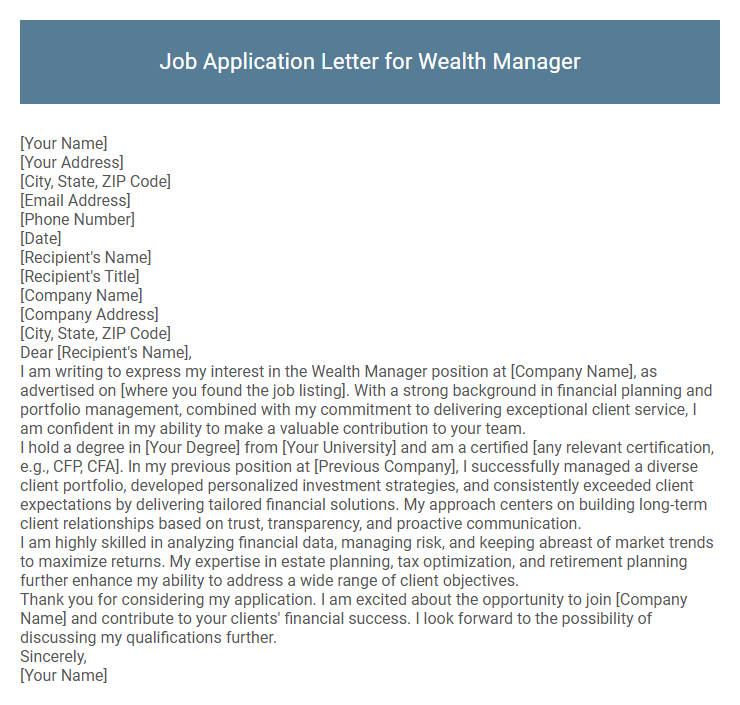

Job Application Letter for Wealth Manager Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Wealth Manager position at [Company Name], as advertised on [where you found the job listing]. With a strong background in financial planning and portfolio management, combined with my commitment to delivering exceptional client service, I am confident in my ability to make a valuable contribution to your team.

I hold a degree in [Your Degree] from [Your University] and am a certified [any relevant certification, e.g., CFP, CFA]. In my previous position at [Previous Company], I successfully managed a diverse client portfolio, developed personalized investment strategies, and consistently exceeded client expectations by delivering tailored financial solutions. My approach centers on building long-term client relationships based on trust, transparency, and proactive communication.

I am highly skilled in analyzing financial data, managing risk, and keeping abreast of market trends to maximize returns. My expertise in estate planning, tax optimization, and retirement planning further enhance my ability to address a wide range of client objectives.

Thank you for considering my application. I am excited about the opportunity to join [Company Name] and contribute to your clients' financial success. I look forward to the possibility of discussing my qualifications further.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a wealth manager position requires highlighting expertise in financial planning, investment strategies, and client relationship management. Demonstrating a strong track record of helping clients grow and protect their assets through tailored solutions emphasizes the candidate's value. Clear communication of relevant certifications, experience, and a client-focused approach will capture the attention of potential employers in the competitive wealth management industry.

What key qualifications should I highlight in a wealth manager job application letter?

Highlight your strong financial analysis skills and expertise in portfolio management to demonstrate your ability to maximize client wealth. Emphasize your excellent communication and interpersonal skills to build trust and maintain long-term client relationships. Showcase relevant certifications such as CFA or CFP to validate your professional knowledge and commitment to the wealth management field.

How do I demonstrate my financial expertise in a cover letter?

How do I demonstrate my financial expertise in a cover letter for a Wealth Manager position? Highlight specific achievements managing client portfolios, including metrics such as portfolio growth percentages and risk mitigation success. Mention certifications like CFA or CFP and experience with diverse financial instruments to emphasize proficiency.

What format should a wealth manager application letter follow?

A wealth manager application letter should follow a formal business letter format, including the sender's contact information, date, recipient's contact details, and a professional salutation. The body must concisely highlight relevant financial expertise, client management skills, and tailored value propositions aligned with the firm's objectives. Closing with a call to action and a professional sign-off reinforces interest and professionalism.

How can I showcase my client relationship skills effectively?

Highlight specific examples where you successfully managed and grew client portfolios, emphasizing personalized strategies tailored to individual financial goals. Mention your proactive communication style and ability to build long-term trust with high-net-worth clients.

Illustrate your expertise in understanding complex client needs and delivering customized wealth management solutions. Showcase any client testimonials or measurable outcomes that demonstrate your commitment to exceptional service and relationship management.

Should I mention relevant certifications in the letter?

| Include Certifications | Yes, mentioning relevant certifications such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) strengthens your credibility and demonstrates expertise in wealth management. |

| Placement | Briefly mention certifications in the opening or middle paragraphs to highlight qualifications early without overwhelming the letter. |

| Detail Level | Focus on certifications most relevant to the job to showcase specialized skill sets and professional commitment. |

| Supporting Proof | Refer to your resume or LinkedIn profile for detailed credentials and accomplishments related to those certifications. |

| Purpose | Certifications signal proficiency, dedication, and readiness to manage client portfolios efficiently, increasing your chances of securing the role. |

Can I include measurable achievements in my application letter?

Including measurable achievements in a job application letter for a Wealth Manager positions you as a results-driven professional. Quantifiable successes enhance credibility and demonstrate your ability to deliver value.

- Highlight Portfolio Growth - Mention specific percentages of asset growth you managed to showcase your impact on clients' wealth.

- Showcase Client Retention Rates - Include statistics on client retention to reflect your relationship-building skills and trustworthiness.

- Detail Revenue Contributions - Provide figures related to revenue increases or cost savings resulting from your strategies to emphasize your financial acumen.

How long should a wealth manager cover letter be?

A wealth manager cover letter should be concise, typically between 250 to 400 words, fitting on one page. Focus on key qualifications, relevant experience, and your value proposition to the employer. Keep the content clear and targeted to maintain the reader's interest and professional tone.

What salutation should I use for financial industry applications?

Use formal salutations such as "Dear Hiring Manager" or "Dear [Company Name] Recruitment Team" for job applications in the financial industry. Avoid casual greetings to maintain professionalism and respect for the company's hiring process.

When possible, address the letter to a specific individual by name, such as "Dear Mr. Smith" or "Dear Ms. Johnson," to show attention to detail. Researching the hiring manager's name can enhance the personalization of your application.

Is it important to tailor the letter to each employer?

Tailoring a job application letter for a Wealth Manager demonstrates a clear understanding of the employer's specific needs and values. It highlights relevant skills and experiences, making the candidate stand out in a competitive field.

Each employer has unique priorities, such as client relationship management or portfolio diversification strategies, which should be addressed explicitly. Customizing the letter shows genuine interest and effort, increasing the likelihood of securing an interview. General letters often fail to capture the employer's attention or align with their objectives.