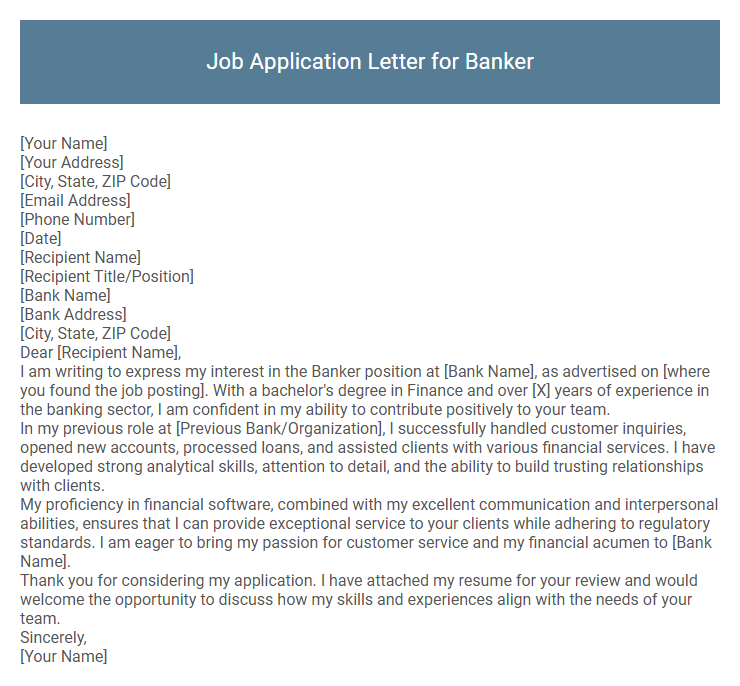

Job Application Letter for Banker Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Recipient Title/Position]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Banker position at [Bank Name], as advertised on [where you found the job posting]. With a bachelor's degree in Finance and over [X] years of experience in the banking sector, I am confident in my ability to contribute positively to your team.

In my previous role at [Previous Bank/Organization], I successfully handled customer inquiries, opened new accounts, processed loans, and assisted clients with various financial services. I have developed strong analytical skills, attention to detail, and the ability to build trusting relationships with clients.

My proficiency in financial software, combined with my excellent communication and interpersonal abilities, ensures that I can provide exceptional service to your clients while adhering to regulatory standards. I am eager to bring my passion for customer service and my financial acumen to [Bank Name].

Thank you for considering my application. I have attached my resume for your review and would welcome the opportunity to discuss how my skills and experiences align with the needs of your team.

Sincerely,

[Your Name]

A well-crafted job application letter for a banker highlights relevant financial expertise, customer service skills, and attention to detail. Emphasizing experience in managing accounts, processing transactions, and ensuring regulatory compliance demonstrates readiness for the role. Clear communication of a commitment to delivering excellent client service and supporting bank operations enhances the candidate's appeal.

What should I include in a job application letter for a banker position?

Include your relevant banking experience, emphasizing skills like financial analysis, customer service, and risk management. Highlight your educational background, certifications, and any achievements related to banking or finance. Clearly state your enthusiasm for the position and how your expertise aligns with the bank's goals.

How do I address my letter if I don't know the hiring manager's name?

When you do not know the hiring manager's name, use a professional and respectful generic greeting in your job application letter for a banker position. This maintains formality and shows attention to detail.

- Use "Dear Hiring Manager" - This is the most common and widely accepted greeting when the recipient's name is unknown.

- Consider "Dear Recruitment Team" - Suitable if the job posting indicates a recruitment department handling applications.

- Avoid vague salutations - Phrases like "To Whom It May Concern" are outdated and less engaging for modern banking employers.

What qualifications are important to mention for a banking job application?

| Qualification | Importance for Banker Job Application |

|---|---|

| Educational Background | Degree in finance, economics, accounting, or business administration is crucial to demonstrate foundational knowledge. |

| Professional Certifications | Certifications such as CFA, CPA, or Banking Diploma enhance credibility and specialized expertise. |

| Technical Skills | Proficiency in banking software, MS Excel, financial analysis tools, and knowledge of regulatory frameworks. |

| Experience | Relevant experience in banking roles like teller, loan officer, or financial analyst shows practical application of skills. |

| Soft Skills | Strong communication, customer service, problem-solving, and attention to detail are critical for client interactions and compliance. |

How can I highlight my financial skills in the letter?

Emphasize your proficiency in financial analysis, risk management, and budgeting by detailing specific achievements or certifications such as CFA or CPA. Highlight experience with financial software and tools relevant to banking operations. Demonstrate your ability to interpret financial data to support decision-making and improve client investment outcomes.

Should I include my previous banking experience?

Including your previous banking experience in a job application letter is essential as it highlights your relevant skills and industry knowledge. Emphasize specific roles, responsibilities, and achievements that demonstrate your expertise in financial services. This information can significantly strengthen your candidacy for a banking position.

How long should a banker job application letter be?

A banker job application letter should be concise, ideally between 250 to 400 words, fitting on one page. This length allows clear communication of key qualifications without overwhelming the recruiter.

The letter should highlight relevant banking skills, experience, and achievements in a focused manner. Keep paragraphs short, usually 3 to 4 sentences each, to maintain readability. A well-structured letter typically consists of an introduction, body, and conclusion within this length range.

Is it necessary to customize my letter for each bank?

Customizing your job application letter for each bank is essential to highlight how your skills align with their specific values and requirements. Tailored letters demonstrate genuine interest and research, making your application stand out.

Generic letters risk being overlooked as they do not address the bank's unique culture or job expectations. Personalizing each letter increases your chances of securing an interview by showing commitment and attention to detail.

What tone should I use in my banker job application letter?

Use a professional and confident tone in your banker job application letter to demonstrate your competence and reliability. Maintain clarity and formality to convey respect and seriousness about the position.

- Professionalism - Reflects your understanding of banking industry standards and builds trust.

- Confidence - Shows assurance in your skills and ability to contribute effectively.

- Clarity - Ensures your message is easily understood and highlights your qualifications.

Which achievements should I emphasize in my letter?

Emphasize achievements that demonstrate your financial expertise and client relationship management skills. Highlight measurable results to showcase your impact in previous banking roles.

- Revenue Growth - Quantify how you increased branch revenue or portfolio growth by a specific percentage or amount.

- Client Retention - Show your success in maintaining and expanding client relationships through tailored financial solutions.

- Risk Management - Illustrate your ability to minimize loan defaults or improve compliance with regulatory standards.

Focus on achievements that align with the prospective employer's goals and banking sector trends.