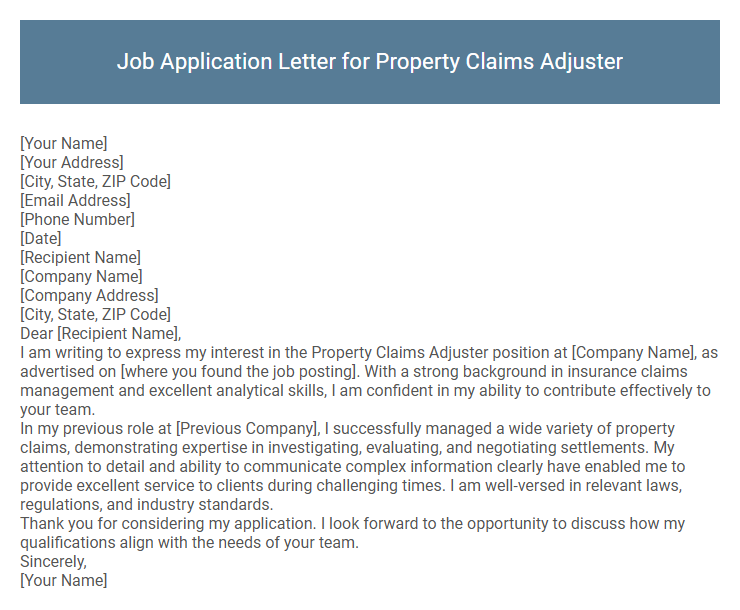

Job Application Letter for Property Claims Adjuster Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Property Claims Adjuster position at [Company Name], as advertised on [where you found the job posting]. With a strong background in insurance claims management and excellent analytical skills, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I successfully managed a wide variety of property claims, demonstrating expertise in investigating, evaluating, and negotiating settlements. My attention to detail and ability to communicate complex information clearly have enabled me to provide excellent service to clients during challenging times. I am well-versed in relevant laws, regulations, and industry standards.

Thank you for considering my application. I look forward to the opportunity to discuss how my qualifications align with the needs of your team.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a Property Claims Adjuster position requires highlighting relevant experience in claims investigation, negotiation, and customer service. Emphasizing strong analytical skills and attention to detail demonstrates your ability to assess property damages accurately and ensure fair settlements. Showcasing knowledge of insurance policies and regulatory compliance strengthens your suitability for the role.

What should I include in a job application letter for a Property Claims Adjuster position?

Include a strong opening expressing your interest in the Property Claims Adjuster position and mention relevant certifications such as CPCU or AIC. Highlight your experience in assessing property damage, negotiating settlements, and your knowledge of insurance policies and state regulations. Emphasize key skills like attention to detail, communication, and problem-solving to demonstrate your suitability for the role.

How do I highlight relevant experience in my application letter?

Highlight relevant experience by detailing specific property claims you have handled, emphasizing your success in accurate damage assessments and timely settlements. Mention any certifications or training related to insurance claims adjustment to demonstrate your technical expertise. Include metrics or examples that showcase your problem-solving skills and ability to communicate effectively with clients and insurance companies.

What key skills should I emphasize for a Property Claims Adjuster role?

Emphasize strong analytical skills to accurately assess property damage and determine claim validity. Highlight excellent communication abilities for effectively liaising with customers, insurance agents, and contractors. Demonstrate proficiency in negotiation and problem-solving to efficiently resolve claims and minimize company losses.

How formal should my job application letter be?

Your job application letter for a Property Claims Adjuster position should maintain a formal tone to reflect professionalism and respect for the hiring process.

Use clear, concise language, proper salutations, and avoid slang or overly casual expressions to create a strong first impression.

Focus on highlighting relevant skills and experiences with precise terminology related to property claims adjustment.

Ensure proper grammar, punctuation, and a structured format to demonstrate attention to detail and communication skills essential for the role.

Should I mention specific certifications in my letter?

Mentioning specific certifications in your job application letter for a Property Claims Adjuster position can significantly strengthen your candidacy by highlighting your relevant expertise. Certifications such as CPCU (Chartered Property Casualty Underwriter) or AIC (Associate in Claims) demonstrate your specialized knowledge and commitment to the field. Including these credentials aligns your qualifications with the employer's expectations and can differentiate you from other applicants.

How do I address a lack of direct adjusting experience?

Addressing a lack of direct adjusting experience requires emphasizing transferable skills and relevant knowledge in your job application letter. Highlight your ability to quickly learn and adapt within the property claims field to assure employers of your potential.

- Emphasize Transferable Skills - Showcase skills like investigation, negotiation, and customer service gained in related roles.

- Highlight Relevant Certifications - Mention any insurance licenses or training programs completed to demonstrate foundational knowledge.

- Show Willingness to Learn - Express eagerness to undergo further training and adapt to the company's specific claims processes.

Is it important to tailor my letter for each employer?

Tailoring your job application letter for each employer is crucial when applying for a Property Claims Adjuster position. It highlights your specific skills and experiences that match the employer's needs.

Customizing your letter demonstrates genuine interest and increases the chances of standing out in a competitive job market. Employers look for candidates who understand their company and industry challenges. A tailored letter effectively aligns your qualifications with the job requirements.

What is the ideal length for a Property Claims Adjuster application letter?

The ideal length for a Property Claims Adjuster application letter is concise, typically one page. It should clearly highlight relevant skills and experience without unnecessary detail.

- Conciseness - Keep the letter focused and avoid exceeding one page to maintain the reader's attention.

- Relevance - Emphasize key qualifications and achievements pertinent to property claims adjustment.

- Clarity - Use clear and direct language to effectively communicate your value to the employer.

A well-structured, one-page letter increases the chances of making a positive impact on hiring managers.

Should I reference knowledge of insurance laws in my letter?

Referencing knowledge of insurance laws in your job application letter for a Property Claims Adjuster position demonstrates your understanding of industry regulations and compliance requirements. This expertise assures employers of your capability to handle claims accurately and ethically.

Highlighting specific laws or regulations you are familiar with can set you apart from other candidates by showing your readiness to navigate complex claims processes. Employers value candidates who can apply legal knowledge to mitigate risks and ensure fair claim settlements.