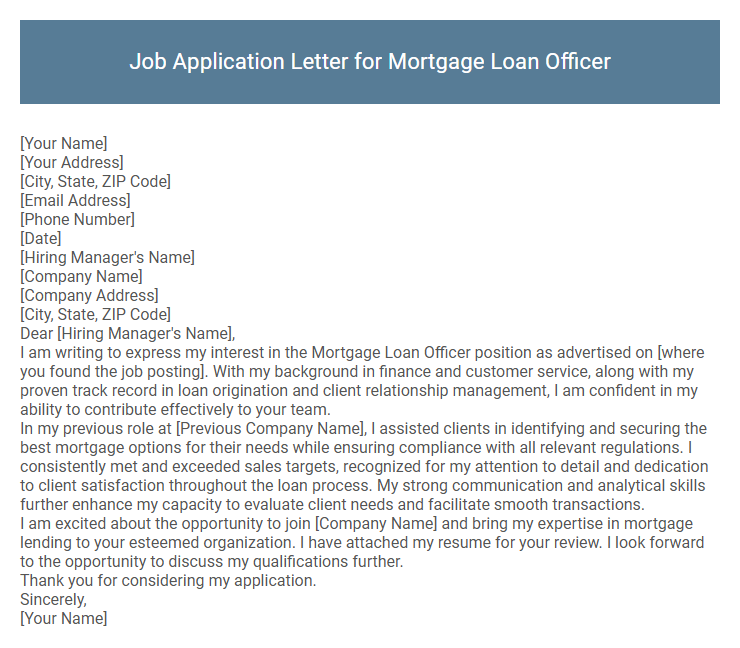

Job Application Letter for Mortgage Loan Officer Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

I am writing to express my interest in the Mortgage Loan Officer position as advertised on [where you found the job posting]. With my background in finance and customer service, along with my proven track record in loan origination and client relationship management, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I assisted clients in identifying and securing the best mortgage options for their needs while ensuring compliance with all relevant regulations. I consistently met and exceeded sales targets, recognized for my attention to detail and dedication to client satisfaction throughout the loan process. My strong communication and analytical skills further enhance my capacity to evaluate client needs and facilitate smooth transactions.

I am excited about the opportunity to join [Company Name] and bring my expertise in mortgage lending to your esteemed organization. I have attached my resume for your review. I look forward to the opportunity to discuss my qualifications further.

Thank you for considering my application.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a mortgage loan officer role highlights your expertise in assessing clients' financial situations and guiding them through loan processes. Emphasize your strong communication skills, attention to detail, and ability to build trust with clients to secure favorable loan terms. Demonstrating knowledge of mortgage regulations and lending criteria ensures you stand out as a qualified candidate ready to contribute effectively.

What should I include in a job application letter for a Mortgage Loan Officer position?

Include a clear introduction stating your interest in the Mortgage Loan Officer position and how your skills align with the company's needs. Highlight relevant experience such as loan processing, client relationship management, and knowledge of mortgage products. Emphasize your strong communication skills, attention to detail, and ability to meet sales targets in the mortgage industry.

How do I highlight my financial and customer service skills in the letter?

Emphasize your expertise in financial analysis and loan processing by detailing your experience with mortgage products, risk assessment, and regulatory compliance. Highlight your ability to explain complex financial information clearly to clients, ensuring informed decision-making throughout the loan process.

Showcase your customer service skills by describing instances where you successfully resolved client concerns and built strong relationships. Mention your proficiency in managing client expectations, maintaining empathy, and delivering personalized service to enhance client satisfaction and trust.

What is the ideal length for a Mortgage Loan Officer application letter?

The ideal length for a Mortgage Loan Officer application letter is one page, concisely presenting key qualifications and experience. This length ensures clarity and keeps the hiring manager engaged without overwhelming them.

- Conciseness - A one-page letter allows focused communication of professional skills and achievements relevant to mortgage lending.

- Readability - Maintaining brevity supports better readability, increasing the chances of the letter being thoroughly reviewed.

- Professionalism - A succinct letter reflects professionalism and respect for the recruiter's time.

Should I mention my mortgage or banking certifications in the letter?

Mentioning your mortgage or banking certifications in a job application letter for a Mortgage Loan Officer position is highly recommended. Certifications demonstrate your expertise, credibility, and commitment to the field, making you a more attractive candidate. Highlight your relevant certifications early in the letter to immediately capture the employer's attention.

How do I address gaps in employment in my application letter?

| Strategy | Description |

|---|---|

| Acknowledge Gaps Briefly | Mention employment gaps concisely without detailed excuses. Focus on skills gained or personal growth during that period. |

| Highlight Relevant Experience | Emphasize qualifications and achievements related to mortgage loan officer responsibilities to shift focus from gaps. |

| Explain Constructively | Provide positive context for gaps, such as pursuing education, certifications, or caregiving, demonstrating responsibility and upskilling. |

| Focus on Skills and Results | Showcase abilities like client communication, loan processing expertise, and attention to detail that are critical for mortgage loans. |

| Maintain Professional Tone | Keep letter optimistic and professional, reinforcing readiness to contribute immediately to the hiring institution. |

What tone should I use in a Mortgage Loan Officer cover letter?

What tone should I use in a Mortgage Loan Officer cover letter? Use a professional and confident tone that highlights your expertise in mortgage lending. Maintain a friendly and approachable attitude to build trust with potential employers.

Is it necessary to personalize the letter for each employer?

Personalizing a Job Application Letter for a Mortgage Loan Officer is essential to demonstrate genuine interest and align qualifications with the employer's specific needs. Tailoring the letter highlights key skills such as loan processing expertise and customer relationship management, matching the company's values and goals. Customized letters increase the likelihood of securing an interview by showing attention to detail and professional commitment.

How do I showcase my sales achievements in mortgage lending?

Highlight specific sales achievements by quantifying your mortgage loan origination volumes and comparing them to company or industry averages. Mention awards or recognitions received for sales performance to demonstrate credibility.

Use concrete numbers such as total loan amounts closed or percentage growth in your client portfolio to provide measurable evidence of your success. Describe strategies you implemented to exceed sales targets, like personalized client consultations or innovative marketing techniques. Emphasize your ability to build long-term client relationships that drive repeat business and referrals.

Should I include references in my job application letter?

Including references in a mortgage loan officer job application letter is generally unnecessary unless specifically requested by the employer. Focus on highlighting your relevant skills and experience, and prepare references to provide later in the hiring process.

- Employer Preferences - Most employers ask for references during the interview or after initial screening rather than in the cover letter.

- Professional Focus - Emphasize your mortgage loan expertise and accomplishments to capture attention immediately.

- Reference Readiness - Keep a list of professional references ready to share upon request to streamline the hiring process.