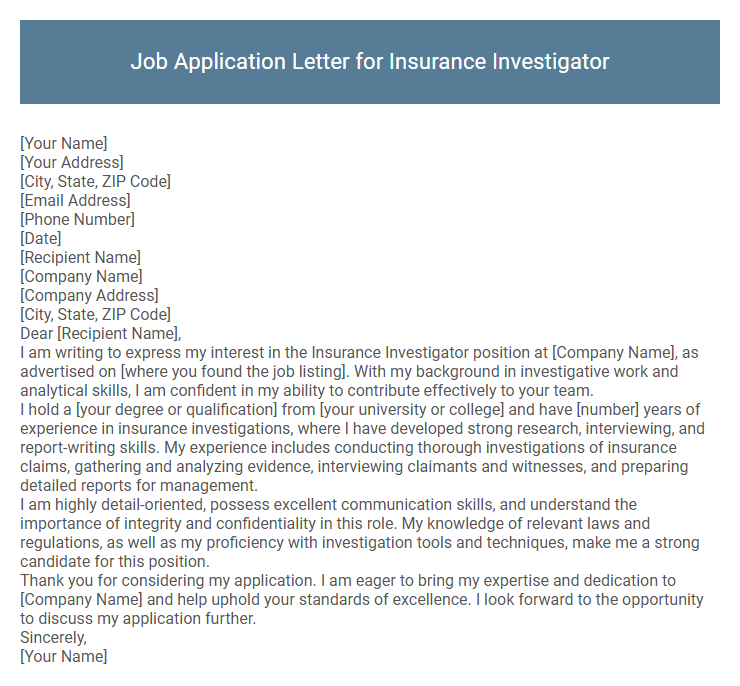

Job Application Letter for Insurance Investigator Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient Name],

I am writing to express my interest in the Insurance Investigator position at [Company Name], as advertised on [where you found the job listing]. With my background in investigative work and analytical skills, I am confident in my ability to contribute effectively to your team.

I hold a [your degree or qualification] from [your university or college] and have [number] years of experience in insurance investigations, where I have developed strong research, interviewing, and report-writing skills. My experience includes conducting thorough investigations of insurance claims, gathering and analyzing evidence, interviewing claimants and witnesses, and preparing detailed reports for management.

I am highly detail-oriented, possess excellent communication skills, and understand the importance of integrity and confidentiality in this role. My knowledge of relevant laws and regulations, as well as my proficiency with investigation tools and techniques, make me a strong candidate for this position.

Thank you for considering my application. I am eager to bring my expertise and dedication to [Company Name] and help uphold your standards of excellence. I look forward to the opportunity to discuss my application further.

Sincerely,

[Your Name]

A job application letter for an Insurance Investigator highlights relevant investigative skills, attention to detail, and experience in fraud detection within the insurance industry. Emphasizing strong analytical abilities and a thorough understanding of insurance policies can demonstrate suitability for the role. Showcasing a commitment to integrity and confidentiality helps convey professionalism essential to conducting effective investigations.

What key skills should I highlight in my insurance investigator job application letter?

Highlight strong analytical skills to evaluate claims and detect fraudulent activities accurately. Emphasize attention to detail and thorough investigative abilities to gather evidence effectively. Showcase excellent communication skills for interviewing witnesses and collaborating with legal teams.

How do I format a job application letter for an insurance investigator role?

| Section | Details |

|---|---|

| Header | Include your full name, address, phone number, and email at the top-left or centered. |

| Employer's Information | List the hiring manager's name, title, company name, and company address below your header, aligned left. |

| Salutation | Use formal greetings such as "Dear Hiring Manager" or "Dear [Manager's Name]." |

| Body |

Paragraph 1: State the position applying for and where you found the job posting. Paragraph 2: Highlight relevant skills like investigative experience, attention to detail, knowledge of insurance policies, and analytical abilities. Paragraph 3: Demonstrate your understanding of the role's importance in fraud detection and claim validation. Paragraph 4: Express enthusiasm and mention availability for an interview. |

| Closing | Use formal closings such as "Sincerely" followed by your full name. Include a signature if submitting a hard copy. |

What should the opening paragraph of my application letter include?

The opening paragraph of a job application letter for an Insurance Investigator should capture the employer's attention by clearly stating the position being applied for and expressing genuine interest. It should also briefly highlight relevant skills or experience that make the candidate a strong fit for the role.

- Position Identification - Clearly mention the specific Insurance Investigator role to ensure alignment with the job opening.

- Expression of Interest - Demonstrate enthusiasm and motivation for applying to the company and role.

- Relevant Experience Highlight - Provide a concise overview of key skills or previous investigative experience related to insurance claims.

How can I demonstrate experience in claims assessment in my letter?

Highlight specific instances where you analyzed insurance claims to identify inconsistencies or fraudulent activities, showcasing your attention to detail and analytical skills. Mention any tools or software you used to evaluate claim validity, reinforcing your technical expertise.

Describe successful outcomes resulting from your assessments, such as cost savings or improved claim processing accuracy. Emphasize collaboration with claims adjusters and law enforcement to demonstrate your comprehensive approach to investigations.

Should I mention certifications in my insurance investigator cover letter?

Mentioning certifications in your insurance investigator cover letter can strengthen your qualifications. Highlighting relevant credentials demonstrates your expertise and commitment to industry standards.

- Credibility - Certifications validate your specialized knowledge and skills in insurance investigation.

- Differentiation - Including certifications helps distinguish you from other applicants by showcasing professional development.

- Relevance - Mentioning certifications linked to fraud detection or risk assessment aligns your abilities with job requirements.

Including certifications strategically enhances your insurance investigator cover letter's impact and appeal to employers.

Is it important to personalize my letter for each insurance company?

Personalizing your job application letter for each insurance company is crucial. It demonstrates your genuine interest and understanding of the company's values and specific needs. Tailored letters increase your chances of standing out and securing an interview.

How long should my insurance investigator application letter be?

Your insurance investigator application letter should be concise, ideally between 250 to 400 words. This length allows you to clearly highlight your relevant skills and experience without overwhelming the reader.

Focus on key qualifications, such as attention to detail and analytical skills, while keeping the letter to one page. Recruiters prefer brief, well-structured letters that emphasize your suitability for the role efficiently.

What achievements should I include in my job application letter?

Include achievements such as successfully identifying and preventing fraudulent claims, which resulted in significant cost savings for previous employers. Highlight your expertise in conducting thorough investigations leading to accurate and timely case resolutions. Emphasize recognition or awards received for exceptional attention to detail and investigative skills in the insurance sector.

Do I need to include references in my application letter?

Do I need to include references in my job application letter for an Insurance Investigator position? References are typically not required in the initial application letter but may be requested later during the hiring process. It is advisable to mention that references are available upon request to demonstrate preparedness and professionalism.