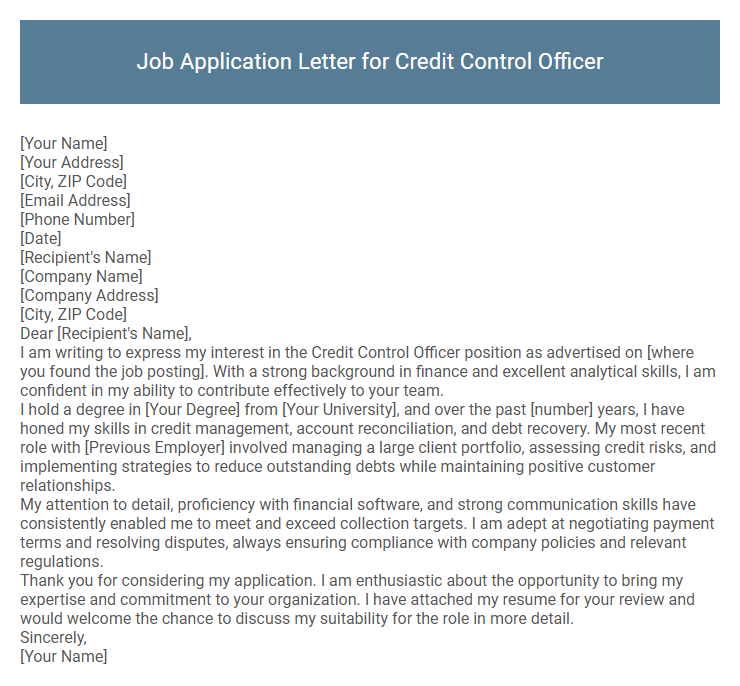

Job Application Letter for Credit Control Officer Sample

[Your Address]

[City, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Company Name]

[Company Address]

[City, ZIP Code]

Dear [Recipient's Name],

I am writing to express my interest in the Credit Control Officer position as advertised on [where you found the job posting]. With a strong background in finance and excellent analytical skills, I am confident in my ability to contribute effectively to your team.

I hold a degree in [Your Degree] from [Your University], and over the past [number] years, I have honed my skills in credit management, account reconciliation, and debt recovery. My most recent role with [Previous Employer] involved managing a large client portfolio, assessing credit risks, and implementing strategies to reduce outstanding debts while maintaining positive customer relationships.

My attention to detail, proficiency with financial software, and strong communication skills have consistently enabled me to meet and exceed collection targets. I am adept at negotiating payment terms and resolving disputes, always ensuring compliance with company policies and relevant regulations.

Thank you for considering my application. I am enthusiastic about the opportunity to bring my expertise and commitment to your organization. I have attached my resume for your review and would welcome the chance to discuss my suitability for the role in more detail.

Sincerely,

[Your Name]

A job application letter for a Credit Control Officer highlights your expertise in managing accounts receivable, monitoring outstanding debts, and ensuring timely payments to maintain optimal cash flow. Emphasize your strong analytical skills, attention to detail, and ability to foster positive client relationships that contribute to reducing credit risk. Demonstrate your proficiency in using financial software and your commitment to enforcing credit policies effectively.

What should I include in a Credit Control Officer job application letter?

Include a strong opening that states the position you are applying for and your enthusiasm for the role. Highlight key skills such as accounts receivable management, debt collection, and financial reporting. Emphasize your ability to maintain accurate records, communicate effectively with clients, and reduce overdue balances to improve cash flow.

How do I highlight my credit management experience in the letter?

Highlight your credit management experience by detailing specific responsibilities such as monitoring credit limits, assessing credit risk, and managing debt recovery processes. Emphasize your use of credit analysis tools and timely reporting to maintain healthy cash flow and minimize bad debts.

Mention achievements like reducing overdue accounts or improving collection rates, showcasing your ability to effectively control credit. Demonstrate your knowledge of credit policies and compliance to reinforce your suitability for the Credit Control Officer role.

What key skills are essential for a Credit Control Officer application?

A Credit Control Officer plays a vital role in managing company receivables and ensuring timely payments. Highlighting relevant skills in your job application letter increases your chances of securing the position.

- Financial Analysis - The ability to evaluate financial statements and creditworthiness to minimize risks.

- Communication Skills - Clear and professional communication with clients and internal departments to resolve payment issues.

- Attention to Detail - Accurate tracking and documentation of transactions to maintain correct financial records.

- Negotiation Skills - Effectively negotiating payment plans or settlements with clients to secure payments.

- Time Management - Prioritizing tasks to handle multiple accounts and deadlines efficiently.

How do I address gaps in my employment history?

Address employment gaps in a job application letter by briefly explaining the reason, such as pursuing education or personal development. Emphasize any skills or experiences gained during the gap that are relevant to the Credit Control Officer role. Highlight your readiness and enthusiasm to contribute effectively to the company's financial management.

Should I mention my knowledge of finance software?

Including your knowledge of finance software in a job application letter for a Credit Control Officer position is highly recommended. This expertise demonstrates your ability to efficiently manage accounts and streamline credit processes.

Employers prioritize candidates familiar with industry-standard finance software to ensure smooth operations and accurate financial tracking. Mention specific software you have used, such as SAP, QuickBooks, or Oracle Financials, to highlight relevant skills. This detail distinguishes your application and shows you can quickly adapt to the company's technology.

How do I show attention to detail in my letter?

Highlight specific examples of your previous work experience where you identified and resolved discrepancies in financial records. Include mentions of your systematic approach to managing invoices, payment follow-ups, and accurate data entry. Emphasize your commitment to maintaining precise documentation and ensuring compliance with company credit policies.

What achievements are relevant for a Credit Control Officer role?

Proven track record in reducing overdue receivables by 30% through effective credit risk assessment and timely follow-ups. Demonstrated ability to implement automated invoicing systems, resulting in a 25% decrease in payment delays. Skilled in negotiating payment plans and resolving disputes, enhancing client relationships and improving cash flow.

Is it necessary to customize my application letter for each job?

Customizing your job application letter for each Credit Control Officer position is essential to highlight relevant skills and experience that match the specific job requirements. Tailored letters demonstrate genuine interest and increase your chances of standing out to employers.

Using generic application letters may result in missed opportunities as employers seek candidates who align closely with their needs. Personalizing each letter shows professionalism and attention to detail, key attributes for a Credit Control Officer role.

What tone should I use in a professional job application letter?

Use a formal and confident tone to convey professionalism and competence in your job application letter for a Credit Control Officer position.

- Professional - Maintain respect and courtesy throughout the letter to reflect your seriousness about the role.

- Concise - Clearly and briefly communicate your skills and experiences relevant to credit control to hold the reader's attention.

- Positive - Express enthusiasm and confidence in your ability to contribute effectively to the company's financial management.

A consistent professional tone enhances your credibility and increases your chances of securing an interview.