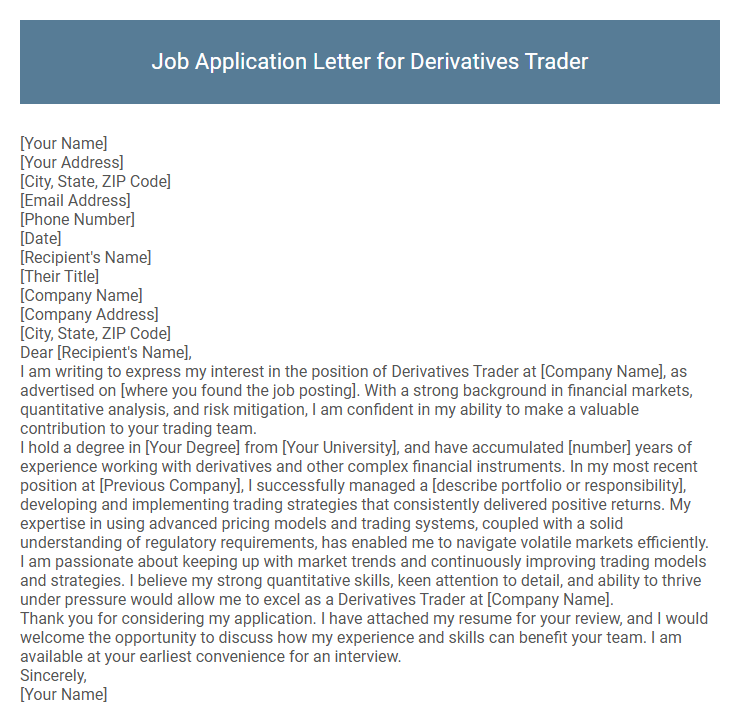

Job Application Letter for Derivatives Trader Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Their Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the position of Derivatives Trader at [Company Name], as advertised on [where you found the job posting]. With a strong background in financial markets, quantitative analysis, and risk mitigation, I am confident in my ability to make a valuable contribution to your trading team.

I hold a degree in [Your Degree] from [Your University], and have accumulated [number] years of experience working with derivatives and other complex financial instruments. In my most recent position at [Previous Company], I successfully managed a [describe portfolio or responsibility], developing and implementing trading strategies that consistently delivered positive returns. My expertise in using advanced pricing models and trading systems, coupled with a solid understanding of regulatory requirements, has enabled me to navigate volatile markets efficiently.

I am passionate about keeping up with market trends and continuously improving trading models and strategies. I believe my strong quantitative skills, keen attention to detail, and ability to thrive under pressure would allow me to excel as a Derivatives Trader at [Company Name].

Thank you for considering my application. I have attached my resume for your review, and I would welcome the opportunity to discuss how my experience and skills can benefit your team. I am available at your earliest convenience for an interview.

Sincerely,

[Your Name]

A job application letter for a derivatives trader highlights expertise in financial markets, risk management, and analytical skills crucial for trading complex financial instruments. Emphasizing experience in option pricing, futures contracts, and market trend analysis demonstrates the candidate's ability to optimize portfolio performance. Clear communication of strategic decision-making and quantitative proficiency sets a strong foundation for success in a fast-paced trading environment.

What key qualifications should a Derivatives Trader highlight in a job application letter?

A Derivatives Trader should highlight strong analytical skills and proficiency in quantitative methods, emphasizing experience with complex financial instruments. Expertise in risk management, market trends analysis, and real-time decision-making under pressure are crucial qualifications. Demonstrating proficiency in trading platforms, programming skills, and a solid understanding of regulatory frameworks will strengthen the application.

How do I structure a job application letter for a Derivatives Trader position?

Structuring a job application letter for a Derivatives Trader position requires clarity and emphasis on relevant skills and experience. The letter should effectively showcase your trading expertise, analytical abilities, and understanding of financial markets.

- Introduction - Start with a clear statement of the position you are applying for and a brief overview of your professional background related to derivatives trading.

- Skills and Experience - Highlight specific trading strategies, risk management techniques, and quantitative skills relevant to derivatives markets.

- Conclusion - Express enthusiasm for the role, mention your availability for an interview, and provide a professional closing statement.

Which technical skills are most important to mention for Derivatives Trader roles?

| Technical Skill | Importance for Derivatives Trader |

|---|---|

| Financial Modeling | Essential for valuing derivatives and forecasting market trends |

| Quantitative Analysis | Critical for risk assessment and strategy optimization |

| Programming (Python, R, SQL) | Important for developing trading algorithms and data analysis |

| Understanding of Derivative Instruments | Fundamental knowledge of options, futures, swaps, and their pricing |

| Market Data Analysis | Key for tracking and interpreting real-time market movements |

Should I include my trading performance or track record in the letter?

Including your trading performance or track record in a job application letter for a Derivatives Trader position demonstrates your expertise and credibility. Highlight key metrics such as ROI, risk management success, or notable trades to showcase your value. Keep this information concise and relevant to capture the employer's attention effectively.

How do I address my experience with market analysis in my application letter?

Highlight your ability to interpret complex market data and apply quantitative models in your job application letter for a Derivatives Trader position. Emphasize your track record of making informed trading decisions based on thorough market analysis to demonstrate your expertise.

- Data-Driven Insights - Detail your experience using statistical software and real-time data feeds to identify profitable trading opportunities and mitigate risks.

- Technical and Fundamental Analysis - Explain how you combine technical chart patterns with fundamental market indicators to anticipate price movements and market trends.

- Risk Management Skills - Illustrate your capability to analyze derivatives instruments in volatile markets and implement strategies that optimize risk-adjusted returns.

Is it necessary to mention certifications like CFA or FRM in the letter?

Mentioning certifications like CFA or FRM in a job application letter for a Derivatives Trader can enhance your credibility and demonstrate your expertise in financial analysis and risk management. These certifications signal a strong understanding of derivatives markets and investment strategies.

Including relevant certifications is especially important if the job posting highlights them as preferred qualifications. It helps differentiate you from other candidates and aligns your skills with industry standards. Highlighting such credentials can increase the chances of passing initial resume screenings and progressing to interviews.

What soft skills are valued for a Derivatives Trader job application?

Effective communication and strong analytical thinking are essential soft skills for a Derivatives Trader. These abilities enable clear interpretation of market data and precise execution of trading strategies.

Adaptability and stress management are highly valued to navigate volatile markets and fast-paced decision-making. Collaboration skills also enhance teamwork in high-pressure trading environments.

Should I tailor my application letter to each trading firm?

Should I tailor my job application letter to each trading firm when applying for a Derivatives Trader position? Customizing your application letter to highlight relevant skills and experiences that match the trading firm's focus significantly improves your chances. Demonstrating knowledge of their trading strategies and culture shows genuine interest and professionalism.

How long should my Derivatives Trader job application letter be?

A Derivatives Trader job application letter should be concise, ideally one page long, typically around 250-300 words. Focus on relevant experience, key skills, and your enthusiasm for the role without unnecessary details. Keeping it brief ensures the hiring manager quickly grasps your qualifications and interest.