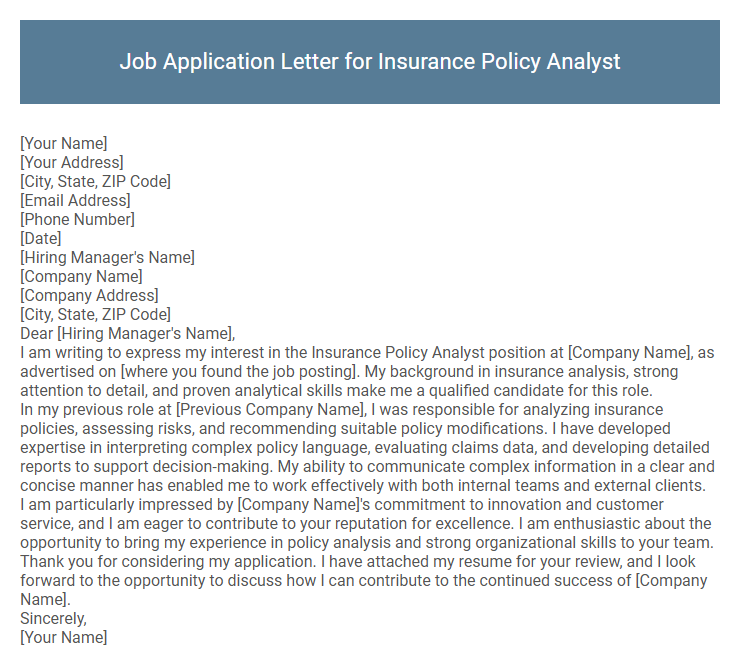

Job Application Letter for Insurance Policy Analyst Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insurance Policy Analyst position at [Company Name], as advertised on [where you found the job posting]. My background in insurance analysis, strong attention to detail, and proven analytical skills make me a qualified candidate for this role.

In my previous role at [Previous Company Name], I was responsible for analyzing insurance policies, assessing risks, and recommending suitable policy modifications. I have developed expertise in interpreting complex policy language, evaluating claims data, and developing detailed reports to support decision-making. My ability to communicate complex information in a clear and concise manner has enabled me to work effectively with both internal teams and external clients.

I am particularly impressed by [Company Name]'s commitment to innovation and customer service, and I am eager to contribute to your reputation for excellence. I am enthusiastic about the opportunity to bring my experience in policy analysis and strong organizational skills to your team.

Thank you for considering my application. I have attached my resume for your review, and I look forward to the opportunity to discuss how I can contribute to the continued success of [Company Name].

Sincerely,

[Your Name]

A job application letter for an Insurance Policy Analyst should clearly highlight expertise in risk assessment, data analysis, and policy evaluation. Emphasizing experience with regulatory compliance and strong analytical skills demonstrates the candidate's ability to support effective insurance strategies. Tailoring achievements to the insurer's needs increases the letter's impact and relevance.

What should I include in a job application letter for an Insurance Policy Analyst position?

Include a clear introduction stating your interest in the Insurance Policy Analyst position and where you found the job listing. Highlight relevant skills such as data analysis, risk assessment, and knowledge of insurance policies, supported by specific achievements or experiences. Conclude with a confident statement about your suitability for the role and a call to action for an interview.

How do I highlight my analytical skills in the application letter?

Highlight your analytical skills in a job application letter for an Insurance Policy Analyst by presenting specific examples of data evaluation and problem-solving experience. Emphasize your ability to interpret complex insurance data to improve policy accuracy and risk assessment.

- Quantify Achievements - Showcase how you used data analysis to increase policy efficiency or reduce risks by a measurable percentage.

- Use Industry Terminology - Incorporate terms such as risk modeling, claims analytics, and policy underwriting to demonstrate expertise.

- Highlight Tools and Techniques - Mention proficiency in analytical software, statistical methods, or predictive modeling relevant to insurance analysis.

Integrate these points naturally within your letter to clearly convey your analytical capabilities tailored to the insurance policy analyst role.

Is work experience in insurance required for the letter?

Work experience in insurance is highly valuable but not always mandatory for a Job Application Letter for an Insurance Policy Analyst position. Emphasis on analytical skills and understanding of insurance terminology can compensate for limited direct experience.

- Experience requirement varies - Some employers prioritize insurance background, while others focus on candidates' analytical expertise and problem-solving skills.

- Highlight transferable skills - Skills in data analysis, risk assessment, and policy evaluation are critical regardless of direct insurance experience.

- Customize application focus - Tailor the letter to emphasize relevant competencies and any insurance-related knowledge to strengthen candidacy.

What keywords should I use for an Insurance Policy Analyst role?

Use keywords such as "risk assessment," "policy analysis," "regulatory compliance," "data interpretation," and "claims evaluation" to highlight relevant skills. Incorporate terms like "insurance underwriting," "statistical modeling," "trend forecasting," and "report generation" to showcase technical expertise. Emphasize "communication skills," "problem-solving," and "attention to detail" to demonstrate essential professional attributes.

How do I format a professional job application letter?

Begin your job application letter for an Insurance Policy Analyst by including your contact information, the employer's details, and a clear, professional salutation. In the body, concisely state your interest in the position, highlight relevant qualifications such as analytical skills and knowledge of insurance policies, and express enthusiasm for contributing to the company. End with a polite closing, include your signature, and ensure the letter is formatted with consistent font, margins, and spacing for a clean, professional appearance.

Should I address specific insurance regulations in my letter?

Should I address specific insurance regulations in my job application letter for an Insurance Policy Analyst position? Yes, demonstrating knowledge of relevant insurance regulations such as HIPAA or state-specific compliance requirements shows your expertise and attention to detail. Including this information highlights your ability to navigate regulatory frameworks essential for the role.

How long should my job application letter be?

Your job application letter for an Insurance Policy Analyst should ideally be concise, ranging between 250 to 400 words. This length ensures you provide essential information without overwhelming the reader.

Focus on highlighting your relevant skills, experience, and motivation within one page. Hiring managers typically spend limited time on each letter, so clarity and brevity are crucial.

Do I need to include examples of problem-solving in my letter?

Including examples of problem-solving in your job application letter for an Insurance Policy Analyst position demonstrates your analytical skills and ability to handle complex policy issues. Employers value candidates who can proactively identify risks and implement effective solutions.

Highlight specific instances where you resolved policy discrepancies or improved claim processes to strengthen your application. Concrete examples provide evidence of your expertise and make your letter stand out.

How do I tailor my letter for the insurance industry?

Highlight your expertise in risk assessment, data analysis, and regulatory compliance specific to the insurance industry. Emphasize your familiarity with industry standards, policies, and software used for insurance policy evaluation. Showcase your ability to interpret complex data to optimize insurance strategies and improve overall client outcomes.