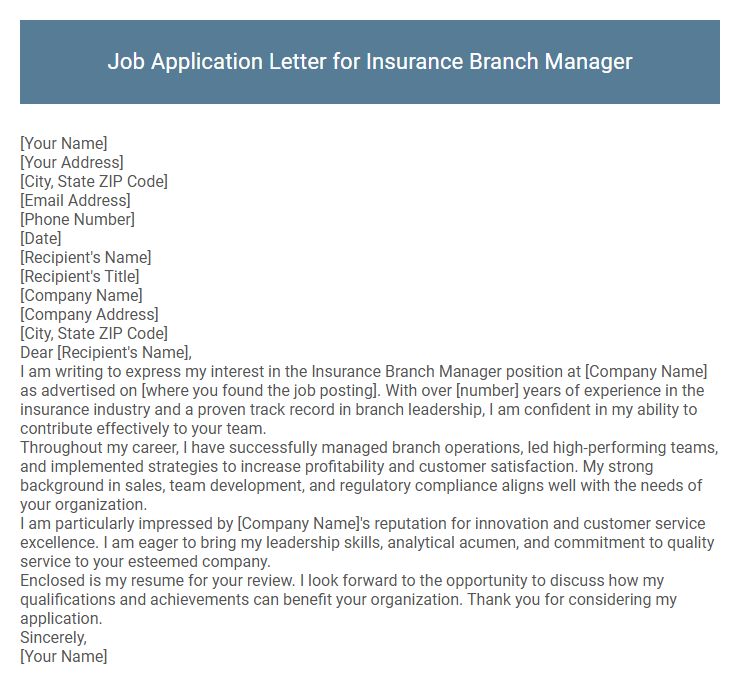

Job Application Letter for Insurance Branch Manager Sample

[Your Address]

[City, State ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Branch Manager position at [Company Name] as advertised on [where you found the job posting]. With over [number] years of experience in the insurance industry and a proven track record in branch leadership, I am confident in my ability to contribute effectively to your team.

Throughout my career, I have successfully managed branch operations, led high-performing teams, and implemented strategies to increase profitability and customer satisfaction. My strong background in sales, team development, and regulatory compliance aligns well with the needs of your organization.

I am particularly impressed by [Company Name]'s reputation for innovation and customer service excellence. I am eager to bring my leadership skills, analytical acumen, and commitment to quality service to your esteemed company.

Enclosed is my resume for your review. I look forward to the opportunity to discuss how my qualifications and achievements can benefit your organization. Thank you for considering my application.

Sincerely,

[Your Name]

Crafting an effective job application letter for an Insurance Branch Manager position requires highlighting leadership skills, industry expertise, and a commitment to customer service excellence. Emphasizing experience in managing teams, driving sales growth, and ensuring regulatory compliance will strengthen the candidacy. Tailoring the letter to reflect understanding of the company's values and goals makes a compelling case for the role.

What key qualifications should I highlight in my Insurance Branch Manager job application letter?

Highlight leadership experience managing insurance teams and achieving sales targets to demonstrate your capability in driving branch performance. Emphasize strong knowledge of insurance products, regulatory compliance, and risk management to show your industry expertise. Showcase excellent communication and customer relationship skills to underline your ability to build client trust and ensure customer satisfaction.

Should I mention my leadership experience in the job application letter?

Mentioning your leadership experience in a job application letter for an Insurance Branch Manager is crucial. It highlights your ability to manage teams and drive branch success effectively.

- Demonstrates Capability - Leadership experience shows your skills in team management and decision-making.

- Aligns with Role Requirements - Branch Manager roles require strong leadership to oversee operations and staff.

- Builds Credibility - Sharing leadership achievements establishes you as a qualified candidate for the position.

Is it important to include my sales achievements in the application letter?

Including sales achievements in a Job Application Letter for Insurance Branch Manager is crucial because it demonstrates proven success in driving revenue growth. Highlighting specific sales metrics and targets met showcases leadership and the ability to manage high-performing teams. This information helps employers assess your potential impact on their branch's financial performance.

How long should the application letter for Insurance Branch Manager be?

The application letter for an Insurance Branch Manager should be concise, typically no longer than one page. Aim for 250 to 400 words to clearly highlight relevant experience and leadership skills. Keeping it brief ensures the hiring manager reads the key qualifications quickly and effectively.

Do I need to address my letter to a specific person?

Addressing your job application letter to a specific person, such as the hiring manager or branch supervisor, demonstrates professionalism and attention to detail. It increases the likelihood that your letter will be read and considered seriously.

If you cannot find a specific name, use a general but respectful salutation like "Dear Hiring Manager" or "Dear Recruitment Team." Avoid generic greetings like "To Whom It May Concern" to maintain a professional tone tailored to the insurance industry.

Should I tailor my application letter for each insurance company?

Should I tailor my job application letter for each insurance company when applying for an Insurance Branch Manager position? Customizing your application letter demonstrates a clear understanding of the specific company's values and needs. Tailored letters increase your chances of standing out by highlighting relevant skills and experiences aligned with the company's goals.

Which soft skills are most relevant for an Insurance Branch Manager position?

An Insurance Branch Manager must demonstrate exceptional soft skills to lead teams, build client relationships, and drive business growth effectively. Key soft skills enhance operational efficiency and customer satisfaction in this role.

- Leadership - Inspires and guides the team to meet branch targets and foster a positive work environment.

- Communication - Facilitates clear, persuasive interactions with clients, staff, and stakeholders.

- Problem-solving - Addresses challenges proactively to ensure smooth branch operations and client satisfaction.

Mastering these soft skills significantly boosts the performance and success of an Insurance Branch Manager.

Can I mention industry certifications in my cover letter?

Mentioning industry certifications in your job application letter for an Insurance Branch Manager position enhances your credibility and demonstrates your expertise. Certifications such as Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC) highlight your commitment to professional development.

Including relevant certifications helps differentiate you from other candidates and aligns your qualifications with industry standards. Employers value certified professionals who can effectively manage risk and lead insurance teams.

How do I demonstrate knowledge of local insurance markets in my letter?

Highlight specific trends and challenges within the local insurance market to show your understanding. Mention any experience working with regional clients or familiarity with local regulations and compliance standards. Emphasize your ability to tailor insurance products and strategies to meet the unique needs of the community and market demands.