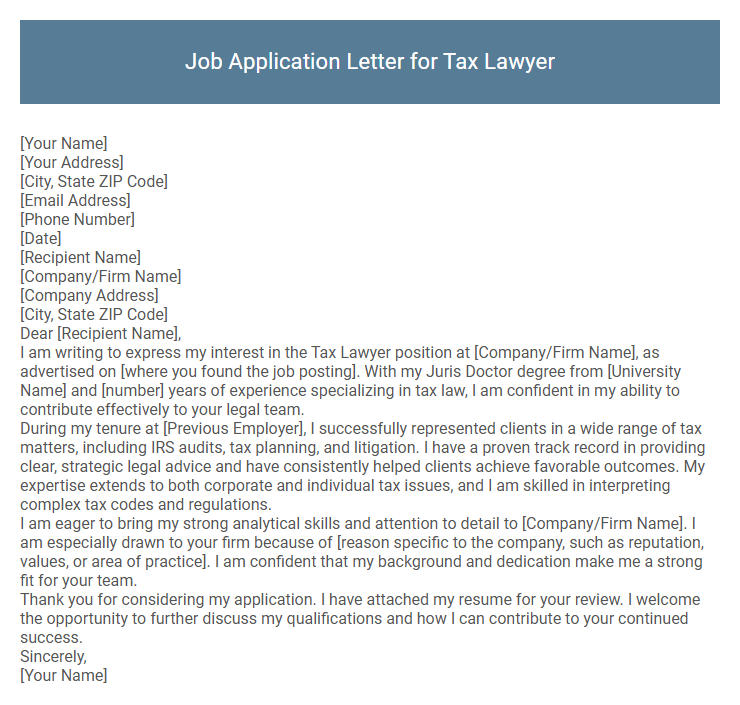

Job Application Letter for Tax Lawyer Sample

[Your Address]

[City, State ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company/Firm Name]

[Company Address]

[City, State ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Tax Lawyer position at [Company/Firm Name], as advertised on [where you found the job posting]. With my Juris Doctor degree from [University Name] and [number] years of experience specializing in tax law, I am confident in my ability to contribute effectively to your legal team.

During my tenure at [Previous Employer], I successfully represented clients in a wide range of tax matters, including IRS audits, tax planning, and litigation. I have a proven track record in providing clear, strategic legal advice and have consistently helped clients achieve favorable outcomes. My expertise extends to both corporate and individual tax issues, and I am skilled in interpreting complex tax codes and regulations.

I am eager to bring my strong analytical skills and attention to detail to [Company/Firm Name]. I am especially drawn to your firm because of [reason specific to the company, such as reputation, values, or area of practice]. I am confident that my background and dedication make me a strong fit for your team.

Thank you for considering my application. I have attached my resume for your review. I welcome the opportunity to further discuss my qualifications and how I can contribute to your continued success.

Sincerely,

[Your Name]

A well-crafted job application letter for a tax lawyer highlights expertise in tax law, compliance, and litigation. Emphasizing experience with complex tax regulations and successful case outcomes demonstrates value to potential employers. Clear communication of legal skills and commitment to client advocacy boosts the chances of securing an interview.

What should I include in a job application letter for a tax lawyer position?

Include a clear introduction stating the tax lawyer position you are applying for and where you found the job listing. Highlight your relevant qualifications, such as experience in tax law, understanding of tax codes, and successful cases or client outcomes. Conclude with a professional closing that expresses enthusiasm for the role and invites further communication.

How do I highlight my tax law experience in the letter?

In your job application letter for a tax lawyer position, emphasize your specialized expertise and successful outcomes in tax law cases. Clearly showcase your in-depth knowledge and practical experience handling complex tax regulations.

- Highlight Relevant Cases - Mention specific tax law cases or projects where you provided effective legal solutions and achieved favorable results for clients.

- Showcase Technical Knowledge - Reference your understanding of tax codes, compliance issues, and recent legislative changes impacting tax law.

- Demonstrate Client Impact - Describe how your legal advice helped clients minimize liabilities, resolve disputes, or optimize tax strategies efficiently.

What format should I use for a tax lawyer job application letter?

Use a formal business letter format for a tax lawyer job application letter, including your contact information, the employer's details, and the date at the top. Begin with a professional salutation, followed by a concise introduction, your qualifications, and relevant experience in tax law. Conclude with a polite closing statement and your signature.

How long should my application letter for a tax lawyer role be?

A job application letter for a tax lawyer role should be concise and focused, ideally between 250 to 400 words. This length allows you to effectively highlight your expertise in tax law without overwhelming the reader.

Employers prefer clear, well-structured letters that emphasize relevant experience, key achievements, and your passion for tax law. Keeping the letter to one page ensures readability and increases the chances of making a strong impression.

Should I mention specific tax cases I have handled?

Mentioning specific tax cases in your job application letter for a tax lawyer position can demonstrate your practical experience and expertise. Highlighting key cases shows your ability to handle complex tax issues effectively.

- Confidentiality - Ensure you do not disclose sensitive client information when discussing cases.

- Relevance - Focus on cases that directly relate to the employer's practice areas or job requirements.

- Achievements - Emphasize successful outcomes or innovative solutions you provided in those cases.

Including well-chosen examples of tax cases can strengthen your application by showcasing your real-world legal skills and knowledge.

How do I address the recipient if I don't know their name?

If you do not know the recipient's name in a job application letter for a tax lawyer position, use a professional and respectful generic greeting such as "Dear Hiring Manager" or "Dear Recruitment Team." Avoid informal salutations to maintain a formal tone.

Start your letter by clearly stating the position you are applying for and briefly introducing your qualifications. Emphasize your expertise in tax law and relevant experience to capture the reader's attention. Conclude by expressing your enthusiasm for the opportunity and your willingness to provide further information.

Can I use the same application letter for different tax law firms?

Can I use the same job application letter for different tax law firms? It is advisable to customize each application letter to reflect the specific values and needs of the individual firm. Tailoring your letter demonstrates genuine interest and a clear understanding of each firm's unique tax law expertise.

Do I need to attach certifications in tax law with my letter?

| Requirement | Attach Certifications in Tax Law |

| Standard Practice | Yes, include relevant tax law certifications to validate expertise |

| Purpose | Demonstrate qualifications and build trust with the employer |

| Types of Certifications | Certified Tax Law Specialist, CPA with tax emphasis, relevant continuing education |

| Presentation Tips | Include copies or mention certifications explicitly in the letter and attach scans |

How do I show familiarity with relevant tax codes in my letter?

Demonstrate familiarity with relevant tax codes by referencing specific sections or recent amendments within your letter. Highlight your experience applying these codes in practical scenarios to showcase your expertise.

Include examples of how you advised clients or resolved issues based on intricate tax regulations. This approach signals a thorough understanding of tax law critical to the role.