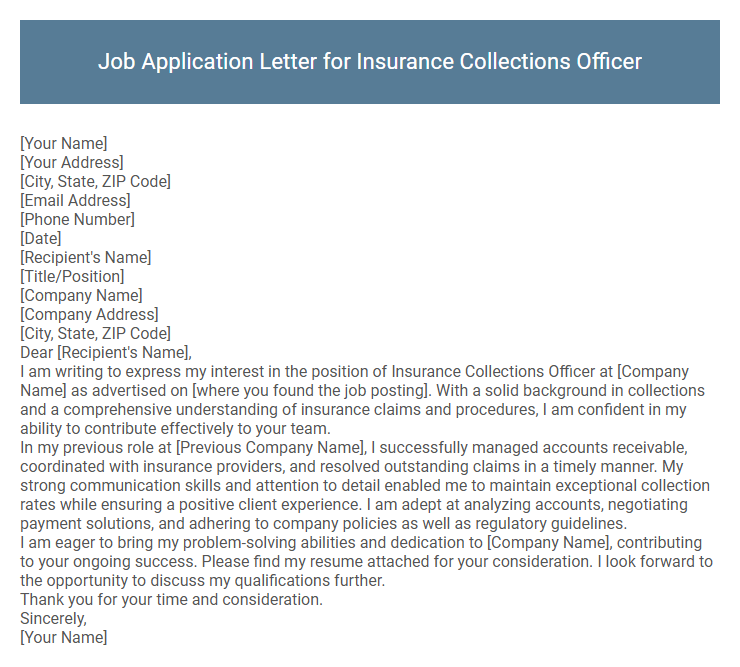

Job Application Letter for Insurance Collections Officer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the position of Insurance Collections Officer at [Company Name] as advertised on [where you found the job posting]. With a solid background in collections and a comprehensive understanding of insurance claims and procedures, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I successfully managed accounts receivable, coordinated with insurance providers, and resolved outstanding claims in a timely manner. My strong communication skills and attention to detail enabled me to maintain exceptional collection rates while ensuring a positive client experience. I am adept at analyzing accounts, negotiating payment solutions, and adhering to company policies as well as regulatory guidelines.

I am eager to bring my problem-solving abilities and dedication to [Company Name], contributing to your ongoing success. Please find my resume attached for your consideration. I look forward to the opportunity to discuss my qualifications further.

Thank you for your time and consideration.

Sincerely,

[Your Name]

A well-crafted job application letter for an Insurance Collections Officer highlights relevant experience in managing accounts receivable and resolving payment discrepancies efficiently. Emphasizing strong communication skills and knowledge of insurance billing processes enhances the candidate's ability to maintain positive client relationships and ensure timely collections. Demonstrating attention to detail and proficiency with collection software further strengthens the application by showcasing the candidate's capability to contribute to the company's financial health.

What should I include in a Job Application Letter for an Insurance Collections Officer position?

Include a clear introduction stating the position you are applying for and where you found the job listing. Highlight relevant experience in insurance collections, knowledge of claims processing, and strong communication skills. Emphasize your ability to manage accounts receivable, resolve payment disputes, and maintain accurate records efficiently.

How do I highlight my experience in collections and insurance?

Emphasize your extensive experience in managing insurance claim collections by detailing specific achievements, such as successfully recovering outstanding premiums and reducing delinquent accounts. Highlight your proficiency in using industry-standard software and your strong understanding of insurance policies and regulations. Showcase your excellent communication and negotiation skills that have consistently resulted in timely payments and improved customer relationships.

What key skills are employers looking for in an Insurance Collections Officer?

Employers seek Insurance Collections Officers with strong communication skills and attention to detail. These professionals must effectively manage account receivables and resolve payment disputes efficiently.

- Effective Communication - Ability to liaise clearly with clients and internal teams to negotiate payments and resolve conflicts.

- Analytical Skills - Proficient in reviewing account information and identifying discrepancies to ensure accurate collection processes.

- Organizational Ability - Capable of managing multiple accounts simultaneously while maintaining detailed records and meeting deadlines.

Key skills such as negotiation, accuracy, and time management are essential for success in this role.

Do I need to mention specific software proficiency in my letter?

Including specific software proficiency in your job application letter for an Insurance Collections Officer position highlights your technical skills and adaptability. Mentioning relevant software like collection management systems or CRM tools demonstrates your readiness to handle job responsibilities efficiently. Tailoring this information to the job description increases your chances of standing out to employers.

How do I address gaps in my employment history?

Address gaps in your employment history by briefly explaining the reasons without over-detailing, such as pursuing further education, personal development, or family responsibilities. Emphasize skills gained or activities undertaken during that period that are relevant to the Insurance Collections Officer role.

Demonstrate your readiness to re-enter the workforce with a focus on your commitment, reliability, and specific qualifications related to insurance collections. Highlight any volunteer work, courses, or certifications completed during the gap to reinforce your continuous professional growth.

Should I include professional certifications related to insurance or collections?

Including professional certifications related to insurance or collections in your job application letter for an Insurance Collections Officer is highly recommended. These certifications demonstrate your specialized knowledge and commitment to the field.

Certifications such as CPCU (Chartered Property Casualty Underwriter) or Certified Collection Professional (CCP) enhance your credibility and make your application stand out. They provide evidence of your expertise in managing insurance claims and collections efficiently. Employers value candidates who show continuous professional development through relevant certifications.

How formal should the tone of my application letter be?

The tone of a Job Application Letter for an Insurance Collections Officer should be professional and respectful, reflecting the seriousness of the role. It is important to balance formality with clarity to convey competence and confidence effectively.

- Professionalism - Use formal language that demonstrates your understanding of the industry's standards and expectations.

- Clarity - Write clearly and concisely to ensure your qualifications and intentions are easily understood.

- Respectfulness - Maintain a courteous tone to show respect for the hiring manager and the company's protocols.

Can I use a template for an Insurance Collections Officer cover letter?

Using a template for an Insurance Collections Officer cover letter can streamline the writing process. A well-structured template ensures all essential information is included clearly and professionally.

- Consistency - Templates provide a uniform format that highlights key skills and experiences relevant to insurance collections.

- Customization - Templates allow modification to tailor specific job requirements and company expectations.

- Efficiency - Using a template saves time while maintaining a professional tone and organized presentation.

How do I customize my letter for different insurance companies?

| Customization Aspect | Implementation Strategy |

|---|---|

| Company Research | Study the insurance company's mission, values, and services to align your letter with their core principles and demonstrate your genuine interest. |

| Specific Job Requirements | Highlight relevant skills such as debt recovery, customer communication, and compliance that match the job description for the Insurance Collections Officer role. |

| Use of Industry Terminology | Incorporate terms familiar to the specific insurer, like health insurance claims, life insurance premiums, or policy lapse procedures, to show industry knowledge. |

| Address Recipient Correctly | Find the hiring manager's name or department to personalize the greeting, increasing the letter's impact and professionalism. |

| Showcase Company Achievements | Reference recent company milestones or initiatives, such as digital transformation in claims processing, to link your skills to their current objectives. |