Job Application Letter for Auto Claims Adjuster Sample

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Hiring Manager's Name]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Hiring Manager's Name],

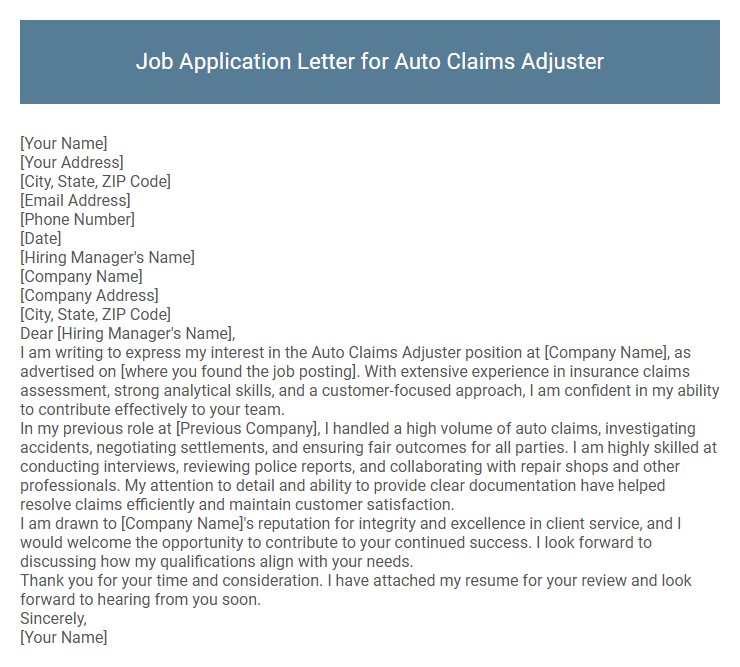

I am writing to express my interest in the Auto Claims Adjuster position at [Company Name], as advertised on [where you found the job posting]. With extensive experience in insurance claims assessment, strong analytical skills, and a customer-focused approach, I am confident in my ability to contribute effectively to your team.

In my previous role at [Previous Company], I handled a high volume of auto claims, investigating accidents, negotiating settlements, and ensuring fair outcomes for all parties. I am highly skilled at conducting interviews, reviewing police reports, and collaborating with repair shops and other professionals. My attention to detail and ability to provide clear documentation have helped resolve claims efficiently and maintain customer satisfaction.

I am drawn to [Company Name]'s reputation for integrity and excellence in client service, and I would welcome the opportunity to contribute to your continued success. I look forward to discussing how my qualifications align with your needs.

Thank you for your time and consideration. I have attached my resume for your review and look forward to hearing from you soon.

Sincerely,

[Your Name]

A job application letter for an auto claims adjuster highlights relevant skills such as evaluating vehicle damage, processing insurance claims, and negotiating settlements efficiently. Emphasizing expertise in assessing damages, customer service, and claim documentation strengthens the candidate's suitability for this role. Demonstrating attention to detail and knowledge of insurance policies ensures a compelling and targeted application.

What key skills should I highlight in my Auto Claims Adjuster job application letter?

Highlight strong analytical skills to accurately assess damage and determine claim validity. Emphasize excellent communication abilities for effective interaction with clients, insurance companies, and repair shops. Showcase attention to detail and proficiency in negotiation to ensure fair settlements and prevent fraud.

How should I address my letter if I don't know the hiring manager's name?

If you don't know the hiring manager's name when applying for an Auto Claims Adjuster position, use a professional and generic salutation to maintain formality. Avoid informal greetings to ensure your letter appears polished and respectful.

- Use "Dear Hiring Manager" - This is a widely accepted and professional way to address unknown recipients.

- Consider "Dear Claims Department" - This targets the relevant team for your application, showing specificity.

- Avoid "To Whom It May Concern" - This can feel outdated and impersonal, reducing engagement.

Choosing a respectful and relevant salutation improves the tone and first impression of your job application letter.

What qualifications are most important for an Auto Claims Adjuster role?

Key qualifications for an Auto Claims Adjuster include a strong understanding of insurance policies and auto damage assessment. Proficiency in negotiation and customer service skills is essential to resolve claims efficiently. Attention to detail and the ability to analyze accident reports and repair estimates ensure accurate claim processing.

Should I mention certifications or licenses in my cover letter?

Including certifications or licenses in a job application letter for an Auto Claims Adjuster position strengthens your qualifications. Highlighting relevant credentials demonstrates your expertise and compliance with industry standards.

- Certification relevance - Mention certifications like AIC or CPCU to showcase specialized knowledge in claims adjusting.

- License requirements - Include state adjuster licenses if required to validate legal eligibility and professionalism.

- Competitive advantage - Presenting certifications distinguishes you from other candidates, emphasizing your commitment to the profession.

How do I show experience with insurance claims in my application letter?

| Highlight Specific Roles | Detail previous positions with responsibilities related to auto claims, such as investigating claims, assessing damages, and negotiating settlements. |

| Mention Relevant Skills | Include skills like risk assessment, knowledge of insurance policies, use of claims management software, and strong communication abilities. |

| Include Quantifiable Achievements | Showcase metrics such as number of claims handled, percentage of claims accurately processed, or savings generated through fraud detection. |

| Use Industry Keywords | Incorporate terms such as "subrogation," "coverage evaluation," "loss adjustment," and "compliance with insurance regulations" to pass automated screening tools. |

| Demonstrate Problem-Solving Experience | Describe situations where you resolved complex claims or disputes effectively, emphasizing analytical skills and attention to detail. |

Is it necessary to include specific software proficiency in my letter?

Including specific software proficiency in a job application letter for an Auto Claims Adjuster position demonstrates your technical skills relevant to the role. Employers often seek candidates familiar with industry-standard tools such as Xactimate, Guidewire, or CAD software.

Highlighting these proficiencies can set you apart from other applicants by showing your readiness to handle claims processing efficiently. Tailoring your letter to include key software knowledge aligns with job descriptions and increases your chances of securing an interview.

What is the ideal length for a job application letter for this position?

The ideal length for a job application letter for an Auto Claims Adjuster is concise yet comprehensive, typically one page. This length ensures clear communication of relevant skills and experience without overwhelming the reader.

- Conciseness - One page allows the applicant to present key qualifications efficiently, respecting the employer's time.

- Relevance - Focusing on specific auto claims adjusting skills within a brief format keeps the letter targeted and impactful.

- Readability - A well-structured single-page letter maintains reader engagement and increases the chance of progressing to the interview stage.

How should I format my application letter for readability?

How should I format my job application letter for an Auto Claims Adjuster position to ensure maximum readability? Use clear headers and short paragraphs to organize information logically. Incorporate bullet points for key skills and achievements to enhance skimmability and highlight relevant qualifications efficiently.

Can I use the same letter for different Auto Claims Adjuster job applications?

Using the same job application letter for different Auto Claims Adjuster positions is possible but not always effective. Tailoring the letter to each company's requirements increases your chances of standing out.

Each Auto Claims Adjuster role may emphasize unique skills or experiences, so customizing your letter highlights your relevant qualifications. Employers value personalized applications that address their specific needs. Generic letters risk being overlooked in competitive job markets.