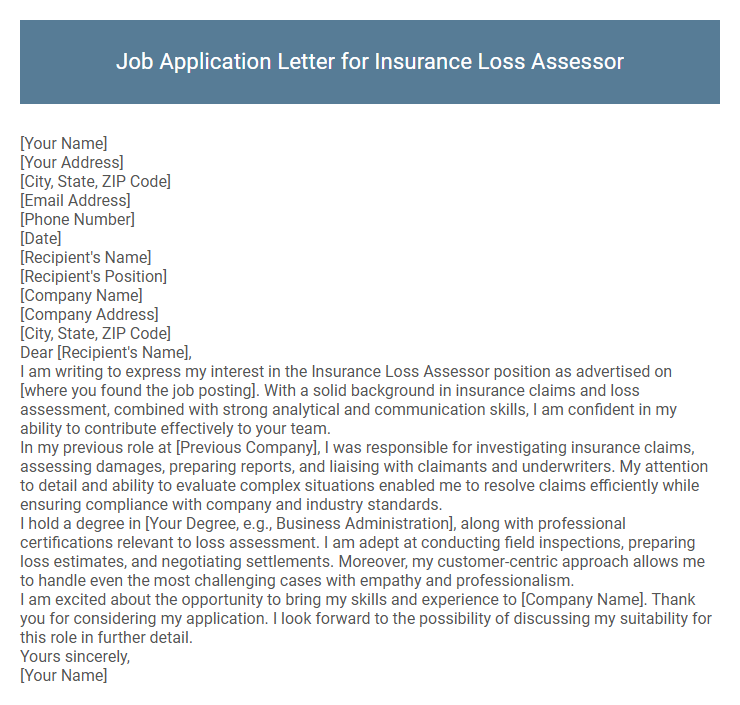

Job Application Letter for Insurance Loss Assessor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Loss Assessor position as advertised on [where you found the job posting]. With a solid background in insurance claims and loss assessment, combined with strong analytical and communication skills, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I was responsible for investigating insurance claims, assessing damages, preparing reports, and liaising with claimants and underwriters. My attention to detail and ability to evaluate complex situations enabled me to resolve claims efficiently while ensuring compliance with company and industry standards.

I hold a degree in [Your Degree, e.g., Business Administration], along with professional certifications relevant to loss assessment. I am adept at conducting field inspections, preparing loss estimates, and negotiating settlements. Moreover, my customer-centric approach allows me to handle even the most challenging cases with empathy and professionalism.

I am excited about the opportunity to bring my skills and experience to [Company Name]. Thank you for considering my application. I look forward to the possibility of discussing my suitability for this role in further detail.

Yours sincerely,

[Your Name]

A job application letter for an Insurance Loss Assessor should clearly highlight expertise in evaluating insurance claims and assessing property damage with accuracy. Emphasizing strong analytical skills and knowledge of insurance policies ensures the ability to determine fair compensation promptly. Demonstrating attention to detail and effective communication skills will strengthen the case for a successful hire.

What should I include in a job application letter for an Insurance Loss Assessor position?

Include a clear introduction stating the position you are applying for and a brief overview of your relevant experience in insurance loss assessment. Highlight key skills such as damage evaluation, claim analysis, and knowledge of insurance policies. Conclude with a confident statement expressing your enthusiasm for contributing to the company's success and requesting an interview opportunity.

How do I format my cover letter for an Insurance Loss Assessor role?

Formatting your cover letter for an Insurance Loss Assessor role requires clarity and professionalism to highlight your expertise and attention to detail. Use a structured approach to showcase relevant skills, experience, and your ability to assess insurance claims accurately.

- Header and Contact Information - Include your full name, phone number, email address, and the date, along with the employer's contact details at the top of the letter.

- Introduction Paragraph - Start with a concise opening that states the role you are applying for and a brief overview of your relevant qualifications and motivation.

- Body Paragraphs - Detail your experience with insurance claim assessments, knowledge of policies, and strong analytical skills, supported by specific examples of past achievements or case evaluations.

Which key skills should I highlight for an Insurance Loss Assessor job application?

Which key skills should I highlight for an Insurance Loss Assessor job application? Emphasize analytical skills to accurately evaluate insurance claims and determine the extent of loss or damage. Strong communication skills are essential for effectively interacting with clients, adjusters, and other stakeholders.

How important is attention to detail for an Insurance Loss Assessor? High attention to detail ensures precise assessment of damages and accurate documentation, reducing errors in claim processing. Technical knowledge of insurance policies and relevant regulations also plays a crucial role in effective claim evaluation.

Should I mention my certifications in the application letter?

Including certifications in a job application letter for an Insurance Loss Assessor enhances your credibility and showcases relevant expertise. Mentioning certifications such as Certified Insurance Counselor (CIC) or Associate in Claims (AIC) highlights your specialized knowledge. This detail helps employers assess your qualifications quickly and increases your chances of securing an interview.

How do I address a lack of direct experience in loss assessment?

When addressing a lack of direct experience in loss assessment, emphasize your transferable skills such as attention to detail, analytical abilities, and strong communication. Highlight relevant experiences in related fields like risk management or customer service to demonstrate your capability.

Express your enthusiasm for learning and adapting quickly to new challenges within the insurance industry. Mention any certifications or training you are pursuing to bridge knowledge gaps. Show confidence in applying your existing skills to effectively support loss assessment tasks.

What professional tone is expected in a loss assessor job application letter?

A job application letter for an Insurance Loss Assessor should maintain a professional tone that is clear, concise, and respectful. The language must reflect attention to detail, analytical skills, and a strong understanding of insurance policies and claims processes. Demonstrating confidence and reliability while avoiding overly casual expressions is essential to convey professionalism.

Is it necessary to refer to the job posting in my application letter?

Referring to the job posting in your application letter for an Insurance Loss Assessor position is highly recommended. It demonstrates your genuine interest and aligns your qualifications with the employer's requirements.

- Shows attentiveness - Mentioning the job posting confirms you have read and understood the specific job details.

- Highlights relevant skills - Directly linking your experience to the posting emphasizes your suitability for the role.

- Personalizes the application - Referencing the job ad makes your letter targeted, increasing the chance of consideration.

Including references to the job posting strengthens your application by showcasing alignment with employer expectations.

How can I demonstrate attention to detail in my application letter?

Highlight specific examples of previous experience where precise evaluation and documentation of insurance claims were critical. Include quantifiable achievements, such as reducing claim processing errors or improving accuracy in loss assessments. Use clear, concise language and thoroughly proofread the letter to ensure it is free of mistakes, showcasing your meticulous nature.

Should I mention my knowledge of insurance regulations and claims processes?

Mentioning your knowledge of insurance regulations and claims processes in a job application letter for an Insurance Loss Assessor is essential. It demonstrates your expertise and suitability for the role to potential employers.

Highlighting relevant regulatory knowledge assures employers of your ability to handle claims accurately and comply with legal standards.

- Showcases Expertise - Demonstrates your understanding of industry rules and claim procedures crucial for accurate loss assessment.

- Builds Employer Trust - Indicates reliability and professional competence in managing complex insurance claims.

- Enhances Application Impact - Differentiates you from other candidates by emphasizing specialized knowledge in insurance compliance.