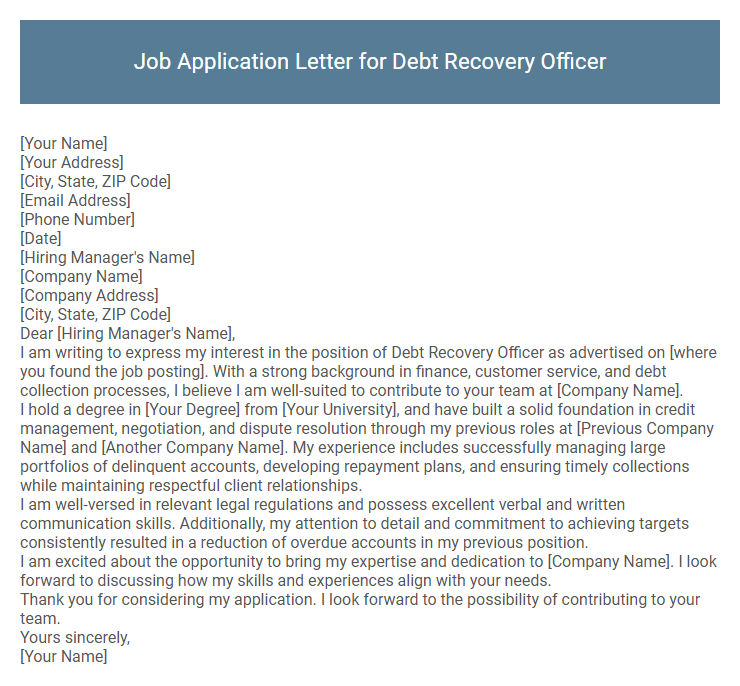

Job Application Letter for Debt Recovery Officer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

I am writing to express my interest in the position of Debt Recovery Officer as advertised on [where you found the job posting]. With a strong background in finance, customer service, and debt collection processes, I believe I am well-suited to contribute to your team at [Company Name].

I hold a degree in [Your Degree] from [Your University], and have built a solid foundation in credit management, negotiation, and dispute resolution through my previous roles at [Previous Company Name] and [Another Company Name]. My experience includes successfully managing large portfolios of delinquent accounts, developing repayment plans, and ensuring timely collections while maintaining respectful client relationships.

I am well-versed in relevant legal regulations and possess excellent verbal and written communication skills. Additionally, my attention to detail and commitment to achieving targets consistently resulted in a reduction of overdue accounts in my previous position.

I am excited about the opportunity to bring my expertise and dedication to [Company Name]. I look forward to discussing how my skills and experiences align with your needs.

Thank you for considering my application. I look forward to the possibility of contributing to your team.

Yours sincerely,

[Your Name]

A strong job application letter for a Debt Recovery Officer highlights relevant experience in financial analysis, negotiation, and customer service. Demonstrating a clear understanding of debt recovery processes, legal compliance, and effective communication skills can set candidates apart. Tailoring the letter to emphasize problem-solving abilities and a track record of recovering outstanding debts enhances the application's impact.

What is a Job Application Letter for a Debt Recovery Officer?

A Job Application Letter for a Debt Recovery Officer is a formal document submitted to express interest in a debt recovery position. It highlights relevant skills such as negotiation, financial analysis, and communication abilities. The letter aims to demonstrate the applicant's qualifications and suitability for managing debt collection responsibilities effectively.

What key skills should I highlight in my application letter for this role?

In your job application letter for a Debt Recovery Officer, emphasize skills that demonstrate your ability to manage debt portfolios effectively. Highlight capabilities that show your proficiency in communication, negotiation, and compliance with financial regulations.

- Strong Communication Skills - Essential for explaining repayment terms clearly and maintaining professional client interactions.

- Negotiation Expertise - Crucial for reaching mutually beneficial payment agreements with debtors.

- Regulatory Knowledge - Important to ensure all recovery practices comply with financial laws and company policies.

Presenting these key skills will make your application stand out to hiring managers in the debt recovery sector.

How should I structure my Debt Recovery Officer application letter?

Begin your Debt Recovery Officer application letter with a clear introduction stating the position you are applying for and a brief overview of your relevant experience in debt recovery and financial management. In the body, highlight key skills such as negotiation, communication, and knowledge of debt collection laws that make you a strong candidate. Conclude by expressing enthusiasm for the role and your willingness to contribute to the company's recovery goals.

What qualifications are important to mention?

A Job Application Letter for a Debt Recovery Officer should highlight relevant financial and communication skills. Emphasizing specific qualifications demonstrates suitability for managing debt recovery processes effectively.

- Financial knowledge - Proficiency in accounting principles and debt management techniques ensures accurate handling of recovery cases.

- Negotiation skills - Ability to negotiate payment plans with debtors facilitates successful debt resolution.

- Regulatory compliance - Understanding of debt recovery laws and regulations guarantees adherence to legal standards.

Should I address specific experience in debt recovery in my letter?

Explicitly addressing specific experience in debt recovery strengthens your job application letter by showcasing relevant skills and achievements. Employers prioritize candidates with proven expertise in managing debt recovery processes effectively.

Highlight your hands-on experience with collection strategies, negotiation with debtors, and successful resolution of outstanding accounts. Mention any familiarity with legal regulations and financial software used in debt recovery. This targeted approach demonstrates your suitability for the Debt Recovery Officer role and increases your chances of selection.

How formal should my application letter be?

A job application letter for a Debt Recovery Officer should be highly formal, reflecting professionalism and respect for the hiring organization. Use clear, concise language and maintain a polite tone throughout the letter.

Address the letter to the hiring manager or relevant department, and avoid informal expressions or slang. Proper grammar, punctuation, and a structured format are essential to demonstrate your seriousness and attention to detail.

Do I need to customize the letter for each employer?

Customizing your job application letter for each Debt Recovery Officer employer increases your chances of securing an interview. Tailoring shows your understanding of the company's specific debt recovery needs and highlights relevant skills effectively.

- Highlight Relevant Experience - Emphasize debt collection successes and familiarity with industry regulations specific to the company.

- Address Employer Needs - Reflect the job description and company goals to demonstrate a strong fit for their recovery strategies.

- Showcase Personalization - Use the employer's name and reference unique company values or software tools to prove genuine interest.

Is it important to discuss negotiation skills in the letter?

Is it important to discuss negotiation skills in a job application letter for a Debt Recovery Officer? Negotiation skills are crucial for a Debt Recovery Officer because the role requires effective communication to resolve payment issues with debtors. Highlighting these skills demonstrates your ability to achieve recoveries while maintaining customer relationships.

Should I include references in my application letter?

Including references in a Job Application Letter for a Debt Recovery Officer position is generally not necessary unless explicitly requested by the employer. Focus on highlighting your relevant skills and experience in debt recovery within the letter.

References can be provided separately when asked during the interview stage or in a follow-up email. This approach keeps your application concise and targeted to the job requirements.