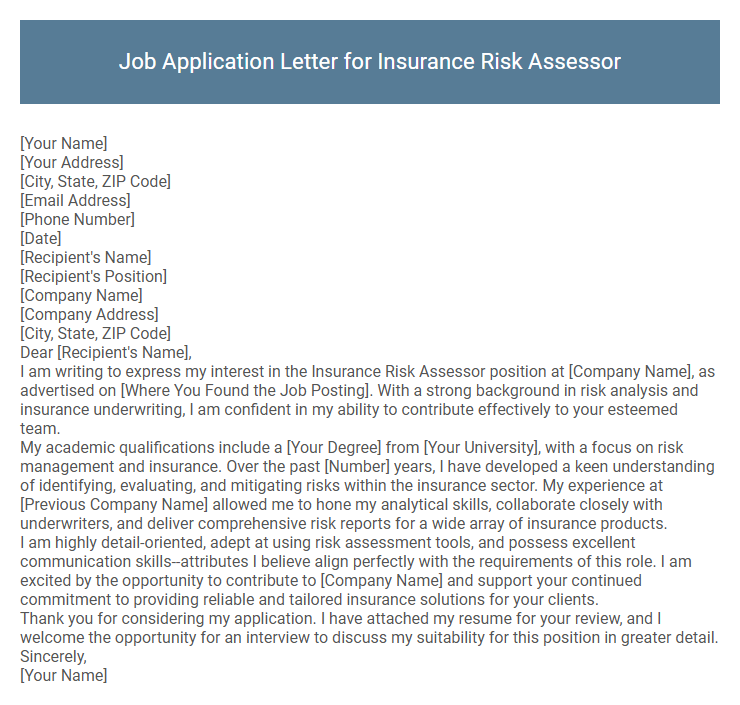

Job Application Letter for Insurance Risk Assessor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Risk Assessor position at [Company Name], as advertised on [Where You Found the Job Posting]. With a strong background in risk analysis and insurance underwriting, I am confident in my ability to contribute effectively to your esteemed team.

My academic qualifications include a [Your Degree] from [Your University], with a focus on risk management and insurance. Over the past [Number] years, I have developed a keen understanding of identifying, evaluating, and mitigating risks within the insurance sector. My experience at [Previous Company Name] allowed me to hone my analytical skills, collaborate closely with underwriters, and deliver comprehensive risk reports for a wide array of insurance products.

I am highly detail-oriented, adept at using risk assessment tools, and possess excellent communication skills--attributes I believe align perfectly with the requirements of this role. I am excited by the opportunity to contribute to [Company Name] and support your continued commitment to providing reliable and tailored insurance solutions for your clients.

Thank you for considering my application. I have attached my resume for your review, and I welcome the opportunity for an interview to discuss my suitability for this position in greater detail.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an Insurance Risk Assessor involves highlighting expertise in risk analysis, attention to detail, and strong decision-making skills. Emphasize relevant experience with evaluating insurance policies, assessing potential risks, and recommending appropriate coverage options. Demonstrating knowledge of industry regulations and data-driven risk assessment techniques strengthens the application significantly.

What should I include in a job application letter for an Insurance Risk Assessor position?

Include a clear introduction stating the position you are applying for and a brief overview of your relevant qualifications and experience in risk assessment within the insurance industry.

Highlight specific skills such as risk analysis, data interpretation, and knowledge of insurance policies, emphasizing your ability to evaluate and mitigate potential risks effectively.

Conclude with a confident statement of your enthusiasm for the role, your willingness to contribute to the company's risk management goals, and a request for an interview to discuss your application further.

How do I highlight my risk assessment skills in the letter?

How do I highlight my risk assessment skills in a job application letter for an Insurance Risk Assessor position? Emphasize specific experiences where you identified, analyzed, and mitigated risks effectively. Use quantifiable achievements to demonstrate your expertise in evaluating insurance risks and applying industry standards.

What qualifications are important to mention for this role?

Relevant qualifications for an Insurance Risk Assessor include a degree in finance, risk management, or insurance. Professional certifications such as CPCU (Chartered Property Casualty Underwriter) or ARM (Associate in Risk Management) enhance credibility.

Strong analytical skills and experience with risk assessment tools and software are critical. Knowledge of regulatory requirements and excellent communication abilities are also important to effectively evaluate and report risks.

How do I tailor my letter to the insurance industry?

Highlight your understanding of insurance policies, risk management principles, and regulatory compliance to demonstrate industry-specific knowledge. Emphasize your analytical skills and experience in evaluating potential risks to align with the core responsibilities of an Insurance Risk Assessor. Use industry-related terminology and reference relevant certifications or training to strengthen your credibility in the insurance field.

Should I provide examples of previous risk assessment work?

Including examples of previous risk assessment work in a job application letter for an Insurance Risk Assessor significantly enhances credibility. Concrete evidence of past achievements demonstrates relevant expertise and practical skills.

- Showcases Expertise - Examples provide tangible proof of your ability to identify and evaluate risks accurately.

- Builds Trust - Highlighting successful assessments reassures employers of your competence and reliability.

- Differentiates Candidate - Specific accomplishments set you apart from other applicants by illustrating real-world impact.

What is the ideal length for the application letter?

| Aspect | Details |

|---|---|

| Ideal Length | One page |

| Word Count | 300-400 words |

| Paragraphs | 3 to 4 |

| Content Focus | Relevant skills, experience, and motivation specific to Insurance Risk Assessor role |

| Readability | Clear, concise, and well-structured |

How formal should the language be?

The language in a job application letter for an Insurance Risk Assessor should be highly formal to convey professionalism and expertise. Maintaining a respectful and precise tone reflects the serious nature of the insurance industry and the critical assessment role.

- Professional Terminology - Use industry-specific terms to demonstrate knowledge and competence in risk assessment and insurance policies.

- Clear and Concise - Avoid slang or overly complex sentences; clarity ensures the recruiter understands your qualifications effectively.

- Polite and Respectful - Formal greetings and closings establish a courteous tone, essential for business correspondence.

Formal language ensures the application stands out as credible and suitably aligned with the professional standards of the insurance sector.

How can I demonstrate my analytical abilities in the letter?

Highlight specific experiences where you analyzed data to identify potential risks and recommended mitigation strategies, such as evaluating insurance claims or assessing client portfolios. Quantify your achievements by mentioning results, like reducing risk exposure by a percentage or improving accuracy in risk evaluations.

Explain your proficiency with analytical tools and software commonly used in risk assessment, showcasing your ability to interpret complex data sets. Emphasize your problem-solving skills by describing scenarios where your insights directly influenced decision-making or policy adjustments.

Is it necessary to research the insurance company before writing the letter?

Researching the insurance company before writing a job application letter for an Insurance Risk Assessor is essential. Understanding the company's risk management policies, values, and market position allows for a tailored and impactful letter. This knowledge demonstrates genuine interest and aligns your expertise with the company's specific needs.