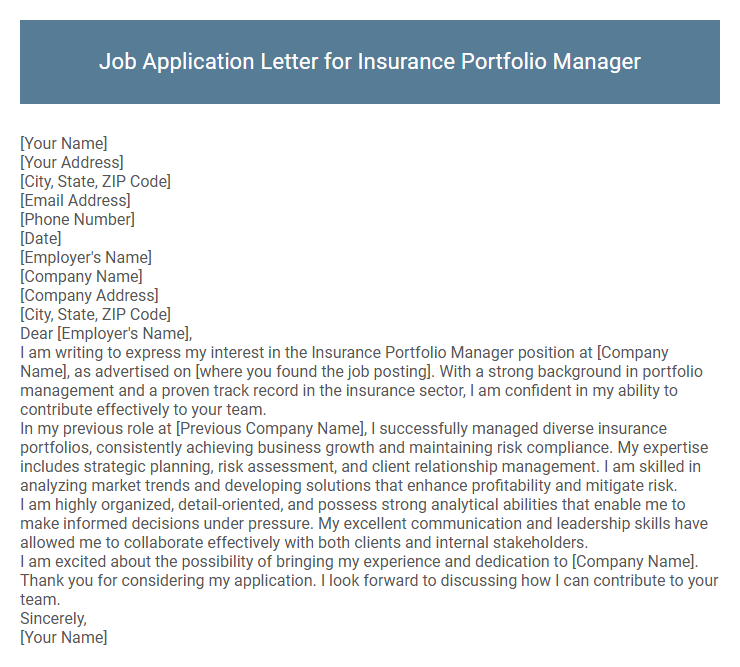

Job Application Letter for Insurance Portfolio Manager Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Employer's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Employer's Name],

I am writing to express my interest in the Insurance Portfolio Manager position at [Company Name], as advertised on [where you found the job posting]. With a strong background in portfolio management and a proven track record in the insurance sector, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company Name], I successfully managed diverse insurance portfolios, consistently achieving business growth and maintaining risk compliance. My expertise includes strategic planning, risk assessment, and client relationship management. I am skilled in analyzing market trends and developing solutions that enhance profitability and mitigate risk.

I am highly organized, detail-oriented, and possess strong analytical abilities that enable me to make informed decisions under pressure. My excellent communication and leadership skills have allowed me to collaborate effectively with both clients and internal stakeholders.

I am excited about the possibility of bringing my experience and dedication to [Company Name]. Thank you for considering my application. I look forward to discussing how I can contribute to your team.

Sincerely,

[Your Name]

Crafting a compelling job application letter for an Insurance Portfolio Manager position requires highlighting proven expertise in risk assessment, client management, and strategic portfolio growth. Emphasizing strong analytical skills and a thorough understanding of insurance markets can demonstrate your ability to optimize investment returns while mitigating risks. Showcasing relevant accomplishments and tailored qualifications ensures your application stands out to potential employers in the competitive insurance industry.

What key skills should I highlight in my Insurance Portfolio Manager job application letter?

Highlight your expertise in risk assessment and portfolio diversification to demonstrate your ability to optimize insurance assets effectively. Emphasize strong analytical skills and proficiency in financial modeling to support data-driven decision-making. Showcase leadership experience in managing cross-functional teams and maintaining client relationships to drive portfolio growth.

How do I begin a cover letter for an Insurance Portfolio Manager role?

Begin your cover letter for an Insurance Portfolio Manager role by introducing your professional background and highlighting key achievements relevant to portfolio management. Express enthusiasm for the opportunity and the company to create an immediate connection.

- Professional Introduction - State your current role and years of experience managing insurance portfolios to establish credibility.

- Key Achievements - Mention specific results like portfolio growth, risk reduction, or client retention rates to demonstrate impact.

- Enthusiasm for Company - Reference the company's values or market position to show alignment and genuine interest.

End the introduction with a clear statement of your intent to contribute to the company's success through your expertise in insurance portfolio management.

What industry certifications should I mention in my application letter?

Mentioning relevant industry certifications in your job application letter for an Insurance Portfolio Manager role demonstrates your expertise and commitment to the field. Highlighting these certifications increases your credibility and aligns your qualifications with industry standards.

- Chartered Property Casualty Underwriter (CPCU) - This certification showcases deep knowledge in risk management, insurance operations, and portfolio analysis.

- Certified Insurance Counselor (CIC) - Validates proficiency in strategic insurance management, underwriting, and claims handling.

- Financial Risk Manager (FRM) - Emphasizes expertise in risk assessment, financial analysis, and portfolio risk mitigation strategies.

Is it important to discuss experience with risk assessment in my letter?

Discussing experience with risk assessment in your job application letter for an Insurance Portfolio Manager position is important. Risk assessment skills demonstrate your ability to evaluate and mitigate potential losses, which is critical in managing insurance portfolios effectively. Highlighting this experience can showcase your qualifications and align your expertise with the job requirements.

How should I demonstrate my portfolio performance history in the letter?

Highlight key metrics such as portfolio growth percentage, risk-adjusted returns, and client retention rates to demonstrate your success as an Insurance Portfolio Manager. Use specific examples of profitable strategies and measurable achievements to make your case compelling.

Quantify your portfolio performance with clear figures like annualized returns or loss ratios improved under your management. Mention any awards, recognitions, or certifications that validate your expertise. Emphasize how your portfolio management directly contributed to business growth or client satisfaction.

Should I include knowledge of compliance and regulatory standards?

Including knowledge of compliance and regulatory standards in a job application letter for an Insurance Portfolio Manager is essential. It demonstrates your ability to manage portfolios while adhering to legal and industry requirements, ensuring risk mitigation. Highlighting this expertise can set you apart as a responsible and knowledgeable candidate.

What achievements are best to showcase for this position?

| Achievement | Description |

|---|---|

| Portfolio Growth | Demonstrated ability to increase insurance portfolio value by identifying profitable sectors and optimizing risk exposure. |

| Risk Management | Implemented advanced risk assessment models that reduced claim ratios and enhanced portfolio stability. |

| Client Retention | Achieved high client retention rates through personalized insurance solutions and exceptional service delivery. |

| Regulatory Compliance | Ensured 100% compliance with insurance regulatory requirements, minimizing legal risks and penalties. |

| Team Leadership | Led a team of insurance specialists to exceed sales targets and improve underwriting efficiency. |

How long should my job application letter be?

Your job application letter for an Insurance Portfolio Manager should be concise and focused, ideally between 250 to 400 words. Aim for one page that highlights your relevant experience, skills, and achievements efficiently. Keeping it brief ensures hiring managers quickly grasp your qualifications without losing interest.

Do I need to customize the letter for each insurance company?

Customizing a job application letter for each insurance company is essential to highlight your understanding of their specific portfolio management needs. Tailoring your skills and experiences to match the company's values and requirements increases your chances of standing out.

Generic letters may appear impersonal and reduce your likelihood of securing an interview. Demonstrating knowledge of the company's products, market position, and challenges shows genuine interest and professionalism.