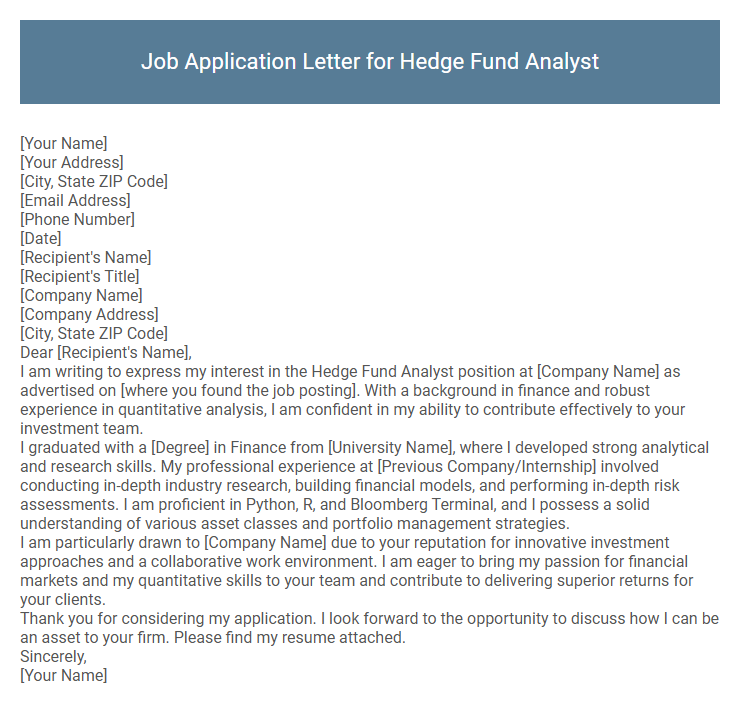

Job Application Letter for Hedge Fund Analyst Sample

[Your Address]

[City, State ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Hedge Fund Analyst position at [Company Name] as advertised on [where you found the job posting]. With a background in finance and robust experience in quantitative analysis, I am confident in my ability to contribute effectively to your investment team.

I graduated with a [Degree] in Finance from [University Name], where I developed strong analytical and research skills. My professional experience at [Previous Company/Internship] involved conducting in-depth industry research, building financial models, and performing in-depth risk assessments. I am proficient in Python, R, and Bloomberg Terminal, and I possess a solid understanding of various asset classes and portfolio management strategies.

I am particularly drawn to [Company Name] due to your reputation for innovative investment approaches and a collaborative work environment. I am eager to bring my passion for financial markets and my quantitative skills to your team and contribute to delivering superior returns for your clients.

Thank you for considering my application. I look forward to the opportunity to discuss how I can be an asset to your firm. Please find my resume attached.

Sincerely,

[Your Name]

A job application letter for a hedge fund analyst highlights analytical skills, financial expertise, and a strong understanding of market trends. Demonstrating quantitative abilities and experience in portfolio management signals readiness to contribute effectively to investment decisions. Tailoring the letter to showcase achievements in data analysis and risk assessment enhances the candidate's appeal to hedge fund employers.

What key qualifications should a hedge fund analyst job application letter highlight?

A hedge fund analyst job application letter should highlight strong analytical skills, proficiency in financial modeling, and experience with market research. Emphasizing expertise in data analysis tools like Excel, Python, or Bloomberg Terminal demonstrates technical capability. Showcasing knowledge of investment strategies and risk management reflects a deep understanding of hedge fund operations.

How do I structure a hedge fund analyst job application letter?

Begin your hedge fund analyst job application letter with a concise introduction stating your interest in the position and a brief overview of your relevant qualifications, such as experience in financial modeling, data analysis, and market research. In the body, highlight specific skills and achievements that align with the hedge fund's investment strategies, including proficiency in quantitative analysis, risk assessment, and knowledge of financial instruments. Conclude by expressing enthusiasm for contributing to the firm's success and your readiness for an interview to discuss how your expertise can add value.

Which technical skills should be mentioned in the application letter?

When applying for a Hedge Fund Analyst position, highlighting specific technical skills can significantly improve your chances. Emphasize expertise that directly impacts investment analysis and decision-making.

- Financial Modeling - Proficiency in building and interpreting complex financial models to forecast investment performance.

- Quantitative Analysis - Ability to analyze large data sets using statistical tools and software for informed trading strategies.

- Programming Languages - Experience with Python, R, or MATLAB for algorithmic trading and automation of analytical processes.

Showcasing these technical skills in your application letter demonstrates your capability to contribute effectively to hedge fund operations.

Is prior finance experience necessary in the application letter?

Prior finance experience is highly valuable when applying for a Hedge Fund Analyst position as it demonstrates familiarity with financial markets and analytical techniques. Candidates without direct finance experience should emphasize transferable skills such as quantitative analysis, data interpretation, and critical thinking. Highlighting relevant internships, certifications, or coursework can also strengthen the application.

What soft skills are important to include for a hedge fund analyst role?

Soft skills play a crucial role in the effectiveness of a hedge fund analyst, complementing technical expertise. Highlighting key interpersonal and cognitive abilities can significantly improve the impact of a job application letter.

- Analytical Thinking - The ability to critically evaluate complex financial data and market trends is essential for making informed investment decisions.

- Communication Skills - Clear and concise communication helps in articulating investment ideas and collaborating with team members and stakeholders.

- Adaptability - The fast-paced and volatile nature of financial markets requires the capacity to quickly adjust strategies and respond to new information.

Should I mention specific financial modeling tools in my letter?

Mentioning specific financial modeling tools in your job application letter for a Hedge Fund Analyst position can demonstrate your technical proficiency and relevance to the role. Highlighting expertise with tools like Excel, VBA, Python, or Bloomberg Terminal aligns your skills with industry expectations.

Focus on how your experience using these tools contributed to accurate financial analysis or improved decision-making. Tailoring this information to the job description increases your application's impact and relevance.

How long should a hedge fund analyst application letter be?

| Aspect | Details |

|---|---|

| Recommended Length | One page |

| Word Count | 300-400 words |

| Purpose | Concise presentation of skills and experience relevant to hedge fund analysis |

| Focus | Key achievements, financial expertise, and analytical capabilities |

| Formatting | Clear, professional, and easy to read |

Do I need to address my letter to a specific person?

Addressing your job application letter for a Hedge Fund Analyst position to a specific person demonstrates professionalism and attention to detail. It increases the chances of your letter being read carefully by the hiring manager or recruiter.

If the job listing does not provide a contact name, research the company's website or LinkedIn to identify the appropriate recipient. When a specific name is unavailable, use a generic but respectful greeting like "Dear Hiring Manager."

Can I include achievements with quantitative results in my letter?

Including achievements with quantitative results in a job application letter for a Hedge Fund Analyst position significantly strengthens your candidacy. Concrete data, such as percentage returns or portfolio growth, demonstrates your impact and analytical skills effectively. Quantified achievements provide clear evidence of your ability to contribute to the fund's performance.