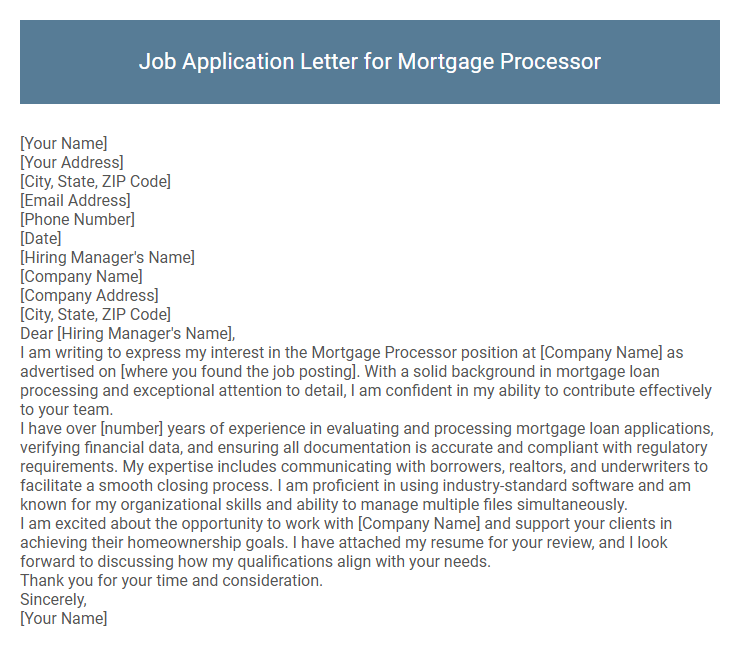

Job Application Letter for Mortgage Processor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

I am writing to express my interest in the Mortgage Processor position at [Company Name] as advertised on [where you found the job posting]. With a solid background in mortgage loan processing and exceptional attention to detail, I am confident in my ability to contribute effectively to your team.

I have over [number] years of experience in evaluating and processing mortgage loan applications, verifying financial data, and ensuring all documentation is accurate and compliant with regulatory requirements. My expertise includes communicating with borrowers, realtors, and underwriters to facilitate a smooth closing process. I am proficient in using industry-standard software and am known for my organizational skills and ability to manage multiple files simultaneously.

I am excited about the opportunity to work with [Company Name] and support your clients in achieving their homeownership goals. I have attached my resume for your review, and I look forward to discussing how my qualifications align with your needs.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a mortgage processor position highlights your expertise in managing loan documentation and ensuring compliance with lending guidelines. Emphasizing attention to detail, strong organizational skills, and experience with loan origination systems showcases your ability to support seamless mortgage transactions. Demonstrating effective communication with clients, underwriters, and real estate agents underlines your role in facilitating timely and accurate loan processing.

What should I include in a job application letter for a Mortgage Processor position?

Include your relevant experience with mortgage processing, such as knowledge of loan documentation, regulatory compliance, and communication with clients and lenders. Highlight key skills like attention to detail, organization, and proficiency with mortgage software systems. Emphasize your ability to manage timelines efficiently and resolve issues to ensure smooth loan processing.

How do I format a Mortgage Processor application letter?

Start your Mortgage Processor application letter with a professional header including your contact information and the employer's details. Use a formal greeting addressing the hiring manager by name if possible.

Begin the body by stating the position you are applying for and briefly mention your relevant experience in mortgage processing. Highlight key skills such as loan documentation review, compliance knowledge, and attention to detail.

What skills are important to highlight for a Mortgage Processor role?

A Mortgage Processor must demonstrate strong organizational skills and meticulous attention to detail to ensure accuracy throughout the loan application process. Effective communication and problem-solving abilities are essential for coordinating between clients, underwriters, and loan officers.

- Organizational Skills - Managing multiple loan files systematically to meet deadlines efficiently.

- Attention to Detail - Verifying documents accurately to prevent errors in mortgage applications.

- Communication Skills - Facilitating clear interactions among clients, lenders, and real estate professionals.

Should I mention certifications in my application letter?

Mentioning certifications in a job application letter for a Mortgage Processor can significantly strengthen your candidacy by showcasing your industry knowledge and specialized skills. Certifications such as Certified Mortgage Processor (CMP) or Mortgage Loan Originator (MLO) demonstrate your professionalism and commitment to the field.

Including relevant certifications helps employers quickly assess your qualifications and increases your chances of standing out among other applicants. Highlight these credentials concisely to maintain a clear and focused application letter.

How long should my Mortgage Processor application letter be?

Your Mortgage Processor application letter should be concise, ideally between 250 to 400 words. Focus on relevant experience, skills, and your understanding of mortgage processing to keep the letter impactful. A one-page letter strikes the right balance between detail and readability for hiring managers.

Do I need to address the letter to a specific person?

Addressing a job application letter for a Mortgage Processor to a specific person improves personalization and shows attention to detail. When possible, research the hiring manager's name to make your cover letter more targeted and professional.

- Increased Engagement - Personalized letters typically capture the reader's attention more effectively.

- Shows Initiative - Finding and addressing the letter to the hiring manager reflects your proactive approach.

- Professional Impression - Specific salutations convey respect and seriousness about the role.

If the hiring manager's name is unavailable, use a general but professional greeting such as "Dear Hiring Manager."

Can I use a template for my Mortgage Processor application letter?

Using a template for your Mortgage Processor application letter helps ensure you include all essential information, such as your experience with loan documentation and attention to detail. A well-designed template provides a professional structure, highlighting your skills in mortgage processing and compliance. Customizing the template to reflect your specific qualifications and the job requirements enhances your chances of standing out to lenders or employers.

Should I include my knowledge of mortgage software in the letter?

Should I include my knowledge of mortgage software in a job application letter for a Mortgage Processor?

Yes, highlighting your proficiency with mortgage software is crucial as it demonstrates your technical capability and efficiency in handling loan processing tasks. Employers value candidates familiar with industry-specific tools like Encompass, Calyx, or LoanLogics because it reduces training time and improves workflow.

Is it necessary to reference my previous mortgage experience?

Referencing previous mortgage experience in a job application letter for a Mortgage Processor is highly beneficial. It demonstrates relevant skills and industry knowledge, increasing your chances of being considered.

Employers value candidates with hands-on experience in mortgage processing, as it reduces training time and ensures familiarity with regulatory requirements. Highlighting past roles in mortgage processing showcases your ability to handle loan documentation, compliance, and client communication. Omitting this experience may weaken your application compared to others with direct industry background.