiency in accounting software such as QuickBooks or SAP enhances efficiency in tracking receivables and generating reports. Strong communication skills for resolving billing discrepancies and coordinating with clients also play a crucial role in this position.

Should I include references in my application letter?

Including references in a job application letter for an Accounts Receivable Clerk position is generally not necessary unless specifically requested by the employer. It is more effective to mention that references are available upon request to keep the letter concise and professional.

Employers typically review references during the later stages of the hiring process, such as after an interview. Providing references too early may clutter the application and distract from your qualifications and experience.

How long should my job application letter be?

Your job application letter for an Accounts Receivable Clerk should be concise, ideally between half a page to one full page. Focus on highlighting relevant experience, skills, and enthusiasm for the role within this length. Keeping it brief ensures hiring managers can quickly assess your qualifications.

Is it necessary to tailor my letter for each application?

Tailoring your job application letter for an Accounts Receivable Clerk position is highly recommended. Customizing the letter increases relevance to the specific employer and job requirements.

- Enhances Specificity - Highlighting skills and experiences that match the job description shows clear alignment with employer needs.

- Improves Engagement - Personalized letters capture recruiter attention by addressing company values and unique challenges.

- Boosts Success Rate - Targeted applications statistically result in higher callback and interview opportunities.

What accounting software proficiency should I mention?

When applying for an Accounts Receivable Clerk position, highlight proficiency in popular accounting software like QuickBooks, SAP, and Oracle Financials. Mention experience with Excel for data analysis and payment reconciliation to demonstrate strong technical skills.

Include knowledge of specialized billing software such as FreshBooks or Xero if applicable. Emphasize your ability to manage invoices, track payments, and generate financial reports efficiently using these tools.

How do I address employment gaps in my application letter?

Addressing employment gaps in a job application letter for an Accounts Receivable Clerk role involves honesty and highlighting relevant skills gained during the gap period. It is important to reassure employers of your commitment and readiness to contribute effectively.

- Be Transparent - Briefly explain the reason for the employment gap without going into unnecessary detail to maintain credibility.

- Highlight Skill Development - Emphasize any courses, certifications, or freelance work related to accounts receivable undertaken during the gap to demonstrate continuous professional growth.

- Focus on Readiness - Convey eagerness to return to work with updated skills and a strong commitment to the Accounts Receivable Clerk role.

What achievements impress employers for this position?

| Achievement | Description |

|---|---|

| Reduction in Outstanding Debts | Successfully decreased overdue accounts receivable by 25% within six months through diligent follow-ups and improved billing processes. |

| Accuracy in Financial Reporting | Maintained 99% accuracy in invoicing and payment records, minimizing errors and enhancing trust with management and clients. |

| Efficient Payment Processing | Processed high volumes of invoices and payments with timely reconciliations, reducing invoice processing time by 30%. |

| Implementation of Automation Tools | Introduced automated reminders and tracking systems, improving cash flow and reducing manual workload for the accounts receivable team. |

| Successful Dispute Resolution | Resolved billing discrepancies swiftly, recovering outstanding payments and maintaining positive client relationships. |