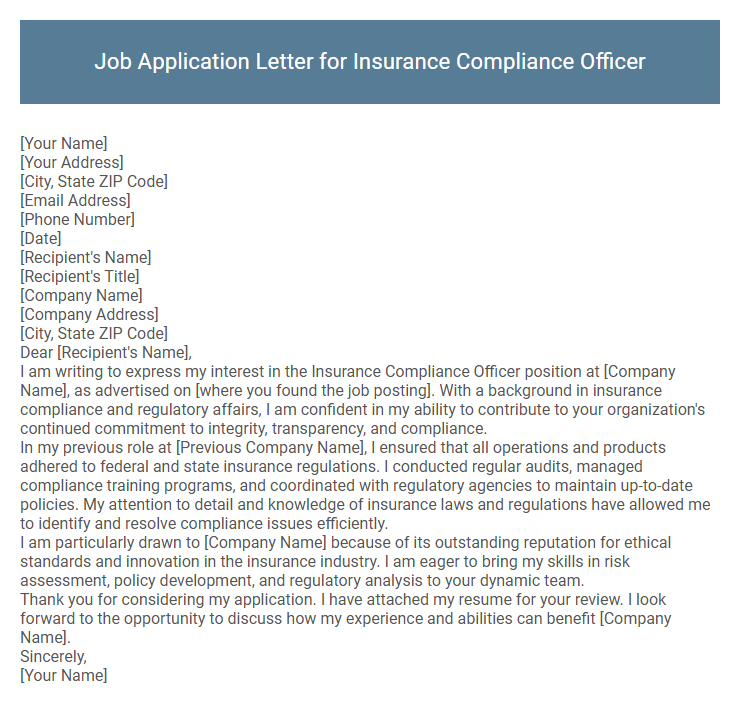

Job Application Letter for Insurance Compliance Officer Sample

[Your Address]

[City, State ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Compliance Officer position at [Company Name], as advertised on [where you found the job posting]. With a background in insurance compliance and regulatory affairs, I am confident in my ability to contribute to your organization's continued commitment to integrity, transparency, and compliance.

In my previous role at [Previous Company Name], I ensured that all operations and products adhered to federal and state insurance regulations. I conducted regular audits, managed compliance training programs, and coordinated with regulatory agencies to maintain up-to-date policies. My attention to detail and knowledge of insurance laws and regulations have allowed me to identify and resolve compliance issues efficiently.

I am particularly drawn to [Company Name] because of its outstanding reputation for ethical standards and innovation in the insurance industry. I am eager to bring my skills in risk assessment, policy development, and regulatory analysis to your dynamic team.

Thank you for considering my application. I have attached my resume for your review. I look forward to the opportunity to discuss how my experience and abilities can benefit [Company Name].

Sincerely,

[Your Name]

Crafting a compelling job application letter for an Insurance Compliance Officer position requires highlighting expertise in regulatory frameworks, risk management, and adherence to industry standards. Demonstrating a proven track record of ensuring organizational compliance and mitigating legal risks emphasizes the candidate's capability to protect both the company and its clients. Emphasizing strong analytical skills and attention to detail reinforces suitability for maintaining strict compliance in a dynamic insurance environment.

What key qualifications should be highlighted in an Insurance Compliance Officer job application letter?

Highlight expertise in insurance laws and regulatory compliance, demonstrating thorough knowledge of industry standards and guidelines. Emphasize strong analytical skills and attention to detail to effectively monitor, evaluate, and manage compliance risks. Showcase experience in implementing compliance programs, conducting audits, and collaborating with legal teams to ensure adherence to regulatory requirements.

How long should my job application letter be for this position?

How long should my job application letter be for the Insurance Compliance Officer position? The ideal length is one page, typically around 300 to 400 words. This ensures concise presentation of relevant qualifications and experience without overwhelming the recruiter.

What compliance certifications are important to mention?

When applying for the position of Insurance Compliance Officer, highlighting relevant compliance certifications strengthens your candidacy. Focus on certifications that demonstrate expertise in regulatory standards and risk management within the insurance sector.

- Certified Regulatory Compliance Manager (CRCM) - This certification validates knowledge of regulatory requirements and compliance processes specific to financial services, including insurance.

- Certified Risk and Compliance Management Professional (CRCMP) - It emphasizes proficiency in identifying, assessing, and managing compliance risks across insurance organizations.

- Insurance Compliance Professional Certification (ICPC) - This certification focuses on insurance laws, ethical standards, and compliance best practices tailored for insurance professionals.

Should I use formal or conversational language in my letter?

Use formal language in your job application letter for an Insurance Compliance Officer position to demonstrate professionalism and respect. Formal tone aligns with the industry's expectations and highlights your seriousness about the role.

Conversational language may appear too casual and unprofessional, potentially reducing your chances of being considered. Maintaining a clear, concise, and respectful tone ensures your qualifications stand out effectively.

Do I need to address specific insurance regulations in my letter?

Addressing specific insurance regulations in your job application letter for an Insurance Compliance Officer position demonstrates your knowledge and attention to detail. Highlighting your familiarity with key regulations like state insurance laws, HIPAA, and AML requirements can make your application stand out.

However, keep the mention concise and relevant to the job description to avoid overwhelming the reader. Emphasize how your regulatory expertise will help the company maintain compliance and reduce risk effectively.

Is it necessary to include achievements with compliance audits in my application?

Including achievements with compliance audits in your job application letter for an Insurance Compliance Officer position strengthens your candidacy by showcasing your expertise. Highlighting specific audit successes demonstrates your ability to ensure regulatory adherence and mitigate risks effectively.

- Demonstrates Expertise - Showcasing achievements with compliance audits highlights your proficiency in navigating complex regulatory frameworks.

- Builds Credibility - Concrete audit successes establish trust with hiring managers by proving your ability to enforce compliance standards.

- Enhances Impact - Detailing measurable outcomes from past audits provides evidence of your positive contributions to organizational risk management.

How do I demonstrate attention to detail in my cover letter?

Demonstrating attention to detail in a cover letter for an Insurance Compliance Officer position involves highlighting your precise document review skills and regulatory knowledge. Emphasize your ability to maintain accuracy while managing complex compliance requirements.

- Highlight Specific Achievements - Mention instances where you identified discrepancies or ensured full compliance with insurance laws, showing meticulous oversight.

- Use Clear, Concise Language - Craft your cover letter with flawless grammar and structured paragraphs to reflect thoroughness.

- Reference Relevant Tools and Processes - Include your experience with compliance software and audit procedures to showcase systematic attention to detail.

These elements collectively demonstrate your capability to uphold stringent compliance standards with precision.

Should I mention my familiarity with insurance software systems?

Mentioning your familiarity with insurance software systems in your job application letter for an Insurance Compliance Officer position can significantly strengthen your candidacy. It highlights your technical proficiency and readiness to handle compliance tasks efficiently.

Employers value candidates who are well-versed in industry-specific tools, as it reduces training time and enhances job performance. Emphasize specific software you have experience with to demonstrate your practical knowledge. This detail shows you can seamlessly integrate into their workflow and contribute immediately.

Can I use the same application letter for different insurance companies?

| Aspect | Details |

|---|---|

| Using Same Letter | Possible with customization to each company's values and requirements |

| Customization Areas | Company name, specific compliance standards, job role emphasis |

| Benefits | Time-saving while maintaining relevance to each insurer |

| Risks | Appearing generic or less committed if not tailored properly |

| Best Practice | Start with a core template, adapt key sections for each insurer |