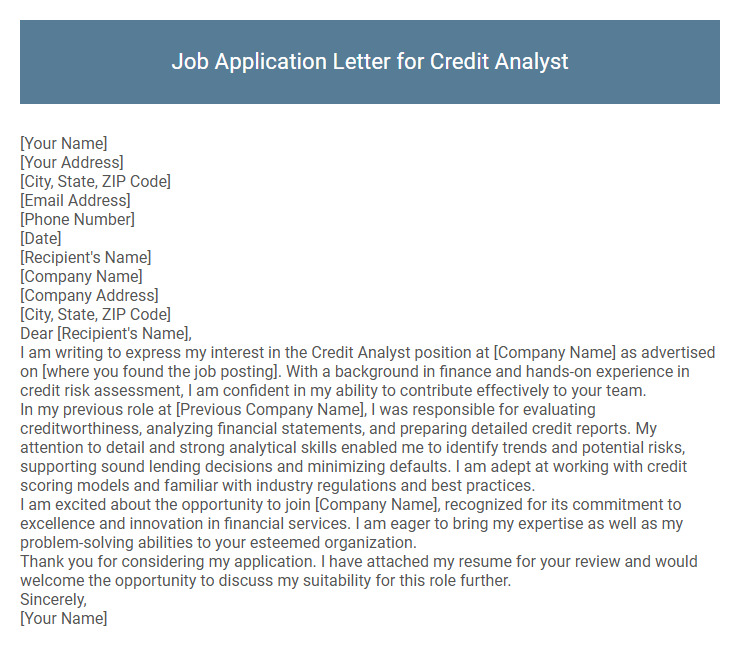

Job Application Letter for Credit Analyst Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Credit Analyst position at [Company Name] as advertised on [where you found the job posting]. With a background in finance and hands-on experience in credit risk assessment, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I was responsible for evaluating creditworthiness, analyzing financial statements, and preparing detailed credit reports. My attention to detail and strong analytical skills enabled me to identify trends and potential risks, supporting sound lending decisions and minimizing defaults. I am adept at working with credit scoring models and familiar with industry regulations and best practices.

I am excited about the opportunity to join [Company Name], recognized for its commitment to excellence and innovation in financial services. I am eager to bring my expertise as well as my problem-solving abilities to your esteemed organization.

Thank you for considering my application. I have attached my resume for your review and would welcome the opportunity to discuss my suitability for this role further.

Sincerely,

[Your Name]

A job application letter for a Credit Analyst position highlights the candidate's expertise in assessing financial data, evaluating creditworthiness, and mitigating risk. It emphasizes strong analytical skills, attention to detail, and proficiency in financial modeling and reporting. Demonstrating an understanding of industry regulations and a commitment to accurate decision-making enhances the letter's impact.

What key skills should I highlight in a Credit Analyst job application letter?

Emphasize strong analytical skills and proficiency in financial data interpretation to assess creditworthiness effectively. Highlight attention to detail and risk assessment abilities to make informed lending decisions. Showcase excellent communication skills for clear reporting and collaboration with clients and stakeholders.

How should I format my Credit Analyst application letter?

Format your Credit Analyst application letter with a professional header including your contact information and the employer's details. Begin with a clear introduction stating the position you are applying for and a brief overview of your qualifications. Conclude with a strong closing paragraph expressing your enthusiasm and availability for an interview, maintaining a formal tone throughout.

What qualifications are preferred for a Credit Analyst position?

Preferred qualifications for a Credit Analyst position include a bachelor's degree in finance, economics, or accounting. Strong analytical skills and proficiency in financial modeling and credit risk assessment software are essential. Experience in banking, credit analysis, or financial services enhances candidacy for this role.

How do I demonstrate analytical abilities in my cover letter?

In my cover letter for a Credit Analyst position, I highlight specific experiences where I analyzed financial statements and credit reports to assess borrower risk. I emphasize my ability to interpret complex data sets to make informed lending decisions.

I detail instances of using quantitative methods and financial modeling to predict creditworthiness and mitigate risk. I showcase my experience with tools like Excel and SQL for data analysis and report generation. Demonstrating results, I mention how my insights helped reduce default rates or improve portfolio performance.

Should I mention experience with financial modeling in my letter?

Including experience with financial modeling in a job application letter for a credit analyst position strengthens your candidacy. It highlights relevant technical skills crucial for credit risk assessment and decision-making.

- Relevance - Financial modeling is a core skill for credit analysts to evaluate creditworthiness accurately.

- Competitive Advantage - Demonstrating this experience differentiates you from other candidates by showing practical expertise.

- Employer Expectation - Employers often seek credit analysts proficient in financial analysis tools and models.

Mention financial modeling experience concisely and relate it to how it supports your effectiveness as a credit analyst.

Is it necessary to include specific software proficiency for Credit Analyst roles?

Including specific software proficiency in a job application letter for a Credit Analyst role is highly beneficial. Employers often seek candidates familiar with financial analysis tools such as Excel, SAS, and credit scoring systems.

Highlighting expertise in relevant software demonstrates technical competence and can set applicants apart. Tailoring this information to match the job description increases the chances of passing automated screening systems.

How can I show my knowledge of credit risk assessment?

| Aspect | How to Show Knowledge of Credit Risk Assessment |

|---|---|

| Financial Statement Analysis | Discuss experience in analyzing balance sheets, income statements, and cash flow statements to evaluate borrower creditworthiness. |

| Risk Rating Models | Highlight familiarity with credit scoring systems, internal risk rating models, and the ability to interpret risk metrics. |

| Industry and Market Research | Explain how you assess external factors like industry trends and economic conditions influencing credit risk. |

| Regulatory Compliance | Demonstrate knowledge of regulatory frameworks such as Basel III and their impact on credit risk management. |

| Decision-Making and Reporting | Mention experience in preparing credit risk reports, recommending credit limits, and supporting lending decisions. |

What achievements are relevant to mention for a Credit Analyst application?

What achievements are relevant to mention for a Credit Analyst application? Highlighting successful credit risk assessments and accurate financial analysis demonstrates expertise. Including instances of reducing default rates or improving credit approval processes adds value.

How do I address a lack of direct credit analysis experience?

Addressing a lack of direct credit analysis experience in a job application letter involves highlighting transferable skills and relevant accomplishments. Demonstrating a strong foundation in financial principles can assure employers of your potential as a Credit Analyst.

- Emphasize Transferable Skills - Focus on analytical abilities, attention to detail, and proficiency with financial software that apply directly to credit analysis tasks.

- Showcase Related Experience - Highlight previous roles where you evaluated financial data, managed risk, or supported decision-making processes.

- Demonstrate Willingness to Learn - Express enthusiasm for acquiring credit analysis expertise through training and on-the-job experience.