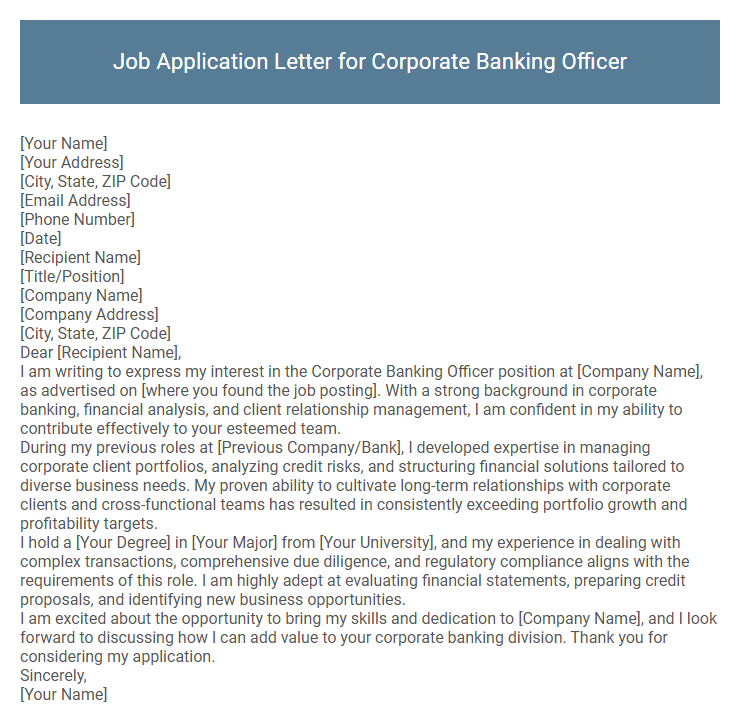

Job Application Letter for Corporate Banking Officer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Corporate Banking Officer position at [Company Name], as advertised on [where you found the job posting]. With a strong background in corporate banking, financial analysis, and client relationship management, I am confident in my ability to contribute effectively to your esteemed team.

During my previous roles at [Previous Company/Bank], I developed expertise in managing corporate client portfolios, analyzing credit risks, and structuring financial solutions tailored to diverse business needs. My proven ability to cultivate long-term relationships with corporate clients and cross-functional teams has resulted in consistently exceeding portfolio growth and profitability targets.

I hold a [Your Degree] in [Your Major] from [Your University], and my experience in dealing with complex transactions, comprehensive due diligence, and regulatory compliance aligns with the requirements of this role. I am highly adept at evaluating financial statements, preparing credit proposals, and identifying new business opportunities.

I am excited about the opportunity to bring my skills and dedication to [Company Name], and I look forward to discussing how I can add value to your corporate banking division. Thank you for considering my application.

Sincerely,

[Your Name]

A well-crafted job application letter for a Corporate Banking Officer highlights relevant experience in financial analysis, risk management, and client relationship building. Emphasizing strong communication and problem-solving skills demonstrates the ability to manage complex banking transactions and provide tailored financial solutions. Showcasing knowledge of banking regulations and corporate finance underscores a commitment to compliance and strategic growth within the banking sector.

What key qualifications should I highlight in a Corporate Banking Officer job application letter?

Highlight key qualifications such as strong financial analysis skills, proficiency in credit risk assessment, and extensive knowledge of corporate banking products. Emphasize experience in managing client relationships, negotiating loan agreements, and ensuring regulatory compliance. Showcase excellent communication abilities and a proven track record of driving business growth within corporate banking sectors.

How should I address the recipient in my application letter?

Address the recipient as "Dear [Title] [Last Name]" to maintain professionalism in your application letter for a Corporate Banking Officer position. If the hiring manager's name is unknown, use "Dear Hiring Manager" to ensure appropriateness. Avoid generic greetings like "To Whom It May Concern" to create a more personalized and respectful tone.

What is the ideal length for a Corporate Banking Officer cover letter?

The ideal length for a Corporate Banking Officer cover letter is one page, typically between 250 to 400 words. This ensures concise communication of relevant skills and experiences without overwhelming the hiring manager.

Focusing on specific achievements and aligning them with the job requirements improves the letter's effectiveness. Keeping the cover letter clear and structured enhances readability for busy recruitment teams.

Should I mention my experience with corporate clients in the letter?

Mentioning your experience with corporate clients in a job application letter for a Corporate Banking Officer position is essential. It demonstrates your understanding of the sector and your ability to manage key client relationships effectively.

Highlight specific achievements and skills related to corporate banking to strengthen your application. This information helps employers see your direct relevance to the role and your potential contribution to their team.

How do I showcase my knowledge of financial regulations in my application letter?

Demonstrate your expertise in financial regulations by clearly referencing relevant laws and compliance standards in your application letter. Highlight specific experiences where you successfully applied these regulations in corporate banking scenarios.

- Reference Specific Regulations - Mention regulations such as Basel III, AML, and KYC to show familiarity with industry standards.

- Detail Compliance Experience - Describe instances where you ensured regulatory compliance in previous roles, emphasizing risk management.

- Showcase Continuous Learning - Include certifications or training related to financial laws to indicate ongoing professional development.

Connect your regulatory knowledge directly to the responsibilities of a Corporate Banking Officer to reinforce your suitability for the role.

Is it necessary to include specific banking software skills?

Including specific banking software skills in a job application letter for a Corporate Banking Officer is highly beneficial. It demonstrates technical proficiency relevant to modern banking operations.

Employers seek candidates who can efficiently use tools like Oracle FLEXCUBE, SAP, or Microsoft Dynamics to manage corporate accounts and risk assessments. Highlighting these skills can set applicants apart in a competitive job market. Tailoring the letter to mention relevant software aligns with job requirements and showcases readiness to contribute effectively.

What achievements should I emphasize for a Corporate Banking Officer role?

| Achievement Type | Details to Emphasize |

|---|---|

| Client Portfolio Growth | Demonstrated ability to increase corporate client base by identifying market opportunities and fostering long-term relationships. |

| Risk Management | Experience in assessing credit risks, ensuring compliance with banking regulations, and minimizing non-performing assets. |

| Financial Analysis | Proficient in evaluating financial statements, cash flow analysis, and structuring loan proposals to meet corporate needs. |

| Revenue Generation | Track record of achieving targets by cross-selling banking products and tailoring financial solutions to client requirements. |

| Team Leadership | Leading and mentoring teams to improve performance, customer satisfaction, and operational efficiency. |

How can I demonstrate my ability to manage large portfolios in the letter?

Highlight your experience managing large portfolios by specifying the total asset value or number of clients you successfully oversee. Emphasize your skills in risk assessment, strategic planning, and client relationship management that contribute to portfolio growth and stability. Provide concrete examples of achieving targets, improving portfolio performance, or mitigating risks in previous banking roles.

Should I mention teamwork or leadership skills in my application letter?

Should I mention teamwork or leadership skills in my job application letter for a Corporate Banking Officer position? Highlighting teamwork skills demonstrates your ability to collaborate in dynamic financial environments. Showcasing leadership skills indicates your capability to manage projects and guide teams effectively.