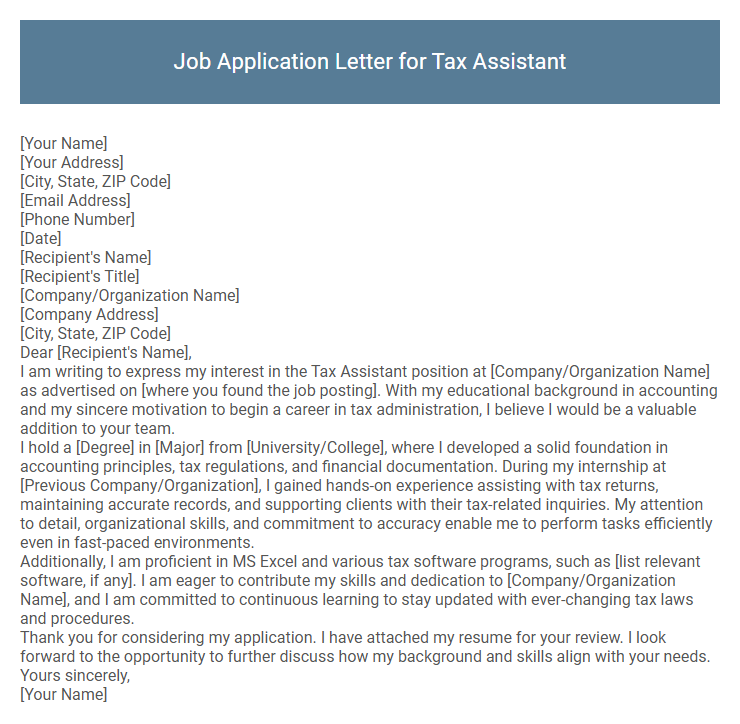

Job Application Letter for Tax Assistant Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company/Organization Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Tax Assistant position at [Company/Organization Name] as advertised on [where you found the job posting]. With my educational background in accounting and my sincere motivation to begin a career in tax administration, I believe I would be a valuable addition to your team.

I hold a [Degree] in [Major] from [University/College], where I developed a solid foundation in accounting principles, tax regulations, and financial documentation. During my internship at [Previous Company/Organization], I gained hands-on experience assisting with tax returns, maintaining accurate records, and supporting clients with their tax-related inquiries. My attention to detail, organizational skills, and commitment to accuracy enable me to perform tasks efficiently even in fast-paced environments.

Additionally, I am proficient in MS Excel and various tax software programs, such as [list relevant software, if any]. I am eager to contribute my skills and dedication to [Company/Organization Name], and I am committed to continuous learning to stay updated with ever-changing tax laws and procedures.

Thank you for considering my application. I have attached my resume for your review. I look forward to the opportunity to further discuss how my background and skills align with your needs.

Yours sincerely,

[Your Name]

Crafting a persuasive job application letter for a Tax Assistant position requires highlighting expertise in tax regulations, attention to detail, and proficiency in accounting software. Emphasizing experience in preparing tax returns, conducting audits, and ensuring compliance can demonstrate suitability for the role. Clear communication and a strong organizational skill set are essential to convey professionalism and reliability to potential employers.

What should I include in a Tax Assistant job application letter?

Include your relevant educational background and any certifications related to accounting or taxation in the Tax Assistant job application letter. Highlight practical experience in tax preparation, data analysis, or financial reporting to demonstrate your suitability for the role. Emphasize your attention to detail, ability to work with tax software, and commitment to accuracy and compliance with tax regulations.

How do I highlight my tax-related skills in the letter?

Highlight your tax-related skills by detailing specific experiences with tax preparation, compliance, and software tools. Emphasize measurable achievements and your knowledge of tax laws to demonstrate expertise.

- Specify Tax Software Proficiency - Mention your experience with popular tax software like QuickBooks, TurboTax, or proprietary systems to show technical competence.

- Detail Compliance Knowledge - Describe your understanding of tax regulations, deadlines, and filing requirements to highlight your regulatory expertise.

- Quantify Achievements - Include metrics such as error reduction rates or successful audits to provide evidence of your effectiveness in tax roles.

What format is best for a Tax Assistant cover letter?

The best format for a Tax Assistant cover letter is a professional business letter layout, including a header with contact details, a formal greeting, and concise paragraphs. Focus on clear, structured content highlighting relevant tax knowledge, analytical skills, and experience with tax software. Use bullet points sparingly to emphasize key qualifications, maintaining a clean and easy-to-read format.

How long should my application letter be?

How long should my job application letter for a Tax Assistant position be?

Your application letter should ideally be one page, consisting of 3 to 4 concise paragraphs. This length allows you to highlight relevant skills and experience without overwhelming the reader.

Should I mention specific tax software proficiency?

Including specific tax software proficiency in a Job Application Letter for Tax Assistant demonstrates technical skills relevant to the position. Mentioning software like QuickBooks, TurboTax, or Sage enhances your candidacy by showcasing practical experience.

Employers value familiarity with tax software as it improves efficiency and accuracy in tax preparation. Highlighting this proficiency aligns your qualifications with job requirements, increasing your chances of securing an interview.

Is it important to address the letter to a specific person?

Addressing a job application letter for a Tax Assistant position to a specific person demonstrates professionalism and attention to detail. It shows that the applicant has researched the company, which can create a positive first impression. Personalizing the letter increases the chance of it being read thoroughly by the hiring manager or relevant authority.

How do I emphasize my attention to detail?

In my previous roles, I consistently demonstrated meticulous attention to detail by accurately reviewing financial documents and ensuring compliance with all tax regulations. I meticulously cross-check data entries to prevent errors and maintain the integrity of tax records. This careful approach guarantees precise and reliable tax support, essential for the role of Tax Assistant.

Can I include non-tax accounting experience?

Including non-tax accounting experience in a job application letter for a Tax Assistant position can strengthen your candidacy. This experience showcases your overall financial knowledge and attention to detail.

Highlight relevant skills such as bookkeeping, financial reporting, and data analysis to demonstrate your competence in handling accounting tasks. Emphasize your adaptability and willingness to learn tax-specific regulations. Tailor your letter to connect these skills with the requirements of the Tax Assistant role.

Should I mention certifications like CPA or EA?

When applying for a Tax Assistant position, mentioning certifications such as CPA (Certified Public Accountant) or EA (Enrolled Agent) can significantly enhance your credibility. These certifications demonstrate specialized knowledge and a strong commitment to the tax profession.

If you hold relevant certifications, highlight them early in your job application letter to capture the employer's attention. Including certifications aligned with tax preparation and compliance shows your expertise and readiness for the role.