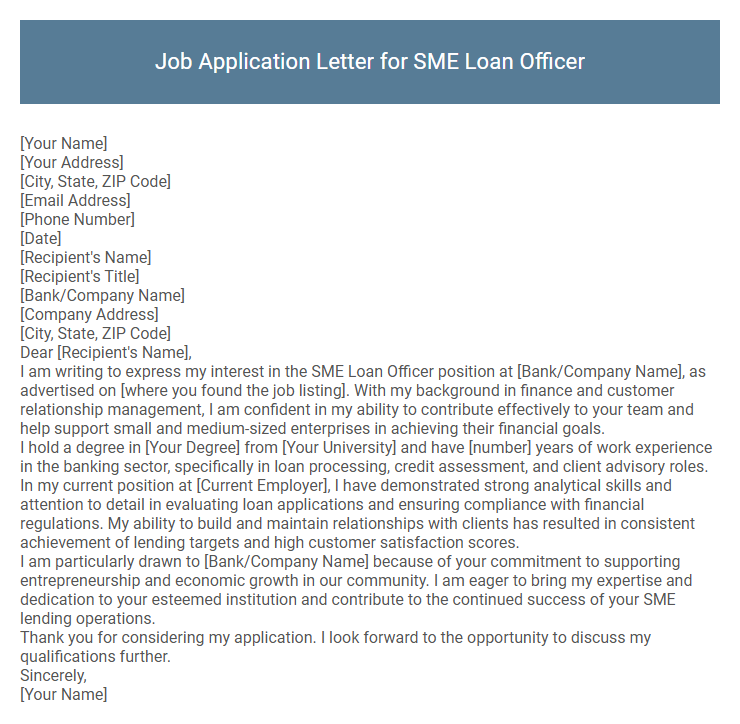

Job Application Letter for SME Loan Officer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Bank/Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the SME Loan Officer position at [Bank/Company Name], as advertised on [where you found the job listing]. With my background in finance and customer relationship management, I am confident in my ability to contribute effectively to your team and help support small and medium-sized enterprises in achieving their financial goals.

I hold a degree in [Your Degree] from [Your University] and have [number] years of work experience in the banking sector, specifically in loan processing, credit assessment, and client advisory roles. In my current position at [Current Employer], I have demonstrated strong analytical skills and attention to detail in evaluating loan applications and ensuring compliance with financial regulations. My ability to build and maintain relationships with clients has resulted in consistent achievement of lending targets and high customer satisfaction scores.

I am particularly drawn to [Bank/Company Name] because of your commitment to supporting entrepreneurship and economic growth in our community. I am eager to bring my expertise and dedication to your esteemed institution and contribute to the continued success of your SME lending operations.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

Sincerely,

[Your Name]

A well-crafted job application letter for an SME Loan Officer highlights expertise in financial analysis, risk assessment, and client relationship management. Demonstrating a strong understanding of small and medium-sized enterprise lending practices proves essential for securing the role. Emphasizing effective communication skills and commitment to supporting business growth enhances the application's impact.

What key qualifications should I highlight in my loan officer application letter?

Highlight key qualifications such as strong financial analysis skills, knowledge of credit risk assessment, and experience in loan processing. Emphasize your ability to build relationships with small and medium-sized enterprises (SMEs) and understand their financing needs. Showcase your proficiency in regulatory compliance and excellent communication skills to effectively manage loan portfolios.

How should I structure my job application letter for an SME Loan Officer position?

Begin your job application letter for an SME Loan Officer position with a strong introduction that highlights your relevant experience in loan processing and financial analysis. Emphasize your skills in client relationship management, risk assessment, and knowledge of SME lending products. Conclude by expressing your enthusiasm for contributing to the lending team and supporting small business growth.

What professional experiences are most relevant to mention?

What professional experiences are most relevant to mention in a job application letter for an SME Loan Officer? Demonstrating experience in financial analysis, risk assessment, and client relationship management is crucial. Highlighting previous roles involving SME lending and credit evaluation adds significant value to the application.

Should I include specific achievements or loan approval rates in my letter?

Including specific achievements and loan approval rates in your job application letter for an SME Loan Officer position demonstrates your proven track record and expertise. Quantifiable metrics highlight your ability to contribute effectively to the lender's success.

Detailing successful loan approvals and managing high-value portfolios showcases your skills and reliability. This information makes your application stand out by providing concrete evidence of your performance. Employers appreciate candidates who present clear, measurable results reflective of their capabilities.

How do I demonstrate knowledge of SME lending practices in my application?

In my job application letter for the SME Loan Officer position, I highlight my in-depth understanding of SME lending practices by detailing my experience with credit risk assessment, financial statement analysis, and loan structuring tailored to small and medium-sized enterprises. I emphasize familiarity with regulatory compliance, loan portfolio management, and strategies to support business growth through customized financial solutions.

I demonstrate knowledge of SME lending by referencing specific case studies or successful loan approvals that showcase my ability to evaluate business viability and mitigate lending risks. I also mention my proficiency in using digital tools for loan processing and my commitment to building strong client relationships, ensuring SME borrowers receive appropriate financial guidance.

Is it important to customize my letter for each financial institution?

| Aspect | Importance of Customizing Job Application Letter |

|---|---|

| Relevance | Tailors skills and experience to specific financial institution's needs and values. |

| Impression | Demonstrates genuine interest and effort, making the candidate stand out. |

| Competitiveness | Addresses unique challenges or goals of the institution, increasing chances. |

| ATS Optimization | Incorporates keywords relevant to the institution, improving ranking in applicant tracking systems. |

| Professionalism | Reflects attention to detail and respect for the hiring organization. |

What soft skills are valued for SME Loan Officer roles?

Effective communication and interpersonal skills are crucial for SME Loan Officers to build trust with clients and assess their financial needs accurately. Problem-solving abilities enable officers to evaluate loan applications critically and provide tailored financial solutions.

- Communication - Essential for explaining complex loan terms clearly to small business owners and maintaining transparency.

- Analytical Thinking - Helps in assessing financial data to determine creditworthiness and minimize risk.

- Customer Service - Builds strong client relationships and encourages repeat business through attentive support.

Adaptability and negotiation skills further enhance an SME Loan Officer's effectiveness in dynamic financial environments.

Should I address the letter to a specific person or use a generic greeting?

Addressing a job application letter for an SME Loan Officer to a specific person shows professionalism and attention to detail. Research the hiring manager or recruiter's name through the company website or LinkedIn before applying. If the name is unavailable, use a generic greeting like "Dear Hiring Manager" to maintain formality and respect.

How can I show my understanding of local SME market trends in my letter?

Demonstrate your familiarity with local SME market trends by highlighting relevant industry data and your practical experiences. Emphasize your ability to analyze economic shifts and tailor loan solutions that address specific SME challenges in the region.

- Use recent market data - Reference local SME growth statistics and sector-specific performance to show your market awareness.

- Highlight past client interactions - Describe experience working directly with SMEs, illustrating your understanding of their financial needs and constraints.

- Mention trend adaptation - Explain how you have adapted lending strategies in response to evolving local economic conditions to support SME sustainability.