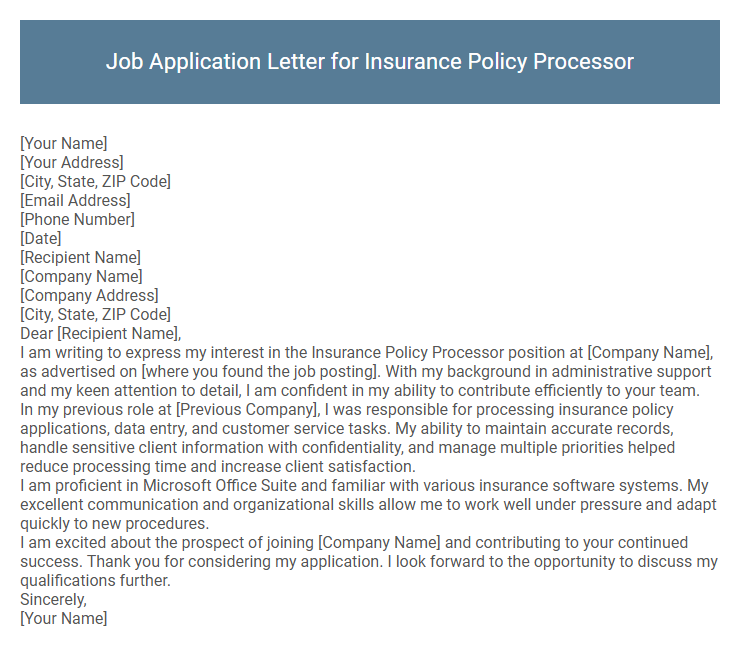

Job Application Letter for Insurance Policy Processor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Policy Processor position at [Company Name], as advertised on [where you found the job posting]. With my background in administrative support and my keen attention to detail, I am confident in my ability to contribute efficiently to your team.

In my previous role at [Previous Company], I was responsible for processing insurance policy applications, data entry, and customer service tasks. My ability to maintain accurate records, handle sensitive client information with confidentiality, and manage multiple priorities helped reduce processing time and increase client satisfaction.

I am proficient in Microsoft Office Suite and familiar with various insurance software systems. My excellent communication and organizational skills allow me to work well under pressure and adapt quickly to new procedures.

I am excited about the prospect of joining [Company Name] and contributing to your continued success. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

Sincerely,

[Your Name]

A job application letter for an Insurance Policy Processor highlights the candidate's expertise in managing and verifying insurance documents with precision and efficiency. Emphasizing strong organizational skills and knowledge of insurance policies ensures accurate data entry and compliance with industry regulations. Demonstrating attention to detail and problem-solving abilities makes the applicant a valuable asset to any insurance company.

What should I include in a job application letter for an Insurance Policy Processor position?

Include a clear statement of your interest in the Insurance Policy Processor position and mention relevant experience with insurance documentation and data accuracy. Highlight key skills such as attention to detail, proficiency in policy management software, and strong organizational abilities. Emphasize your commitment to compliance with insurance regulations and efficient processing of policy information.

How do I highlight my relevant experience in my cover letter?

Emphasize your specific skills and achievements related to insurance policy processing in your cover letter. Tailor your experience examples to reflect the job requirements for an Insurance Policy Processor.

- Quantify experience - Mention the number of insurance policies processed or the accuracy rate to demonstrate your efficiency.

- Highlight relevant skills - Focus on your proficiency with insurance software, data entry, claim evaluations, or regulatory compliance.

- Showcase problem-solving - Provide examples of how you resolved discrepancies or improved processing workflows to add value.

What keywords are important for an Insurance Policy Processor application letter?

Important keywords for an Insurance Policy Processor application letter include "policy administration," "claims processing," "risk assessment," "data accuracy," and "regulatory compliance." Highlighting terms like "customer service," "attention to detail," "documentation management," and "insurance software proficiency" enhances relevance. Emphasizing these keywords aligns the application with industry-specific skills and job requirements.

How long should my job application letter be?

Your job application letter for an Insurance Policy Processor position should ideally be concise and focused, typically between 250 to 400 words. Aim for one page, which usually translates to about three to four paragraphs, ensuring you highlight relevant skills and experiences clearly. Keeping it brief respects the hiring manager's time and increases the chance your key qualifications are noticed.

Should I mention my proficiency in insurance software in the letter?

Should I mention my proficiency in insurance software in the job application letter for an Insurance Policy Processor position?

Highlighting proficiency in insurance software is essential as it demonstrates your technical skills relevant to the role. It increases your chances of standing out by showing you can efficiently handle policy processing tasks.

How do I address gaps in my employment history?

Address employment gaps honestly by briefly explaining the reason, such as pursuing education, personal development, or family responsibilities. Emphasize skills or experiences gained during this period that are relevant to the insurance policy processor role.

Highlight your readiness to return to work and your commitment to contributing effectively. Focus on your qualifications, accuracy, and understanding of insurance policies to assure potential employers of your suitability.

Is it necessary to include references in my application letter?

Including references in a job application letter for an Insurance Policy Processor is generally not necessary unless specifically requested by the employer. Emphasize relevant skills, experience, and qualifications related to insurance processing instead. References are typically provided during later stages, such as interviews or upon employer request.

What achievements should I emphasize as an Insurance Policy Processor?

Highlighting achievements as an Insurance Policy Processor can significantly enhance your job application letter. Emphasize key accomplishments that demonstrate your expertise and impact in the role.

- Accuracy in Policy Processing - Consistently maintained a 99% accuracy rate in processing insurance policies, reducing error-related delays and customer complaints.

- Efficiency Improvement - Implemented streamlined workflow procedures that improved policy processing time by 20%, increasing overall department productivity.

- Compliance and Risk Management - Successfully ensured 100% compliance with regulatory requirements, minimizing company risk and audit findings.

Focus on quantifiable results and specific contributions to highlight your value as an Insurance Policy Processor.

How do I tailor my letter to a specific insurance company?

| Research the Company | Understand the insurance company's mission, values, products, and client base to align your letter with their specific culture and needs. |

| Highlight Relevant Experience | Emphasize your experience with insurance policy processing, claims management, or data entry that matches the company's job description and requirements. |

| Use Company Terminology | Incorporate keywords and phrases from the company's website or job posting to demonstrate familiarity with their industry language and standards. |

| Address the Hiring Manager | Personalize the greeting by finding the hiring manager's name, showing effort and attention to detail. |

| Show Knowledge of Products | Mention specific insurance products or policies the company offers and express enthusiasm for contributing to their success. |