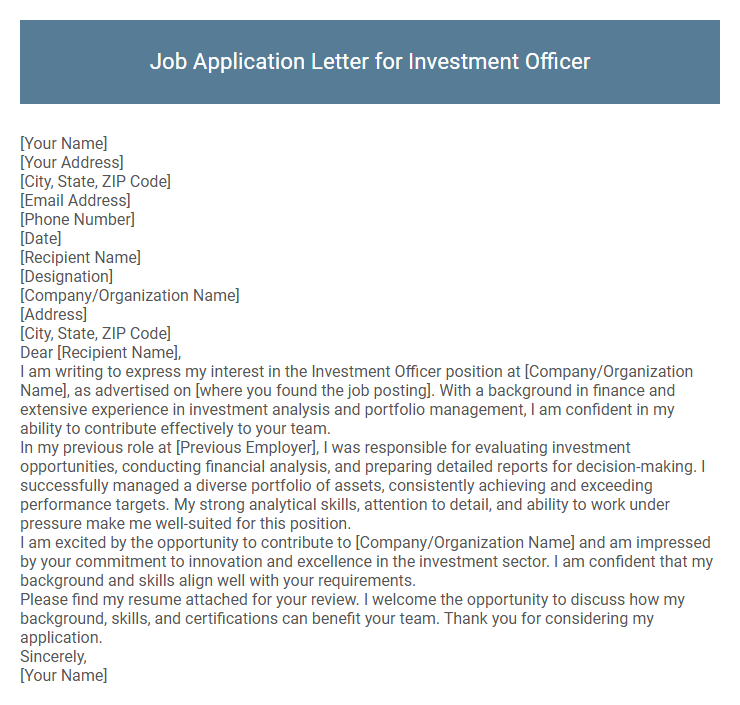

Job Application Letter for Investment Officer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Designation]

[Company/Organization Name]

[Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Investment Officer position at [Company/Organization Name], as advertised on [where you found the job posting]. With a background in finance and extensive experience in investment analysis and portfolio management, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Employer], I was responsible for evaluating investment opportunities, conducting financial analysis, and preparing detailed reports for decision-making. I successfully managed a diverse portfolio of assets, consistently achieving and exceeding performance targets. My strong analytical skills, attention to detail, and ability to work under pressure make me well-suited for this position.

I am excited by the opportunity to contribute to [Company/Organization Name] and am impressed by your commitment to innovation and excellence in the investment sector. I am confident that my background and skills align well with your requirements.

Please find my resume attached for your review. I welcome the opportunity to discuss how my background, skills, and certifications can benefit your team. Thank you for considering my application.

Sincerely,

[Your Name]

A well-crafted job application letter for an Investment Officer highlights relevant financial expertise, analytical skills, and experience in portfolio management. It emphasizes the ability to evaluate investment opportunities, manage risks, and contribute to achieving the organization's financial goals. Demonstrating a strong understanding of market trends and regulatory compliance positions the candidate as a valuable asset.

What is a job application letter for an Investment Officer?

A job application letter for an Investment Officer is a formal document submitted to express interest in a position managing investment portfolios, analyzing financial data, and advising clients. It highlights relevant skills such as financial analysis, market research, and risk management. The letter aims to demonstrate the candidate's qualifications and suitability for the role within finance organizations or investment firms.

What key skills should I highlight in my Investment Officer cover letter?

What key skills should I highlight in my Investment Officer cover letter? Emphasize analytical skills and financial modeling expertise to demonstrate your ability to assess investment opportunities. Highlight your knowledge of market trends and risk management to showcase your capability in maximizing returns while minimizing risks.

How do I address the hiring manager in my application letter?

Address the hiring manager by their full name if it is available in the job posting or company website. Using a specific name shows attention to detail and personalizes your application.

If the name is not provided, use a professional generic greeting such as "Dear Hiring Manager" or "Dear Investment Team." Avoid vague openings like "To Whom It May Concern" to maintain a formal tone.

What format should I use for an Investment Officer job application letter?

Use a formal business letter format for an Investment Officer job application letter. Begin with your contact details, followed by the employer's information and a clear subject line.

Start the body with a strong introduction stating the position you are applying for. Highlight relevant skills, experience, and accomplishments that demonstrate your investment expertise. Conclude politely with a call to action, expressing interest in an interview.

How long should my application letter be?

| Aspect | Recommendation |

|---|---|

| Length | One page, typically 250-400 words |

| Paragraphs | 3 to 4 concise paragraphs |

| Content | Introduction, relevant experience, skills, and closing statement |

| Focus | Highlight investment analysis, portfolio management, and relevant qualifications |

| Readability | Clear, professional, and tailored to the job description |

Should I mention my certifications in the letter?

Mentioning your certifications in a job application letter for an Investment Officer position strengthens your professional credibility. Highlighting relevant certifications demonstrates your expertise and commitment to the investment field.

- Certifications validate expertise - Certifications like CFA or CAIA showcase your technical knowledge and investment skills.

- Certifications differentiate you - Including certifications helps your application stand out among other candidates.

- Certifications align with job requirements - Employers often look for specific certifications to ensure candidates meet industry standards.

Mention your most relevant and recognized certifications concisely to enhance your job application letter's impact.

How do I showcase relevant experience for an Investment Officer role?

Highlight your experience managing investment portfolios, analyzing financial markets, and conducting risk assessments to demonstrate your expertise. Emphasize successful projects where you increased returns or optimized asset allocation. Include specific investment tools and strategies you have applied to showcase practical knowledge in the role.

Is it important to customize my letter for each job application?

Customizing a job application letter for each Investment Officer position is crucial. Tailoring your letter highlights your relevant skills and aligns your experience with the specific job requirements.

A personalized letter demonstrates genuine interest and effort, increasing your chances of standing out to recruiters. Generic letters risk being overlooked, reducing the opportunity for an interview.

What should I avoid including in my application letter?

Avoid including irrelevant personal information or overly detailed work history that does not relate to the investment officer role. Do not use vague language or cliches instead of showcasing concrete skills and accomplishments.

- Overly personal details - These distract from your professional qualifications and are not pertinent to the investment position.

- Generic statements - They fail to demonstrate your unique value and specific expertise in investment management.

- Negative comments about past employers - Such remarks can appear unprofessional and harm your credibility.