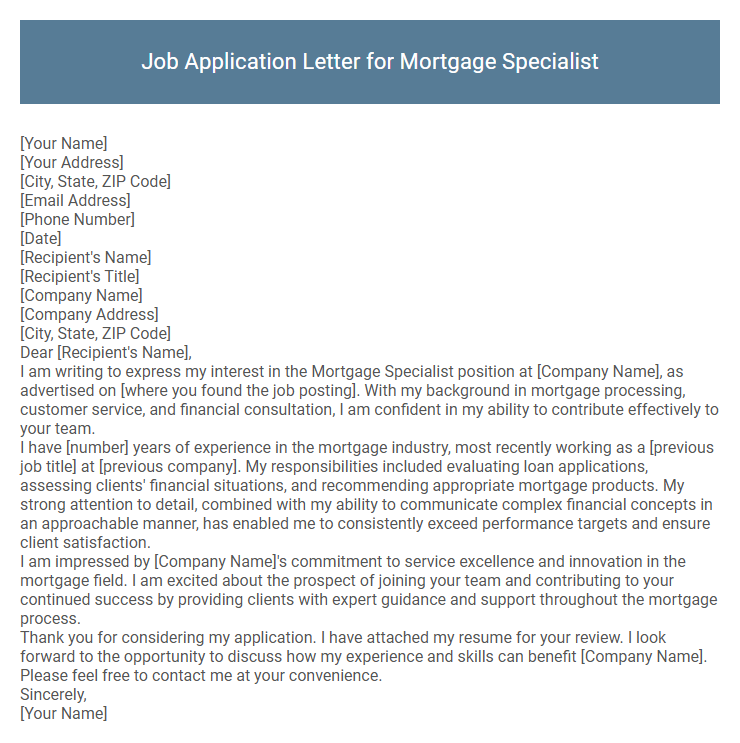

Job Application Letter for Mortgage Specialist Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Mortgage Specialist position at [Company Name], as advertised on [where you found the job posting]. With my background in mortgage processing, customer service, and financial consultation, I am confident in my ability to contribute effectively to your team.

I have [number] years of experience in the mortgage industry, most recently working as a [previous job title] at [previous company]. My responsibilities included evaluating loan applications, assessing clients' financial situations, and recommending appropriate mortgage products. My strong attention to detail, combined with my ability to communicate complex financial concepts in an approachable manner, has enabled me to consistently exceed performance targets and ensure client satisfaction.

I am impressed by [Company Name]'s commitment to service excellence and innovation in the mortgage field. I am excited about the prospect of joining your team and contributing to your continued success by providing clients with expert guidance and support throughout the mortgage process.

Thank you for considering my application. I have attached my resume for your review. I look forward to the opportunity to discuss how my experience and skills can benefit [Company Name]. Please feel free to contact me at your convenience.

Sincerely,

[Your Name]

Crafting a compelling job application letter for a Mortgage Specialist position requires highlighting expertise in loan processing, risk assessment, and client relationship management. Emphasizing strong communication skills and a thorough understanding of mortgage products can set candidates apart in a competitive market. Demonstrating a track record of efficiently guiding clients through the mortgage approval process ensures trust and reliability with potential employers.

What key skills should I highlight in my job application letter for a Mortgage Specialist position?

Highlight your expertise in mortgage loan processing, underwriting, and compliance with financial regulations. Emphasize strong analytical skills and attention to detail to accurately assess clients' financial situations and recommend suitable mortgage products. Showcase excellent communication and customer service abilities to build trust and guide clients through the mortgage application process efficiently.

How do I properly address the hiring manager in my application letter?

| Step | Description |

|---|---|

| Research the Name | Find the hiring manager's full name via company website, LinkedIn, or job posting. |

| Use Formal Titles | Address the manager as Mr., Ms., or Dr., followed by their last name. |

| Generic Address if Unknown | Use "Dear Hiring Manager" or "Dear Mortgage Specialist Recruitment Team." |

| Avoid Informal Greetings | Do not use "To whom it may concern" or casual greetings in professional letters. |

| Personalize for Impact | Including the name shows attention to detail and genuine interest in the position. |

Should I include my licensing or certifications in the letter?

Including your licensing or certifications in a job application letter for a Mortgage Specialist position is essential. These credentials demonstrate your qualifications and reliability to potential employers.

- Enhances Credibility - Licensing and certifications prove your expertise and compliance with industry standards.

- Meets Job Requirements - Many mortgage roles require specific licenses, making this information critical for eligibility.

- Sets You Apart - Highlighting certifications showcases your commitment to professional development and expertise.

Clearly stating your licensing and certifications in the job application letter increases your chances of securing an interview for the Mortgage Specialist role.

How long should my job application letter be for a Mortgage Specialist role?

The job application letter for a Mortgage Specialist role should be concise, ideally between 250 to 300 words. Focus on highlighting relevant experience, key skills in mortgage lending, and customer service expertise. Keep the letter clear and to the point to maintain the hiring manager's attention.

What work experience is most relevant to mention in my letter?

Highlight experience in financial analysis, customer service, and mortgage loan processing to demonstrate industry expertise. Mention familiarity with credit assessment, loan underwriting, and regulatory compliance to showcase technical skills. Emphasize success in managing client relationships and achieving loan approval targets to reflect strong interpersonal and sales abilities.

How do I showcase my customer service skills in the application letter?

Highlight your ability to understand client needs and provide tailored mortgage solutions. Emphasize your experience in handling inquiries and resolving issues efficiently to enhance customer satisfaction.

- Empathy - Describe how you listen actively to clients to fully grasp their financial situations and preferences.

- Clear Communication - Showcase your skill in explaining complex mortgage terms in simple language to ensure clients feel informed and confident.

- Problem-Solving - Illustrate your track record of addressing customer concerns promptly and finding effective solutions to maintain trust.

Is it important to reference knowledge of current mortgage products or regulations?

Referencing knowledge of current mortgage products and regulations is crucial in a job application letter for a Mortgage Specialist position. It demonstrates the applicant's expertise and readiness to navigate complex financial scenarios effectively.

Employers value candidates who stay updated on industry trends and compliance requirements, as this reduces risk and enhances client trust. Highlighting this knowledge can set the candidate apart from others by showcasing practical skills and regulatory awareness.

Can I use bullet points to list qualifications in my application letter?

Using bullet points in a job application letter for a Mortgage Specialist can effectively highlight key qualifications and skills. Bullet points improve readability and allow recruiters to quickly identify your relevant experience. Ensure each point is concise and directly related to the job requirements for maximum impact.

Should I mention my sales achievements or quotas reached in previous positions?

Should I mention my sales achievements or quotas reached in previous positions when applying for a Mortgage Specialist role? Including specific sales achievements and quotas demonstrates your proven ability to meet targets and can significantly strengthen your application by showcasing relevant expertise and results in mortgage sales or financial services.