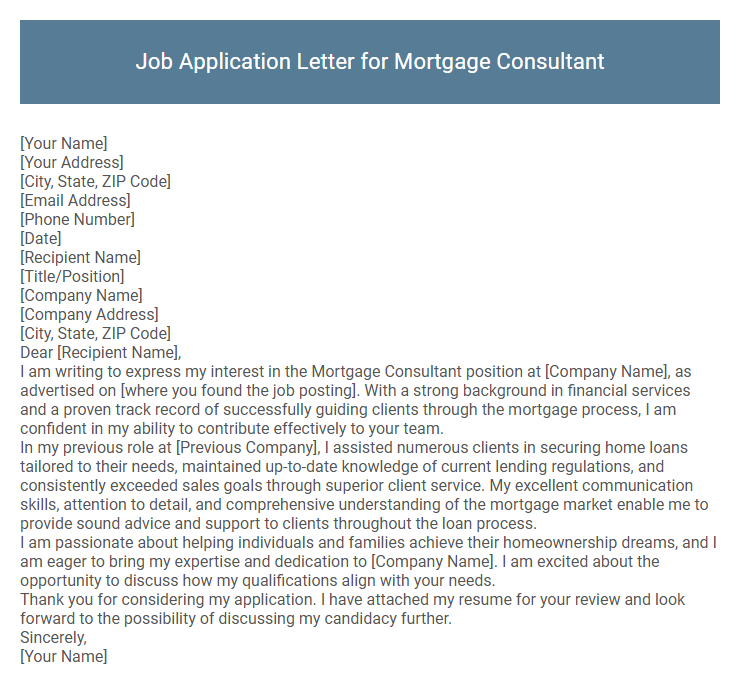

Job Application Letter for Mortgage Consultant Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Mortgage Consultant position at [Company Name], as advertised on [where you found the job posting]. With a strong background in financial services and a proven track record of successfully guiding clients through the mortgage process, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I assisted numerous clients in securing home loans tailored to their needs, maintained up-to-date knowledge of current lending regulations, and consistently exceeded sales goals through superior client service. My excellent communication skills, attention to detail, and comprehensive understanding of the mortgage market enable me to provide sound advice and support to clients throughout the loan process.

I am passionate about helping individuals and families achieve their homeownership dreams, and I am eager to bring my expertise and dedication to [Company Name]. I am excited about the opportunity to discuss how my qualifications align with your needs.

Thank you for considering my application. I have attached my resume for your review and look forward to the possibility of discussing my candidacy further.

Sincerely,

[Your Name]

A job application letter for a mortgage consultant highlights your expertise in assessing client financials and matching them with suitable loan products. Emphasize your deep knowledge of mortgage regulations, strong communication skills, and ability to guide clients through complex processes. Demonstrating a commitment to customer satisfaction and detail-oriented service can set your application apart.

What should I include in a job application letter for a Mortgage Consultant position?

Include your relevant experience in mortgage lending, knowledge of loan products, and strong customer service skills. Highlight your ability to assess clients' financial situations and recommend suitable mortgage options. Emphasize your communication skills and commitment to guiding clients through the mortgage application process efficiently.

How do I highlight relevant experience in my mortgage consultant cover letter?

Highlighting relevant experience in a mortgage consultant cover letter requires emphasizing your industry knowledge and client success. Focus on showcasing specific achievements and skills that align with the job requirements.

- Quantify achievements - Include metrics such as loan amounts processed or client satisfaction ratings to demonstrate your impact.

- Showcase industry expertise - Mention familiarity with mortgage products, regulations, and market trends relevant to the employer.

- Highlight communication skills - Emphasize your ability to explain complex financial information clearly and build client trust.

Tailor these points to the specific job description to make your cover letter stand out.

What key skills are important for a Mortgage Consultant job application letter?

A Mortgage Consultant job application letter should highlight expertise in financial analysis, customer relationship management, and regulatory compliance. Emphasizing these skills demonstrates the candidate's ability to assess client needs, navigate mortgage products, and ensure adherence to industry standards.

- Financial Analysis Proficiency - Ability to evaluate clients' financial documents to recommend suitable mortgage options.

- Customer Relationship Management - Skill in building trust and maintaining communication with clients throughout the loan process.

- Regulatory Compliance Knowledge - Understanding of mortgage laws and regulations to ensure ethical and legal adherence.

How can I address my letter if I don't know the hiring manager's name?

When you don't know the hiring manager's name, use a professional and respectful greeting such as "Dear Hiring Manager" or "Dear Recruitment Team." This approach ensures your letter remains formal and appropriate for any recipient.

Avoid generic greetings like "To Whom It May Concern," which can seem impersonal. Instead, research the company website or LinkedIn to find a specific name if possible, enhancing the letter's personalization.

Should I mention specific mortgage products I am familiar with in my application letter?

Mentioning specific mortgage products you are familiar with in your job application letter can demonstrate your industry knowledge and relevance. Tailoring your letter to highlight these products shows your practical experience and alignment with the employer's needs.

- Showcases Expertise - Listing mortgage products like fixed-rate, adjustable-rate, FHA, or VA loans highlights your technical understanding.

- Targets Employer Requirements - Aligning your skills with the mortgage products used by the company increases your chances of being noticed.

- Enhances Credibility - Specific product knowledge reassures employers of your ability to guide clients through various loan options effectively.

How long should my job application letter be for a Mortgage Consultant role?

| Aspect | Recommended Length |

|---|---|

| Introduction | 1 short paragraph (2-3 sentences) |

| Body | 2 to 3 paragraphs highlighting relevant skills, experience, and achievements |

| Conclusion | 1 concise paragraph expressing interest and call to action |

| Total Length | Approximately 300-400 words (1 page) |

| Formatting | Clear, professional, and easy to read with proper spacing |

What tone is best to use in a mortgage consultant job application letter?

The best tone for a mortgage consultant job application letter is professional and confident. It should convey expertise while remaining approachable and customer-focused.

Maintaining clarity and positivity helps highlight your ability to build trust with clients. Avoid overly formal language to ensure your communication feels genuine and engaging.

Do I need to include my certifications or licenses in the letter?

Including your certifications or licenses in a job application letter for a Mortgage Consultant position strengthens your credibility and demonstrates your qualifications. Employers value candidates who meet industry standards and regulatory requirements.

Highlight relevant certifications such as the Certified Mortgage Consultant (CMC) or state-specific licenses. Mentioning these credentials upfront shows your readiness to handle mortgage consultations responsibly. It also distinguishes you from other applicants who may lack formal accreditation.

How do I end a job application letter for a Mortgage Consultant position?

I am eager to bring my expertise in mortgage consulting to your team and contribute to your company's success. Thank you for considering my application. I look forward to the opportunity to discuss how my skills align with your needs in an interview.