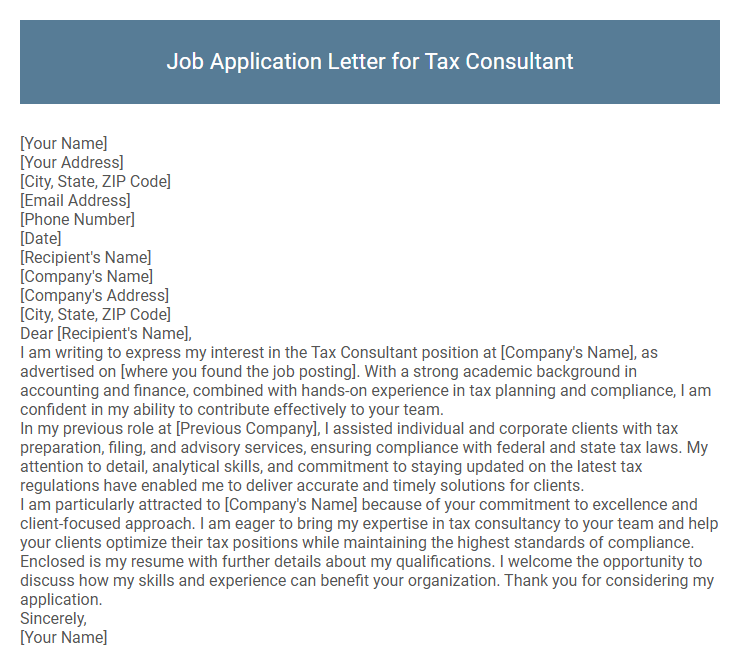

Job Application Letter for Tax Consultant Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Company's Name]

[Company's Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Tax Consultant position at [Company's Name], as advertised on [where you found the job posting]. With a strong academic background in accounting and finance, combined with hands-on experience in tax planning and compliance, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I assisted individual and corporate clients with tax preparation, filing, and advisory services, ensuring compliance with federal and state tax laws. My attention to detail, analytical skills, and commitment to staying updated on the latest tax regulations have enabled me to deliver accurate and timely solutions for clients.

I am particularly attracted to [Company's Name] because of your commitment to excellence and client-focused approach. I am eager to bring my expertise in tax consultancy to your team and help your clients optimize their tax positions while maintaining the highest standards of compliance.

Enclosed is my resume with further details about my qualifications. I welcome the opportunity to discuss how my skills and experience can benefit your organization. Thank you for considering my application.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a tax consultant position highlights your expertise in tax regulations, compliance, and financial analysis. Emphasizing your experience in navigating complex tax codes and providing strategic advice showcases your value to potential employers. Demonstrating strong communication skills and attention to detail ensures your application stands out in the competitive finance sector.

What should I include in a job application letter for a tax consultant position?

Include a clear introduction stating the position you are applying for and a brief summary of your qualifications in tax consulting. Highlight relevant experience, skills such as tax law expertise, financial analysis, and client advisory capabilities. Conclude with a strong statement expressing your enthusiasm for the role and your eagerness to contribute to the company's success.

How do I highlight my tax expertise in a cover letter?

Emphasize your specialized knowledge in tax laws, regulations, and compliance by citing specific examples of successfully managing complex tax cases or implementing tax-saving strategies for clients. Highlight certifications such as CPA or CTA to demonstrate your professional qualifications and commitment to staying updated in the field.

Showcase measurable achievements like reducing tax liabilities, improving audit outcomes, or advising on tax planning that led to significant financial benefits. Mention your analytical skills and ability to interpret tax codes to provide practical solutions tailored to client needs.

Should I mention specific tax software skills?

Mentioning specific tax software skills in a job application letter for a Tax Consultant can enhance your candidacy. Highlighting proficiency in industry-standard software demonstrates your practical expertise and adaptability.

- Relevance to the role - Include tax software skills that align directly with the job description to show your suitability for the position.

- Demonstrates technical competence - Listing software like QuickBooks, TurboTax, or SAP Tax Solutions reflects your ability to efficiently manage tax processes.

- Sets you apart - Specific software knowledge distinguishes you from other candidates by showcasing specialized expertise.

How do I address my letter if the hiring manager's name is unknown?

When the hiring manager's name is unknown, use a professional and respectful greeting to start your job application letter for a Tax Consultant position.

- Use "Dear Hiring Manager" - This is a widely accepted and formal way to address the letter without a specific name.

- Consider "Dear Recruitment Team" - This shows respect for the entire hiring group and is appropriate for companies with multiple recruiters.

- Avoid generic greetings like "To Whom It May Concern" - These can seem outdated and impersonal, reducing the impact of your application.

Choose a clear and direct salutation to maintain professionalism and set a positive tone for your Tax Consultant job application.

What format should I use for a tax consultant job application letter?

Use a professional business letter format for a tax consultant job application letter, including your contact information, the employer's details, date, and a formal greeting. Structure the content into an introduction stating the position applied for, a body highlighting relevant tax expertise and experience, and a conclusion expressing enthusiasm and a call to action. Maintain clear, concise paragraphs with a polite closing and your signature.

How long should my application letter for a tax consultant be?

| Aspect | Recommendation |

|---|---|

| Optimal Length | One page, approximately 300-400 words |

| Content Focus | Concise summary of qualifications, relevant experience, and skills |

| Clarity | Clear and direct language tailored to the tax consultancy role |

| Formatting | Professional structure with introduction, body, and conclusion |

| Purpose | Showcase expertise in tax regulations, client advisory, and problem-solving |

Should I include certifications like CPA in my letter?

Including certifications like CPA in your job application letter for a Tax Consultant position significantly enhances your credibility and showcases your professional qualifications. Highlighting such certifications demonstrates your expertise and commitment to industry standards, making you a stronger candidate. Clearly mentioning your CPA certification can differentiate you from other applicants and increase your chances of securing the role.

What achievements are relevant for a tax consultant application letter?

Highlighting relevant achievements in a job application letter for a tax consultant emphasizes expertise in tax law, successful client outcomes, and process improvements. Showcasing measurable results and professional certifications strengthens the candidate's credibility.

- Implemented Tax Saving Strategies - Developed and executed tax planning strategies that reduced client tax liabilities by up to 20% annually.

- Certified Public Accountant (CPA) Credential - Achieved CPA certification, demonstrating advanced knowledge and commitment to the tax consulting profession.

- Client Compliance Success - Ensured 100% client compliance with evolving tax regulations, avoiding penalties and audits.

Is it necessary to tailor my letter for each job application?

Tailoring your job application letter for each Tax Consultant position significantly increases your chances of success. Customizing highlights your relevant skills and experiences that match the specific job requirements and company values. A generic letter often fails to demonstrate genuine interest or understanding of the employer's needs.