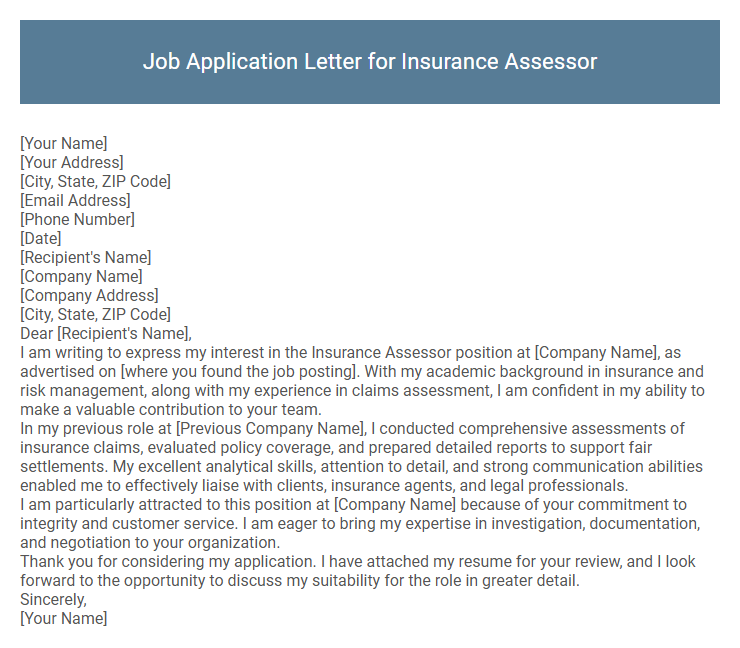

Job Application Letter for Insurance Assessor Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Insurance Assessor position at [Company Name], as advertised on [where you found the job posting]. With my academic background in insurance and risk management, along with my experience in claims assessment, I am confident in my ability to make a valuable contribution to your team.

In my previous role at [Previous Company Name], I conducted comprehensive assessments of insurance claims, evaluated policy coverage, and prepared detailed reports to support fair settlements. My excellent analytical skills, attention to detail, and strong communication abilities enabled me to effectively liaise with clients, insurance agents, and legal professionals.

I am particularly attracted to this position at [Company Name] because of your commitment to integrity and customer service. I am eager to bring my expertise in investigation, documentation, and negotiation to your organization.

Thank you for considering my application. I have attached my resume for your review, and I look forward to the opportunity to discuss my suitability for the role in greater detail.

Sincerely,

[Your Name]

Crafting an effective job application letter for an insurance assessor position requires highlighting relevant skills such as attention to detail, analytical ability, and knowledge of insurance policies. Emphasizing experience in evaluating claims and conducting thorough investigations can showcase suitability for the role. Clear communication of professionalism and commitment to accuracy enhances the overall appeal to potential employers.

What key skills should I highlight in my insurance assessor job application letter?

Highlight analytical skills to accurately evaluate insurance claims and assess risk. Emphasize strong communication abilities for effectively liaising with clients, insurers, and other stakeholders. Showcase attention to detail and proficiency in relevant software tools to ensure precise documentation and reporting.

How do I structure a cover letter for an insurance assessor position?

Structuring a cover letter for an insurance assessor position involves clear presentation of qualifications and relevant experience. The letter should highlight your analytical skills, attention to detail, and understanding of insurance policies.

- Introduction - Start with a strong opening that states the position you are applying for and a brief introduction of your professional background.

- Body - Detail your experience in insurance assessment, including specific skills such as risk evaluation, claim analysis, and report preparation.

- Conclusion - Express enthusiasm for the role, mention your willingness to discuss further, and provide contact information.

This structured approach ensures clarity and focus, increasing your chances of securing an interview.

What qualifications are required for an insurance assessor application letter?

An insurance assessor application letter should highlight qualifications such as a degree in finance, insurance, or a related field. Professional certifications like Chartered Insurance Institute (CII) diplomas or similar credentials are highly valued. Strong analytical skills, attention to detail, and experience in claims assessment must be emphasized to align with the job requirements.

Should I mention specific insurance fields (life, auto, property) in my letter?

Including specific insurance fields such as life, auto, or property in your job application letter can demonstrate targeted expertise and relevance to the employer. Highlighting your experience in particular insurance domains helps align your skills with the job requirements.

Tailor your mention of insurance fields based on the job description to maximize impact. Emphasizing relevant fields shows your understanding of the industry and positions you as a specialized candidate.

How long should my insurance assessor job application letter be?

An insurance assessor job application letter should be concise, ideally between 200 to 300 words. This length allows you to highlight relevant qualifications, experience, and enthusiasm without overwhelming the reader. Keeping it brief ensures the hiring manager can quickly grasp your suitability for the role.

Do I need to include references in my application letter?

Including references in a job application letter for an Insurance Assessor is generally unnecessary unless specifically requested by the employer. Focus on highlighting relevant skills and experiences in the letter instead.

- References Inclusion - Most insurance companies prefer references during the interview or later stages, not in the initial application letter.

- Application Focus - Emphasize assessment expertise, risk evaluation skills, and industry knowledge in the letter.

- Employer Instructions - Always follow the job posting instructions regarding references to ensure compliance with application requirements.

How do I show analytical skills in my cover letter?

Highlight specific examples of identifying patterns and evaluating risks in previous roles to demonstrate analytical skills. Emphasize your ability to interpret data accurately and make informed decisions based on evidence.

Describe situations where you assessed claims or analyzed complex information to deliver precise outcomes. Showcase attention to detail and critical thinking applied to problem-solving in the insurance field.

What achievements are relevant to include as an insurance assessor?

Highlighting achievements in accuracy and efficiency showcases your value as an insurance assessor. Relevant accomplishments reflect your ability to evaluate claims thoroughly and reduce error rates.

Demonstrating successful collaboration with claimants and insurers emphasizes your communication skills and conflict resolution expertise.

- High Claim Accuracy Rate - Consistently maintained a 98% accuracy rate in claim assessments, minimizing errors and fraudulent claims.

- Efficient Claims Processing - Reduced average claims processing time by 20%, improving customer satisfaction and operational efficiency.

- Successful Dispute Resolutions - Resolved over 150 claim disputes through effective negotiation and clear communication, enhancing client trust.

How formal should the language be in my job application letter?

The language in a job application letter for an Insurance Assessor should be formal and professional, reflecting the seriousness of the role. Use clear, concise sentences with industry-specific terminology to demonstrate your expertise and attention to detail. Avoid slang or overly casual expressions to maintain a respectful tone throughout the letter.